Middle East & Africa Electric Scooter Market Size, Share, Trends & Research Report, 2033 | UnivDatos

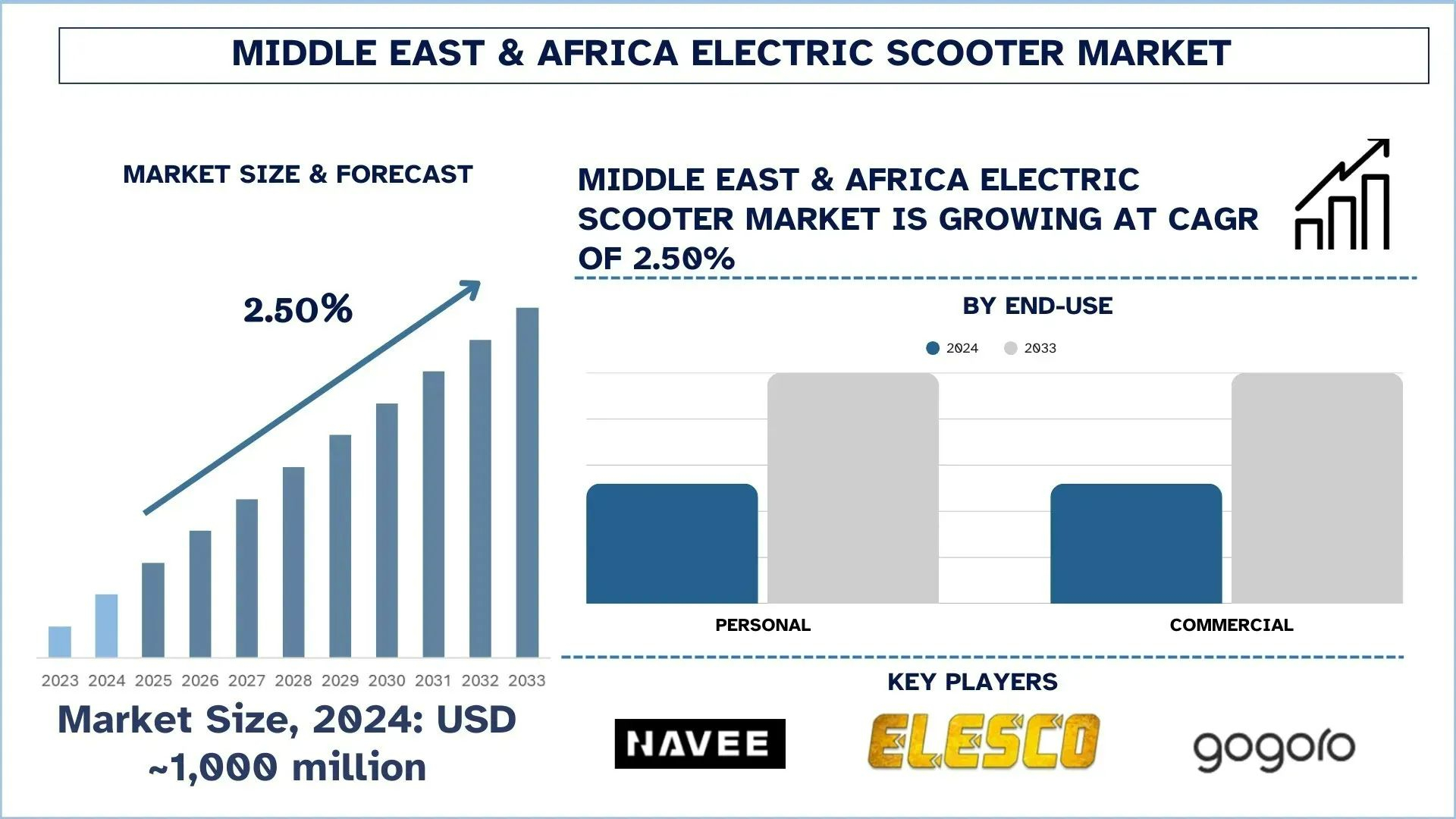

According to UnivDatos, lower running and operating costs of Electric Vehicles, and Government smart-city pilots are some of the key factors that have supported the market growth. As per their “Middle East & Africa Electric Scooter Market” report, the Middle East & Africa market was valued at USD 1,000 million in 2024, growing at a CAGR of about 2.50% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The electric scooter market in the Middle East and Africa is transitioning from fragmented pilots to more structured adoption, driven by urban mobility demand, a sustainability agenda, and the rapid electrification of two-wheeler fleets. In the GCC, both smart-city initiatives and regulated micromobility rollouts are creating distinct avenues for shared and commercial scooter use. In Africa, high applications of two-wheelers, growing delivery economics, and new financing concepts are increasing the speed of interest in electric alternatives. Market momentum is being fundamentally altered by the supporting ecosystem - battery swapping, battery charging networks, and aftersales capability - increasing uptime, improving range anxiety, and enhancing total cost of ownership benefits to personal riders and high-utilization fleets.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/middle-east-and-africa-electric-scooter-market?popup=report-enquiry

Growing Demand for Battery Swapping Infrastructure:

An increase in battery swapping infrastructure is becoming one of the trends in the Middle East and Africa electric scooter ecosystem, as it directly resolves two barriers to adoption: charging downtime and range anxiety. Rather than waiting hours before batteries are recharged, ride and fleet operators can swap out used batteries in a few minutes with fully charged batteries to keep vehicles on the road and maximize daily use. This is particularly appealing to high-mileage applications like last-mile delivery, courier, or the shared micromobility fleets, where profitability is quickly lost in unproductive operating time. The replacement of networks also assists in standardizing energy management- operators can centralize the charge process, check battery conditions, and minimize degradation by carrying out controlled charging processes. Where home charging is either not available (high-density urban housing, slums) or grid reliability is not consistent, swap stations can offer a viable alternative to household charging with larger fleets, swapping turns into an infrastructure layer, which can be expanded faster, at a more stable service level, and more easily to a profitable point.

Latest Trends in the Middle East & Africa Electric Scooter Market.

Rapidly Expanding Charging Infrastructure:

The rapid development of charging infrastructure is emerging as one of the main trends defining the Middle East and African electric scooter market, as both public and private actors are vying to eliminate a key barrier: the lack of charging infrastructure. Day-to-day operations of individual riders and fleet operators are becoming easier as new charge points are being established at mobility hubs, retail destinations, parking, and last-mile logistics depots. In the case of shared micromobility and delivery fleets, specific charging yards and distributed charging nodes reduce the turnaround time, enhance route planning, and enhance vehicle utilization - directly enhancing stronger unit economics. Simultaneously, smarter charging management (software-enabled scheduling, load balancing, and remote monitoring) assists operators in managing the cost of the energy and minimizing the downtime of the equipment. The broader geographic penetration is also promoted through the expansion of infrastructure, which allows cities to scale the micromobility programs with more confidence than having a few pilot areas. The higher the charger density, the lower the range anxiety, the increased customer confidence, and the more sensible the electric scooter becomes, as a viable alternative to the short trips in the city and business mobility.

Key Investment Trends:

The focus of investment in the Middle East and Africa market of the electric scooter is now more on fleet enablement and infrastructure, and not just the sale of the vehicle. There is a capital influx into battery-swapping networks, depot charging, and energy-management software, which is enhancing uptime and reducing operating costs for high-utilisation delivery fleets and shared-mobility fleets. Local assembly and after-sales footprints are also being supported by investors to help in minimizing the import lead times, enhancing the parts availability, and customizing the products to the hot and dusty operating environments. Platform investment in regulated micromobility and smart-city programs is seeking measurement in terms of service performance in the GCC. Africa is seeing an increase in funding of PAYG, leasing, and battery-as-service models, which open the door to affordability and scale.

In 2025, V LAB, the region’s first omni-channel, multi-brand EV retail platform, announced its plans to go for a strategic investment in Pure Electric. Under this partnership, EV LAB becomes the exclusive partner for Pure Electric across the Middle East.

Country Market Growth

The electric scooter market in Saudi Arabia is already in the first stage of development (early adoption). Still, in the future, the market will enter a structured development stage, supported by the priorities of Vision 2030, smart-city initiatives, and the increasing need for efficient short-distance mobility in large cities. Pilots of shared micromobility and controlled deployments are raising awareness and making the use of scooters a normal occurrence as a first and last-mile link between transit station locations, business areas, and locations with high pedestrian traffic. The commercial demand is improving, as well as the delivery and service fleets seek to minimize their operating costs so as to meet the sustainability targets. The success of the market relies on operating in accordance with the changing municipal regulations, rider safety, and dependable functioning in hot and dusty weather. This is why prioritizing the durable components, good after-sales services, and battery management is chosen. With the growth in charging accessibility via individual depots and partner networks, Saudi Arabia will be able to scale e-scooters as a viable urban mobility layer.

The adoption of electric scooters in Saudi Arabia is gaining notable momentum as the government is also taking initiatives. For instance, in 2024, the government of Saudi Arabia announced that Hajj pilgrims will be able to use an electric scooter for their commute as a light, safer, and efficient mode of transportation. For this, a dedicated path has been designated between the Muzdalifah - Mina path, the pedestrian road path for the Jamarat facility - west, and the pedestrian road path entering the Jamarat facility – east for a distance of 1.2 km.

Click here to view the Report Description & TOC https://univdatos.com/reports/middle-east-and-africa-electric-scooter-market

“Battery Swapping and Smart Charging Will Define Scale.”

All in all, the market of MEA electric scooters is not being constructed on the basis of the sales of the vehicle alone, but on the foundation of infrastructure and fleet economics. Battery swapping and increasing the size of the charging networks are also decreasing downtime and increasing scale faster, and smart-city programs are enhancing regulatory clarity. Likely markets such as Saudi Arabia are set to be developed in a well-organized manner as the operation develops and relations become stronger.

Related Report:-

Electric Mobility Market: Current Analysis and Forecast (2022-2030)

Automotive Electric Control Unit Market: Current Analysis and Forecast (2023-2030)

EV Battery Swapping Market: Current Analysis and Forecast (2024-2032)

Electrical Wheel Loader Market: Current Analysis and Forecast (2023-2030)

Electric Motor Market: Current Analysis and Forecast (2021-2027)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness