Global Oat Milk Market Trends, Growth & Demand Forecast 2025-2033

Market Overview:

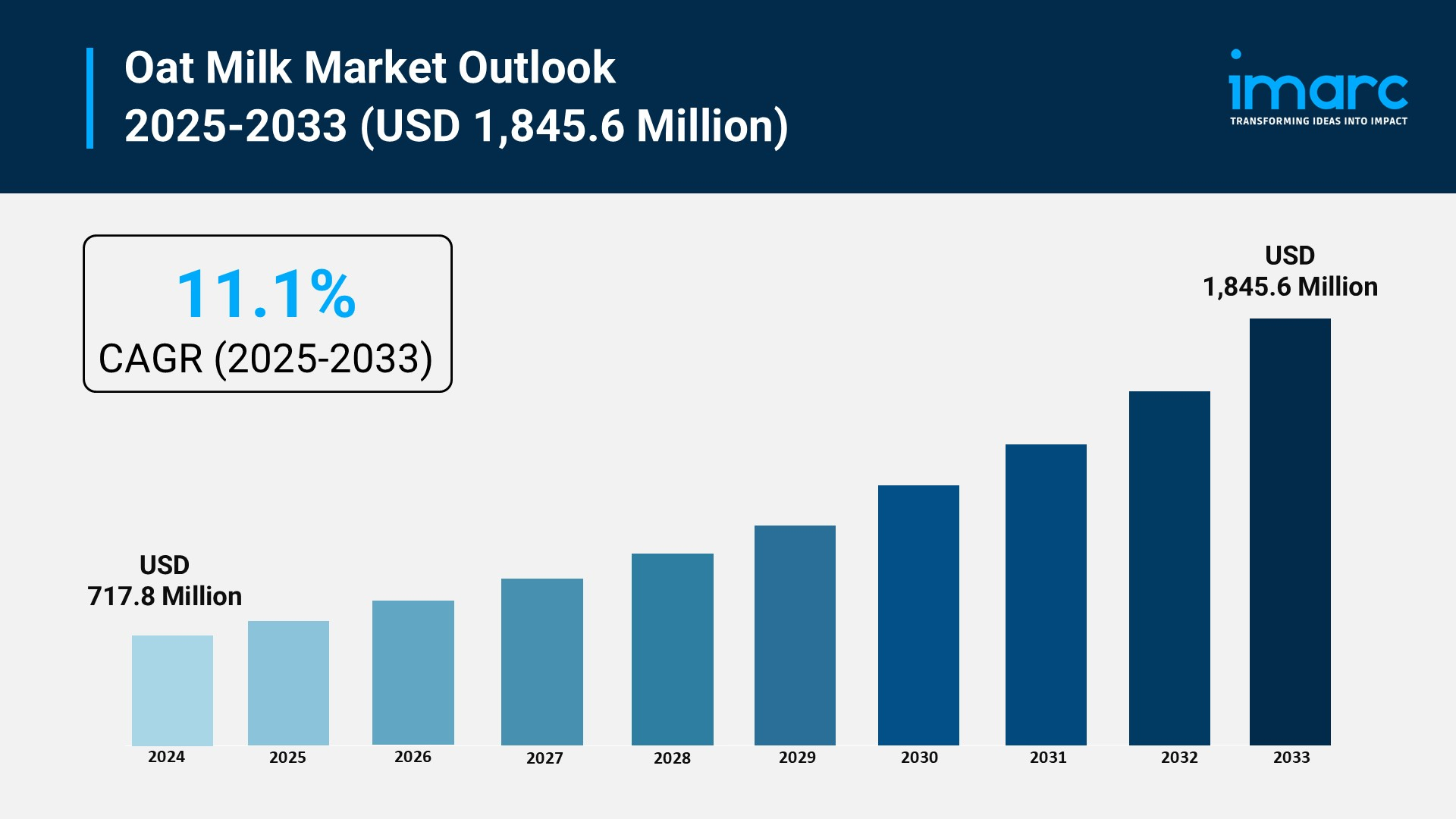

The oat milk market is experiencing rapid growth, driven by rising health consciousness and dietary shifts, environmental sustainability concerns, and innovation in flavour profiles and functional benefits. According to IMARC Group's latest research publication, "Oat Milk Market Size, Share, Trends, and Forecast by Source, Product, Packaging Type, Application, Distribution Channel, and Region, 2025-2033", the global oat milk market size was valued at USD 717.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,845.6 Million by 2033, exhibiting a CAGR of 11.1% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/oat-milk-market/requestsample

Our report includes:

-

Market Dynamics

-

Market Trends and Market Outlook

-

Competitive Analysis

-

Industry Segmentation

-

Strategic Recommendations

Growth Factors in the Oat Milk Market

-

Rising Health Consciousness and Dietary Shifts

Increasing vegan diet adoption is driving demand for oat milk globally, with enhancing health-conscious choices boosting oat milk's popularity for its nutrients. Consumers are increasingly aware of the health benefits associated with plant-based alternatives, with oat milk offering superior nutritional profiles compared to traditional dairy milk. The product contains beta-glucan fiber that helps reduce cholesterol levels and provides sustained energy, appealing to health-conscious consumers seeking functional foods. The global oat milk market is valued at USD 3.27 billion and projected to reach USD 13.81 billion by 2035, reflecting massive consumer adoption across demographics. Medical professionals are recommending plant-based milk alternatives for patients with lactose intolerance, dairy allergies, and cardiovascular concerns. The growing awareness of the connection between diet and long-term health outcomes is driving sustained demand for oat milk as consumers make permanent lifestyle changes rather than temporary dietary experiments.

-

Environmental Sustainability Concerns

Environmental consciousness is significantly influencing consumer purchasing decisions, with oat milk positioned as a more sustainable alternative to dairy and other plant-based milk options. Oat cultivation requires significantly less water than almonds and produces fewer greenhouse gas emissions compared to dairy farming, appealing to environmentally conscious consumers. The sustainability narrative resonates particularly strongly with younger demographics who prioritize environmental impact in their purchasing decisions. Oat milk production generates approximately 80% fewer carbon emissions than dairy milk while using 60% less land and 80% less water resources. Companies are capitalizing on this trend by highlighting their sustainable farming partnerships and carbon-neutral production processes. The environmental benefits extend beyond production to packaging, with many oat milk brands utilizing recyclable cartons and implementing circular economy principles that further reduce their environmental footprint and attract sustainability-focused consumers.

-

Innovation in Flavor Profiles and Functional Benefits

The oat milk market is experiencing rapid expansion through product innovation that goes beyond basic milk replacement to offer enhanced flavors and functional benefits. Manufacturers are developing barista-grade oat milk formulations that froth and steam better than traditional plant-based alternatives, capturing significant market share in the coffee shop sector. Flavored varieties including vanilla, chocolate, and seasonal options like pumpkin spice are attracting consumers who view oat milk as a premium beverage rather than merely a dairy substitute. Fortified oat milk products now include added vitamins, minerals, and protein to match or exceed the nutritional content of dairy milk. Companies are also creating specialized formulations for different consumer needs, such as extra-creamy varieties for cereal, lighter versions for coffee, and protein-enhanced options for fitness enthusiasts. This innovation strategy is expanding the addressable market beyond health-conscious consumers to include mainstream shoppers seeking variety and enhanced experiences in their daily routines.

Key Trends in the Oat Milk Market

-

Premium and Artisanal Product Positioning

The oat milk market is witnessing a significant shift toward premium positioning, with brands emphasizing artisanal production methods, organic ingredients, and sophisticated flavor profiles that command higher price points. Consumers are increasingly willing to pay premium prices for oat milk products that offer superior taste, texture, and ingredient quality compared to mass-market alternatives. Craft oat milk producers are emerging with small-batch production methods that emphasize local sourcing and unique flavor combinations that appeal to discerning consumers. Premium brands are investing in advanced processing technologies that create creamier textures and more milk-like mouthfeel, addressing the primary consumer concern about plant-based milk alternatives. The premiumization trend extends to packaging design, with sleek bottles and sustainable materials that communicate quality and environmental responsibility. Limited edition flavors and seasonal varieties are creating excitement and encouraging trial among consumers who view oat milk as an experiential purchase rather than a commodity product.

-

Expansion into Food Service and Retail Partnerships

Oat milk brands are aggressively pursuing partnerships with major coffee chains, restaurants, and retail outlets to increase accessibility and normalize consumption among mainstream consumers. Major coffee chains have become primary drivers of oat milk adoption by offering it as a standard milk alternative alongside traditional options, exposing millions of consumers to the product daily. Retail partnerships with major grocery chains are securing prominent shelf placement and promotional support that significantly increases brand visibility and trial rates. Food service expansion includes partnerships with restaurants, hotels, and institutional foodservice providers who are incorporating oat milk into their standard offerings. The trend includes co-branded products and exclusive flavors developed specifically for major retail partners, creating differentiation and loyalty. Strategic partnerships with complementary brands like cereal companies and coffee roasters are creating cross-promotional opportunities that expand the addressable market and introduce oat milk to new consumer segments through trusted brand associations.

-

Geographic Market Expansion and Localization

The oat milk market is rapidly expanding beyond its initial North American and European strongholds into emerging markets across Asia, Latin America, and other regions through localized product development and distribution strategies. Asia Pacific is leading adoption with the market valued at USD 3.22 billion and projected to reach USD 8.27 billion, driven by rising disposable incomes and increasing health consciousness among urban populations. Companies are developing region-specific formulations that cater to local taste preferences, dietary requirements, and cultural food traditions. Local production facilities are being established to reduce costs, improve freshness, and demonstrate commitment to regional markets while creating jobs and economic benefits. Marketing strategies are being adapted to emphasize benefits that resonate with local consumers, such as digestive health in lactose-intolerant populations or environmental sustainability in regions experiencing climate challenges. The geographic expansion trend includes partnerships with local distributors and retailers who understand regional market dynamics and can accelerate market penetration through established relationships and cultural knowledge.

Leading Companies Operating in the Oat Milk Industry:

-

Califia Farms LLC

-

Earth's Own Food Company Inc

-

Elmhurst Milked Direct LLC

-

Happy Planet Foods Inc.

-

Oatly AB (Cereal Base Ceba AB)

-

Pacific Foods of Oregon LLC (Campbell Soup Company)

-

Planet Oat Oatmilk (HP Hood LLC.)

-

RISE Brewing Co.

-

The Hain Celestial Group Inc.

-

Thrive Market Inc.

Oat Milk Market Report Segmentation:

By Source:

-

Organic

-

Conventional

Conventional oat milk leads (74.0% share) due to affordability, wide availability, and strong supply chain integration, while organic variants grow steadily.

By Product:

-

Plain

-

Flavored

Plain oat milk dominates (58.3% share) for its versatility, clean-label appeal, and suitability for cooking, beverages, and dietary preferences.

By Packaging Type:

-

Cartons

-

Bottles

-

Others

Cartons hold the largest share (53.2%) owing to convenience, sustainability, and effective preservation, aligning with eco-conscious consumer trends.

By Application:

-

Food

-

Beverages

Beverages lead (68.2% share) as oat milk’s creamy texture and neutral taste make it a preferred dairy alternative in coffee and drinks.

By Distribution Channel

-

Supermarkets and Hypermarkets

-

Grocery Stores

-

Online Stores

-

Others

Supermarkets & hypermarkets capture 40.4% share due to product variety, accessibility, and promotional strategies driving consumer purchases.

Regional Insights:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Europe dominates (52.8% share) with strong plant-based adoption, sustainability focus, and supportive policies, led by Germany, UK, and Sweden.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness