Mexico Electrical Wires and Cables Market Size, Share, Industry Overview, Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “Mexico Electrical Wires and Cables Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

To get more information on this market, Request Sample

Mexico Electrical Wires and Cables Market Overview

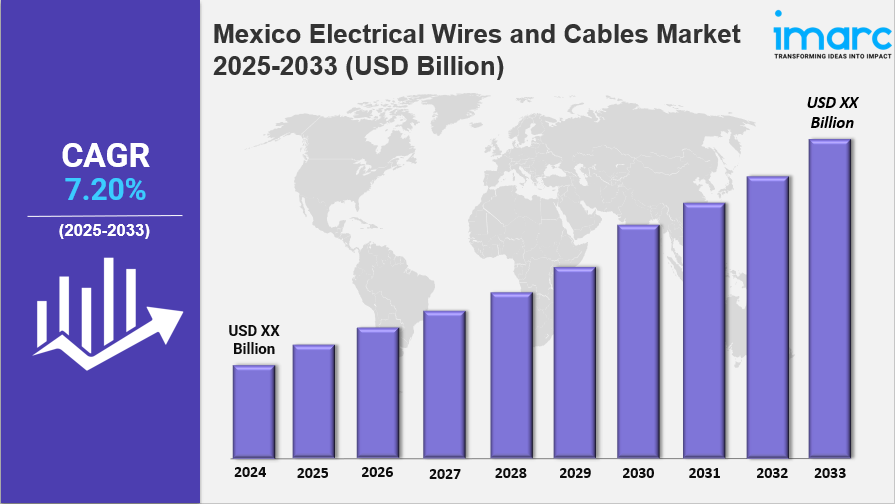

The Mexico electrical wires and cables market size is projected to exhibit a growth rate (CAGR) of 7.20% during 2025-2033. The market is experiencing steady growth driven by increasing infrastructure development, rising energy efficiency demands, and the integration of smart cabling solutions. Expanding urbanization and government investments in renewable energy and digital infrastructure are key factors boosting demand. High-performance, durable cables are essential for supporting these initiatives, ensuring reliable power transmission and data connectivity. These dynamics collectively contribute to the expanding Mexico electrical wires and cables market share.

Key Market Highlights: Mexico Electrical Wires and Cables Market

- Strong Growth Driven by Infrastructure Development: The Mexico electrical wires and cables market is experiencing robust growth, primarily fueled by significant investments in infrastructure development, including residential, commercial, and industrial projects.

- Rising Demand for Renewable Energy Solutions: There is an increasing demand for electrical wires and cables associated with renewable energy installations, such as solar and wind power, as the country shifts towards sustainable energy sources.

- Growing Adoption of Smart Technologies: The adoption of smart technologies and automation in residential and industrial applications is driving the need for advanced electrical wiring solutions, enhancing market opportunities.

- Emphasis on Safety and Compliance Standards: Heightened awareness regarding safety standards and compliance regulations is leading manufacturers to innovate and produce high-quality, reliable electrical wiring and cabling products.

Trends in the Mexico Electrical Wires and Cables Market

The Mexico electrical wires and cables market is poised for significant transformation as various trends emerge and evolve. As infrastructure development projects continue to expand, the demand for high-quality electrical solutions is expected to drive the Mexico electrical wires and cables market size upward. Additionally, the increasing adoption of smart technologies is reshaping the market landscape, with manufacturers focusing on innovative wiring solutions that cater to the needs of smart homes and IoT applications. The market share of companies offering advanced electrical wiring systems is likely to grow as consumers prioritize energy efficiency and connectivity. Furthermore, the emphasis on regulatory compliance and safety standards is prompting manufacturers to enhance product quality, ensuring that they meet both domestic and international requirements. As these trends unfold, the Mexico electrical wires and cables market growth will be closely linked to the industry's ability to adapt to changing consumer demands and regulatory landscapes, positioning it for sustained expansion in the coming years.

Get the full PDF sample copy of the report: (Includes full table of contents, list of tables and figures, and graphs):-

https://www.imarcgroup.com/mexico-electrical-wires-cables-market/requestsample

Market Dynamics of the Mexico Electrical Wires and Cables Market

Surge in Infrastructure Development

One of the primary dynamics driving the Mexico electrical wires and cables market is the surge in infrastructure development across the country. The Mexican government has been investing heavily in various infrastructure projects, including transportation, energy, and telecommunications, to boost economic growth and improve connectivity. This increased investment is significantly impacting the Mexico electrical wires and cables market size, as these projects require extensive electrical wiring and cabling solutions. Additionally, the focus on renewable energy projects, such as solar and wind farms, is further driving demand for specialized electrical cables designed to handle higher voltages and environmental conditions. As infrastructure development continues to expand, the demand for high-quality electrical wires and cables is expected to grow, providing opportunities for manufacturers and suppliers in the market.

Growing Demand for Smart Technologies

Another significant dynamic influencing the Mexico electrical wires and cables market is the growing demand for smart technologies in residential, commercial, and industrial applications. As the trend towards smart homes and smart cities accelerates, there is an increasing need for advanced electrical wiring solutions that can support automation, connectivity, and energy efficiency. This shift is contributing to the overall Mexico electrical wires and cables market share, as manufacturers innovate to develop products that meet the requirements of smart technology integration. The rise of the Internet of Things (IoT) is also driving this demand, as interconnected devices require reliable and efficient wiring systems to function effectively. As consumers and businesses increasingly adopt smart technologies, the market for electrical wires and cables is expected to witness substantial growth.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical dynamics shaping the Mexico electrical wires and cables market. With increasing awareness of electrical safety and the potential hazards associated with substandard wiring, regulatory bodies are implementing stricter guidelines and standards for electrical products. This focus on safety is influencing manufacturers to enhance the quality and reliability of their products, thereby impacting the overall Mexico electrical wires and cables market growth. Compliance with international standards, such as UL and IEC, is becoming essential for companies looking to compete in both domestic and export markets. As the emphasis on safety and compliance continues to rise, manufacturers will need to invest in quality assurance and testing processes to meet these standards, ultimately shaping the competitive landscape of the market.

Get Discount On The Purchase Of This Report- https://www.imarcgroup.com/checkout?id=35531&method=3682

Mexico Electrical Wires and Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Power Cable

- Specialty Cable

- Railway

- Power

- Construction

- Telecom

- Others

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Speak To an Analyst-

https://www.imarcgroup.com/request?type=report&id=35531&flag=C

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electrical Wires and Cables Market News:

- In June 2024, Amphenol TPC Wire & Cable introduced cutting-edge wiring solutions such as high-performance cables aimed at automotive, industrial, and telecom applications. These robust, efficient cables enable harsh environments and changing infrastructure requirements. This product release is most essential to monitor trends in Mexico's electrical wires and cables market.

- November 2024: UL Solutions expanded its laboratory in Querétaro, Mexico, enhancing testing capabilities for consumer technology, automotive, and wire and cable products. The upgrade supports manufacturers in Latin America with safety, performance, and export compliance for the U.S., Canada, and regional markets, strengthening UL’s role in the Mexican testing industry.

- April 2024: Amphenol TPC Wire & Cable launched its ATPC Medium Voltage Cables in Macedonia, Ohio, designed for harsh industrial environments. Compliant with UL 1072, these cables feature aluminum or copper conductors, EPR insulation, and durable PVC jackets, supporting applications in automotive, mining, utilities, and factory automation industries.

- January 2024: Amphenol Corporation acquired TPC Wire & Cable, a specialist in ruggedized industrial cabling solutions. Renamed “Amphenol TPC Wire & Cable,” it will operate within Amphenol’s Harsh Environment Solutions Division from its Ohio headquarters, aiming to expand global reach, enhance industrial applications, and drive innovation across demanding environments.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion.

IMARC’s services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness