Different Types of Business Loans and Their Benefits

Business loans provide essential funding that supports growth, operations, and expansion. They allow enterprises of all sizes to access finance for needs ranging from working capital to long-term investments.

Understanding Business Loans

A business loan is a form of credit extended to enterprises for operational or developmental purposes. It helps cover immediate expenses, acquire assets, or fund expansion. For instance, an MSME Business Loan is often designed to provide micro, small, and medium enterprises with easier access to funds, enabling them to grow despite limited resources.

Major Types of Business Loans

Term Loans

A term loan is a lump sum borrowed for a fixed duration, with repayments spread across months or years. These loans are suited for long-term investments such as buying property, setting up factories, or expanding operations. A manufacturing business, for example, may take a five-year loan to build a new production unit, balancing repayments alongside steady revenue growth.

Working Capital Loans

Working capital loans fund day-to-day expenses like salaries, rent, or seasonal inventory. They help bridge short-term cash gaps and ensure smooth business continuity. A retailer may take such a loan before a festival season to stock more products and repay comfortably once sales generate revenue.

Equipment Financing

Equipment financing helps businesses purchase machinery, vehicles, or technology. The equipment itself usually acts as collateral, making approval simpler. A textile enterprise could use this option to modernise looms, improving productivity without straining operational funds.

Invoice Financing

Also known as bill discounting, invoice financing lets businesses borrow against unpaid client invoices. It maintains liquidity while awaiting payments. An IT services firm with a 60-day billing cycle might use this facility to cover salaries and overheads, ensuring operations remain uninterrupted.

Business Credit Lines

A business line of credit offers revolving funds that can be withdrawn, repaid, and reused as required. This flexibility is ideal for businesses with fluctuating cash needs. A wholesaler, for instance, can draw funds to buy bulk goods during peak demand and repay once customers clear invoices.

Trade Loans

Trade loans are short-term facilities that support import and export transactions. They are valuable for companies managing international trade. An apparel exporter may use a trade loan to pay suppliers upfront, continuing production while awaiting overseas buyer payments.

Government-Supported Loans

Government-backed loans often target MSMEs, offering relaxed eligibility or collateral-free access. A small food-processing unit, for example, might use such a scheme to buy modern machinery and expand production, increasing competitiveness in its sector.

Benefits of Different Business Loans

- Support expansion without using personal reserves

- Provide cash flow stability during seasonal or payment delays

- Enable purchase of modern equipment for higher efficiency

- Strengthen supplier and customer relationships through timely payments

- Encourage competitiveness by funding innovation and scaling opportunities

How to Choose the Right Loan

The right loan depends on your business goals, repayment capacity, and risk appetite. Compare interest rates, tenures, and collateral requirements carefully. Always align borrowing with clear financial planning to avoid unnecessary strain on operations.

Common Challenges and Considerations

Unsecured loans often carry higher costs. Excessive borrowing can lead to repayment stress, while poor credit history may restrict loan access. Disciplined repayment and realistic borrowing ensure loans remain a tool for growth, not a burden.

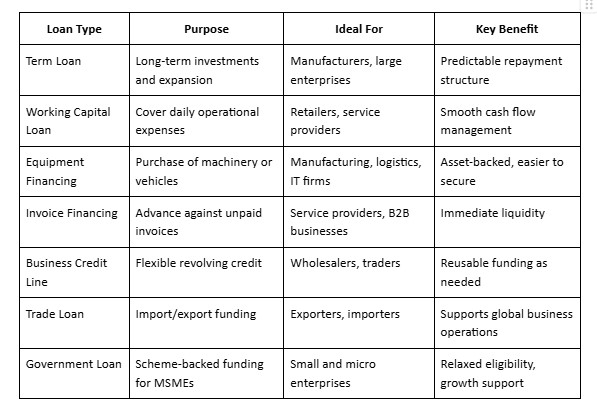

Comparison Table: Types of Business Loans

The table below highlights the main types of business loans, their purposes, ideal users, and key benefits, helping you compare options at a glance:

Conclusion

Understanding the different types of business loans helps you choose funding that matches your business requirements. With the right loan, you can secure stability, invest in growth, and remain resilient in competitive markets.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness