Top SEIS Scheme Benefits for Start-Up Investors in 2026

Investing in early-stage businesses has always carried both high risk and high reward. In the UK, the Seed Enterprise Investment Scheme (SEIS) continues to be one of the most attractive government-backed initiatives designed to encourage investment in start-ups. In 2026, SEIS scheme benefits remain highly valuable for investors who want generous tax reliefs while supporting innovative young companies.

If you are considering a SEIS investment, understanding the SEIS tax relief structure, SEIS qualifying criteria, and overall SEIS eligibility rules is essential. This guide explains everything start-up investors need to know about SEIS scheme benefits in 2026.

What Is the SEIS Tax SEIS Scheme?

The SEIS tax SEIS scheme (Seed Enterprise Investment Scheme) is a UK government initiative designed to help small, early-stage companies raise equity finance. In return for investing in qualifying start-ups, investors receive significant tax reliefs that reduce financial risk.

The scheme was introduced to stimulate entrepreneurship and innovation by making early-stage investment more appealing. Compared to traditional investing, SEIS investment offers powerful tax incentives that can significantly improve overall returns.

Why SEIS Scheme Benefits Matter in 2026

With economic uncertainty, inflation pressures, and market volatility continuing into 2026, investors are increasingly looking for tax-efficient investment opportunities. SEIS scheme benefits provide:

-

Immediate income tax relief

-

Capital gains tax (CGT) exemptions

-

Loss relief protection

-

Inheritance tax advantages

These features make SEIS investment particularly attractive for high-net-worth individuals and sophisticated investors looking to diversify portfolios while reducing downside risk.

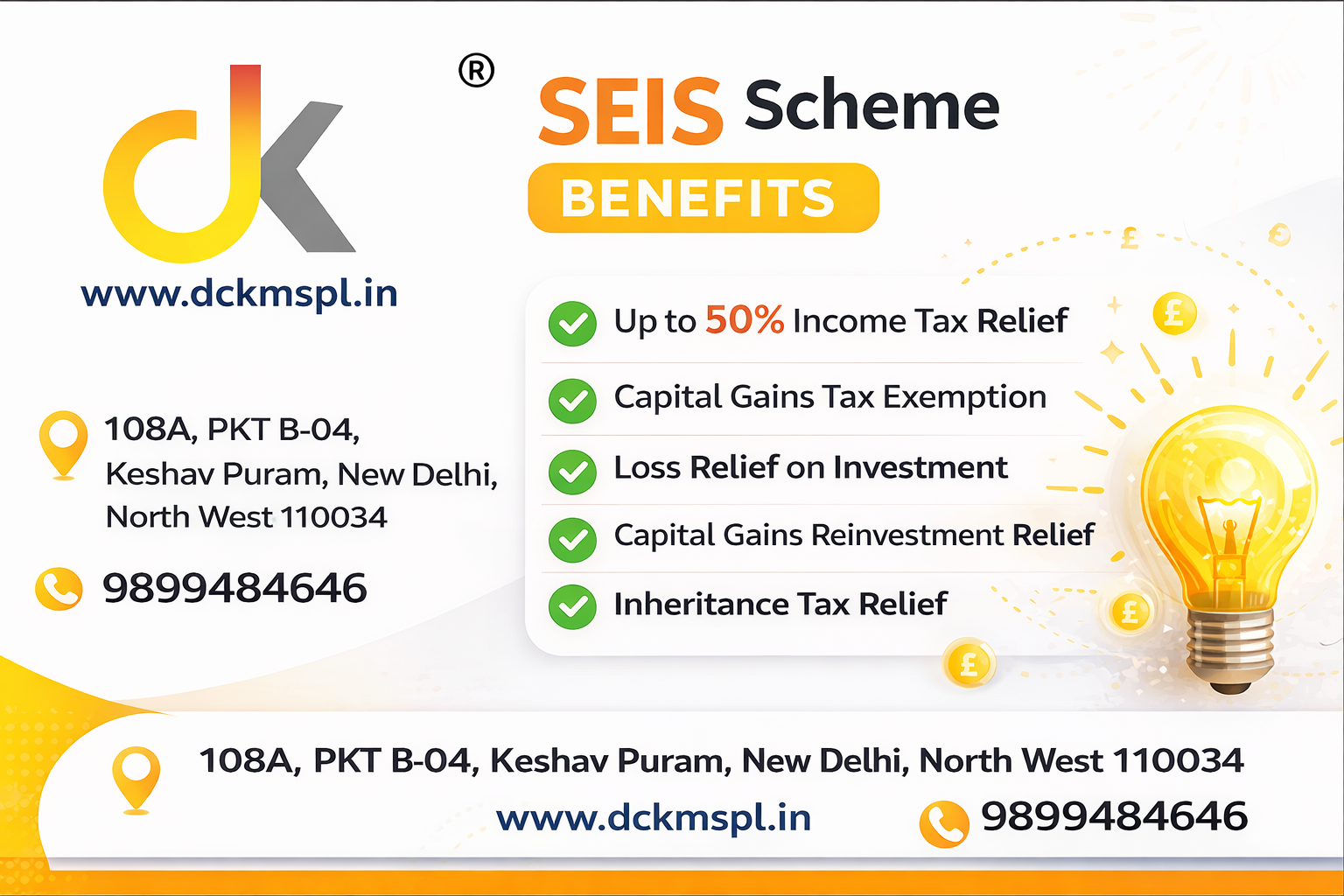

Major SEIS Scheme Benefits for Investors

Let’s break down the top SEIS scheme benefits available in 2026.

1. 50% Income Tax Relief

One of the most powerful SEIS scheme benefits is 50% income tax relief on investments up to the annual limit set by HMRC per tax year.

For example, if you make a qualifying investment, you can claim back half of the invested amount as income tax relief. This significantly reduces your real exposure compared to standard equity investing.

This SEIS tax relief applies as long as:

-

The company meets SEIS qualifying criteria

-

You hold shares for at least three years

-

You meet SEIS eligibility requirements

2. Capital Gains Tax (CGT) Exemption

Another key advantage of SEIS scheme benefits is that any gains made on SEIS shares are completely free from Capital Gains Tax, provided the shares are held for at least three years.

If your SEIS investment grows substantially, you keep 100% of the profit tax-free.

This is especially powerful for investors targeting high-growth start-ups with strong exit potential.

3. Capital Gains Reinvestment Relief

SEIS also offers reinvestment relief. If you have made a capital gain from another asset, you can reinvest that gain into a SEIS investment and receive 50% capital gains tax relief on the reinvested amount.

This means SEIS scheme benefits not only protect new investments but also help manage previous gains efficiently.

4. Loss Relief Protection

Start-ups carry risk. However, SEIS scheme benefits significantly reduce potential downside.

If the company fails, you can claim loss relief against your income or capital gains. When combined with 50% income tax relief, your effective risk exposure may fall to as low as 27.5% (or even lower for higher-rate taxpayers).

This risk mitigation is one of the strongest reasons investors choose SEIS investment opportunities.

5. Inheritance Tax (IHT) Relief

Shares held under the SEIS tax SEIS scheme may qualify for Business Relief. After holding shares for two years, they can become exempt from inheritance tax.

For estate planning purposes, this makes SEIS scheme benefits extremely attractive to long-term investors.

SEIS Qualifying Criteria for Companies

To access SEIS scheme benefits, companies must meet strict SEIS qualifying criteria.

Key requirements in 2026 include:

-

The company must be UK-based

-

It must carry out a qualifying trade

-

Gross assets must remain within the limits set by HMRC before investment

-

The company must have fewer than 25 employees

-

It must be less than three years old

-

It can raise funds only within the official SEIS fundraising limits set by HMRC

If these conditions are not met, investors cannot claim SEIS tax relief.

SEIS Eligibility for Investors

Understanding SEIS eligibility is just as important as understanding company criteria.

To qualify for SEIS scheme benefits, investors must:

-

Not be an employee of the company (with limited director exceptions)

-

Not hold more than 30% of company shares

-

Purchase new shares (not existing shares)

-

Hold shares for at least three years

Failure to meet SEIS eligibility rules may result in loss of tax benefits.

Read More - SCOMET Export Licence Explained: Meaning, Process & Requirements

How to Apply for SEIS

If you are a company founder looking to attract investors, or an investor interested in claiming benefits, understanding how to apply for SEIS is crucial.

For Companies:

-

Apply for Advance Assurance from HMRC

-

Raise funds from investors

-

Submit SEIS1 form after shares are issued

-

Receive SEIS3 certificates for investors

For Investors:

-

Receive SEIS3 certificate

-

Claim SEIS tax relief through self-assessment tax return

Proper documentation is essential to secure SEIS scheme benefits.

Why SEIS Investment Is Ideal for Start-Up Investors in 2026

In 2026, start-up ecosystems are expanding in sectors such as:

-

Artificial Intelligence

-

FinTech

-

Clean Energy

-

HealthTech

-

SaaS platforms

SEIS investment allows investors to support innovation while enjoying generous SEIS scheme benefits. Compared to traditional equity markets, SEIS provides enhanced tax efficiency and greater upside potential.

Risk vs Reward: Is SEIS Worth It?

While SEIS scheme benefits are substantial, investors should still perform due diligence.

Consider:

-

Business model viability

-

Founding team experience

-

Market opportunity

-

Exit strategy

The tax relief reduces financial risk, but investment risk remains. Diversification across multiple SEIS investments is often recommended.

SEIS vs EIS: What’s the Difference?

Although similar, SEIS is designed for earlier-stage companies than EIS.

Key differences:

-

SEIS offers 50% income tax relief (higher than EIS)

-

Lower fundraising limits

-

Smaller company size limits

For very early-stage investing, SEIS scheme benefits are often more attractive than EIS.

Strategic Tax Planning with SEIS in 2026

High-income individuals often use SEIS tax relief as part of broader tax planning strategies.

Benefits include:

-

Reducing income tax liability

-

Offsetting capital gains

-

Estate planning advantages

Professional tax advice is recommended when structuring large SEIS investment portfolios.

Final Thoughts on SEIS Scheme Benefits in 2026

In 2026, SEIS scheme benefits continue to make early-stage investing one of the most tax-efficient opportunities in the UK. With 50% income tax relief, CGT exemptions, loss relief protection, and inheritance tax advantages, the scheme significantly reduces risk while maintaining high growth potential.

For investors who understand SEIS qualifying criteria and meet SEIS eligibility requirements, SEIS investment can be both financially rewarding and strategically smart.

Whether you are looking to diversify your portfolio, reduce tax liability, or support innovative UK start-ups, SEIS remains a powerful investment vehicle.

FAQs

1. What are the main SEIS scheme benefits?

The main SEIS scheme benefits include 50% income tax relief, capital gains tax exemption, loss relief, and inheritance tax advantages.

2. Who qualifies for SEIS tax relief?

Investors who meet SEIS eligibility rules and invest in companies that meet SEIS qualifying criteria can claim SEIS tax relief.

3. How do I apply for SEIS tax relief?

You must receive an SEIS3 certificate from the company and claim the relief through your self-assessment tax return.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness