Middle East & Africa Venture Capital Market Size, Share, Trends & Research Report, 2033 | UnivDatos

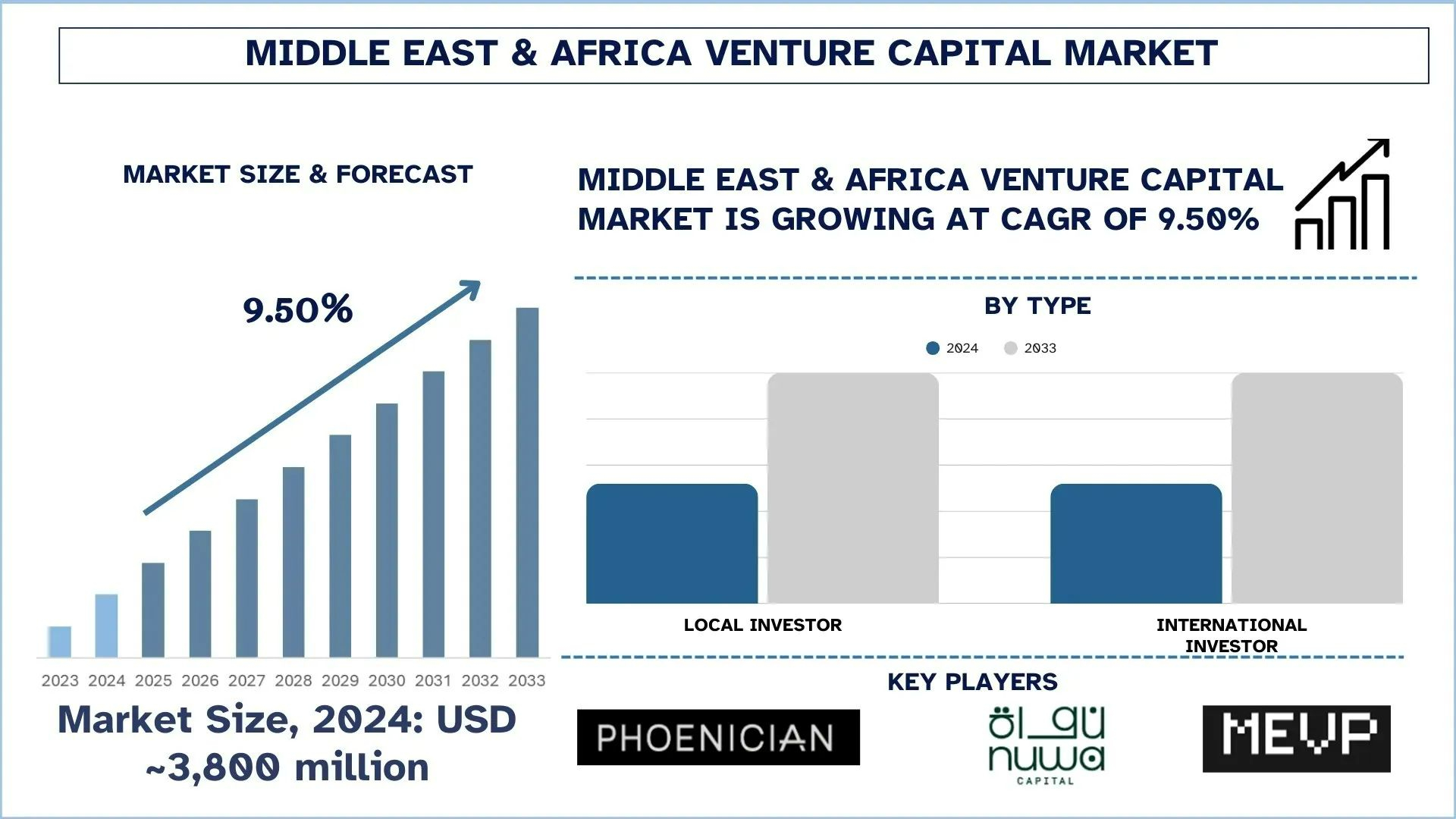

According to UnivDatos, State-backed capital & economic-diversification agendas, Digital adoption, and young, mobile-first consumers, promoting the startup ecosystem, are the key factors contributing to the market rise. As per their “Middle East & Africa Venture Capital Market” report, the Middle East & Africa market was valued at USD 3,800 million in 2024, growing at a CAGR of about 9.50% during the forecast period from 2025 - 2033 to reach USD million by 2033.

Policy reform, structured capital deployment, and increased sector focus are changing Middle East & Africa (MEA) venture capital. In the major hubs, modernization of regulations is decreasing the cost of creating a company, licensing, and investor protections, and sandboxes and frameworks are facilitating innovation by approving consumer-protective regulations. Meanwhile, investments have become more programmatic, such as grants, accelerators, matched co-investment, and government-supported growth funds, which are establishing more obvious channels between pre-seed and Series A and beyond. Investors are also putting more emphasis on scalable, revenue-based business models, and climate, energy resilience, and regional expansion have become potent new frontiers.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/middle-east-and-africa-venture-capital-market?popup=report-enquiry

Regulatory modernization in key hubs:

Policy is becoming a growth engine for venture capital through regulatory modernization in MEA in its key startup hubs. Governments are simplifying the process of forming a company, computerizing licensing, and enhancing shareholders, IP, and insolvency regulations in order to minimize execution risk. Specially designed fintech and payments regulations (usually accompanied by regulatory sandboxes) allow innovators to operate on a regulated footing, faster to market, and consumer-friendly. Recent data-protection, e- signature, and cybersecurity regulations enhance confidence in transacting business across borders, and more explicit foreign-ownership, repatriation, and fund-structuring regulations are also appealing to international LPs. Venture visas, standardized ESOP tax, and simplified KYC/AML onboarding are also being brought on board by Hubs, and these initiatives enhance the movement of talent and acquisition of customers on a region-wide basis with a significant impact. Jurisdictional courts, expedited dispute resolution, and bankruptcy regimes of the present raise recoveries and allow second chances to founders. The net result is reduced uncertainty of compliance, enhanced capital mobility, and a more predictable scaling path, measures that transform diversification plans into regional-scale investable and scalable companies.

Latest Trends in the Middle East & Africa Venture Capital Market.

Structured Funding and Sector Concentration:

It has become the hallmark of MEA venture capital expansion to be structured with capital beginning to be channeled through well-defined programs, pre-seed grants, accelerator cheques, matched co-investment, and government-based growth funds. This architecture risks early experimentation, standardizes diligence, and forms predictable roads between incubation and Series A and further on. Simultaneously, deal flow is moving towards those sectors that have a short-term regulatory pull-through and clear monetization. Fintech is in the first place, as there are high levels of underbanked people and rapidly changing rails of payments, then comes commerce enablement, logistics, B2B SaaS, and health tech, with digitization positively affecting the cost and access directly. Climate, agrosecurity, and energy-transition priorities are becoming more procurement and project pipelines, which are emerging as agrotech priorities. This will lead to reduced spray-and-pray investments and increased thematic portfolios constructed around national priorities, huge addressable markets, and quantifiable unit economics, enabling larger funding rounds, quicker growth, and greater follow-on investment by global investors.

Key Investment Trends:

One of the most critical developments in the Middle East and African venture capital market is the growing interest in scale-based, revenue-oriented start-ups, particularly in technology and fintech. A more disciplined environment is also evidenced by investors' preference for firms with clear unit economics, demonstrated customer traction, and a path to profitability. Simultaneously, the specialization of sectors is becoming stronger, as healthtech, logistics, and enterprise software growth, as well as core consumer platforms, are growing. Funds supported by the government and co-investment initiatives have remained active in catalyzing deal activity, and additional founders are looking to extend their operations regionally to the adjacent MEA markets. There is also growing interest in climate, energy, and resiliency innovations.

In 2025, The Saudi Venture Capital Co. has announced that venture capital in Saudi Arabia has significantly increased in 2025, in terms of investment volume and number of deals. According to SVC, the country has achieved 254 deals during 2025. The venture capital volume also reached 1.66 billion during the same year which was USD 60 million in 2018.

Country Market Growth

The venture capital market in Saudi Arabia has been boosted by the drive toward diversification, digitalization, and increased expansion of the private sector through Vision 2030. Local managers are anchored by sovereign-linked funds and government programs, crowd in family offices and corporates, and offer follow-on capacity to scale startups. Riyadh is becoming a regional hub of headquarters with the help of a streamlined licensing system, friendly regulation of fintech, and talent and residency programs. FinTech, commerce enablement, logistics, SaaS, and health and education platforms have the highest levels of deal flow, and climate and industrial technologies are beginning to gain more attention. Although the exits are still evolving, the M&A activity and bigger late-stage rounds are making the market more mature and building confidence among founders. According to Forbes, the MENA startup ecosystem flourished in 2024 by raising USD 1.3 billion through 352 deals in the first nine months. Additionally, Saudi Arabia captured 39% of the total share of the funding.

Click here to view the Report Description & TOC https://univdatos.com/reports/middle-east-and-africa-venture-capital-market

“From Experimentation to Execution.”

Generally, MEA venture capital is moving towards a fragmented early experimentation to an investable policy-enabled model of growth. Better regulations, an organized source of funds, and specialization in the sector are enhancing confidence and follow-on activity. Nexus cities, Blossoming hubs could characterize the next generation of high-quality regional winners, in terms of climate and energy resilience, coupled with cross-border scale.

Related Report:-

Alternative Financing Market: Current Analysis and Forecast (2025-2033)

Africa Mobile Money Market: Current Analysis and Forecast (2025-2033)

Mexico Private Equity Market: Current Analysis and Forecast (2025-2033)

Insurtech Market: Current Analysis and Forecast (2024-2032)

Neo Banking Market: Current Analysis and Forecast (2023-2030)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness