U.S. Health Insurance Market Size, Share, Industry Overview, Trends and Forecast 2026-2034

IMARC Group has recently released a new research study titled “U.S. Health Insurance Market Size, Share, Trends and Forecast by Provider, Type, Plan Type, Demographics, Provider Type, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

U.S. Health Insurance Market Overview

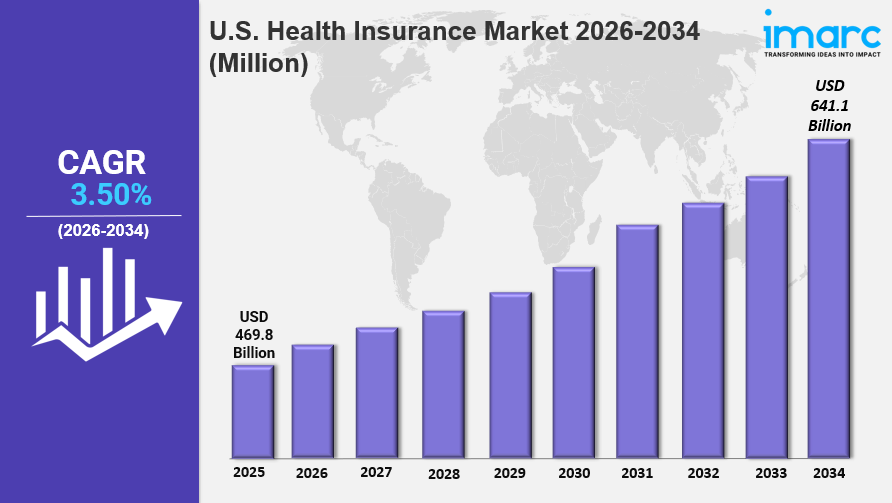

The U.S. health insurance market size was valued at USD 469.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 641.1 Billion by 2034, exhibiting a CAGR of 3.50% from 2026-2034. The escalating demand for private health insurance policies, increasing costs of healthcare services, and the rising need for comprehensive health insurance coverage among the masses across the United States are some of the factors impelling the growth of the market.

Key Market Highlights: United States Health Insurance Market

- Steady Growth Driven by Rising Healthcare Costs: The United States health insurance market is experiencing steady growth, primarily fueled by the rising costs of healthcare services and the increasing need for financial protection against medical expenses.

- Growing Enrollment in Medicare and Medicaid Programs: There is a significant increase in enrollment in Medicare and Medicaid programs, reflecting a growing awareness of the importance of health coverage among aging populations and low-income families.

- Shift Towards Telehealth Services: The market is witnessing a shift towards telehealth services, driven by advancements in technology and changing consumer preferences for convenient healthcare access, which is reshaping the health insurance landscape.

To get more information on this market, Request Sample

Trends in the United States Health Insurance Market

The United States health insurance market is evolving rapidly, influenced by several key trends that are shaping its future. One significant trend is the increasing focus on personalized health insurance plans that cater to individual needs and preferences. As consumers demand more tailored options, insurers are leveraging data analytics to create customized coverage solutions, enhancing the overall customer experience. Additionally, the rise of digital health platforms is transforming how consumers interact with their health insurance providers. These platforms facilitate seamless access to information, claims processing, and telehealth services, contributing to improved customer satisfaction. Furthermore, the emphasis on value-based care is gaining traction, as insurers shift from fee-for-service models to approaches that prioritize patient outcomes and cost-effectiveness. This transition is expected to drive the United States health insurance market size as stakeholders seek innovative solutions to enhance care delivery. Overall, the combination of personalized services, digital transformation, and value-based care is set to significantly impact the United States health insurance market share, fostering growth and adaptation in a dynamic healthcare landscape.

Market Dynamics of the United States Health Insurance Market

Increasing Healthcare Costs

One of the most significant dynamics shaping the United States health insurance market is the continuous rise in healthcare costs. As medical expenses escalate, consumers are increasingly seeking comprehensive health insurance plans to mitigate their financial risks. This trend is driven by various factors, including advancements in medical technology, rising pharmaceutical prices, and increased demand for healthcare services. Consequently, the United States health insurance market size is expanding as insurers adapt their offerings to provide more value to policyholders. Insurers are also focusing on creating cost-effective plans that cater to the needs of diverse populations, ensuring that individuals can access necessary medical services without facing exorbitant out-of-pocket expenses.

Growing Demand for Telehealth Services

The growing demand for telehealth services is another critical dynamic impacting the United States health insurance market. The COVID-19 pandemic accelerated the adoption of virtual healthcare solutions, prompting insurers to recognize the value of telehealth in improving access to care. Consumers appreciate the convenience and flexibility of remote consultations, which have become essential for managing chronic conditions and routine check-ups. As a result, health insurance providers are increasingly incorporating telehealth services into their plans, enhancing the overall value proposition. This shift is contributing to the United States health insurance market share, as more individuals opt for plans that offer telehealth options, reflecting a changing landscape in healthcare delivery and consumer preferences.

Emphasis on Preventive Care and Wellness Programs

An emphasis on preventive care and wellness programs is reshaping the United States health insurance market. Insurers are recognizing the importance of promoting healthy lifestyles to reduce long-term healthcare costs and improve patient outcomes. This trend is leading to the development of insurance plans that incentivize preventive services, such as regular health screenings, vaccinations, and wellness check-ups. By encouraging policyholders to engage in preventive care, insurers aim to lower the incidence of chronic diseases and associated healthcare expenses. As a result, the United States health insurance market growth is being fueled by a shift towards proactive health management, with an increasing number of plans incorporating wellness initiatives and rewards for healthy behaviors.

U.S. Health Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. health insurance market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on provider, type, plan type, demographics, and provider type.

Analysis by Provider:

- Private Providers

- Public Providers

Analysis by Type:

- Life-Time Coverage

- Term Insurance

Analysis by Plan Type:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

Analysis by Demographics:

- Minor

- Adults

- Senior Citizen

Analysis by Provider Type:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

Regional Analysis:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

Key market players are actively adopting strategies to strengthen their market positions and enhance consumer engagement. A major focus is on expanding and integrating digital health solutions to improve service accessibility and user experience. Companies are investing in telehealth services, mobile apps, and data analytics tools to offer virtual consultations, personalized health tracking, and seamless claims processing. Partnerships and acquisitions are playing a major part in broadening service offerings and enhancing networks. For instance, Kaiser Permanente and Town Hall Ventures in 2024 announced the launch of Habitat Health, an organization designed to help older adults overcome the challenges of aging at home. If it is approved by the Centers for Medicare & Medicaid Services and the California Department of Health Care Services, Habitat Health plans to operate as a Program of All-Inclusive Care for the Elderly and support its participants to live independently in their homes and communities with better care and support.

Latest News and Developments:

- November 2024: UnitedHealthcare announced a significant expansion of its Individual & Family Affordable Care Act (ACA) Marketplace plans, now offering coverage in 30 states.This increase includes new coverage areas in Indiana, Iowa, Nebraska and Wyoming, as well as additional counties in 13 other states.

Speak To an Analyst: https://www.imarcgroup.com/request?type=report&id=8951&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion.

IMARC’s services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness