Bare Chip Market Is Climbing Toward USD 10.5Billon — Explore What’s Fueling the Shift

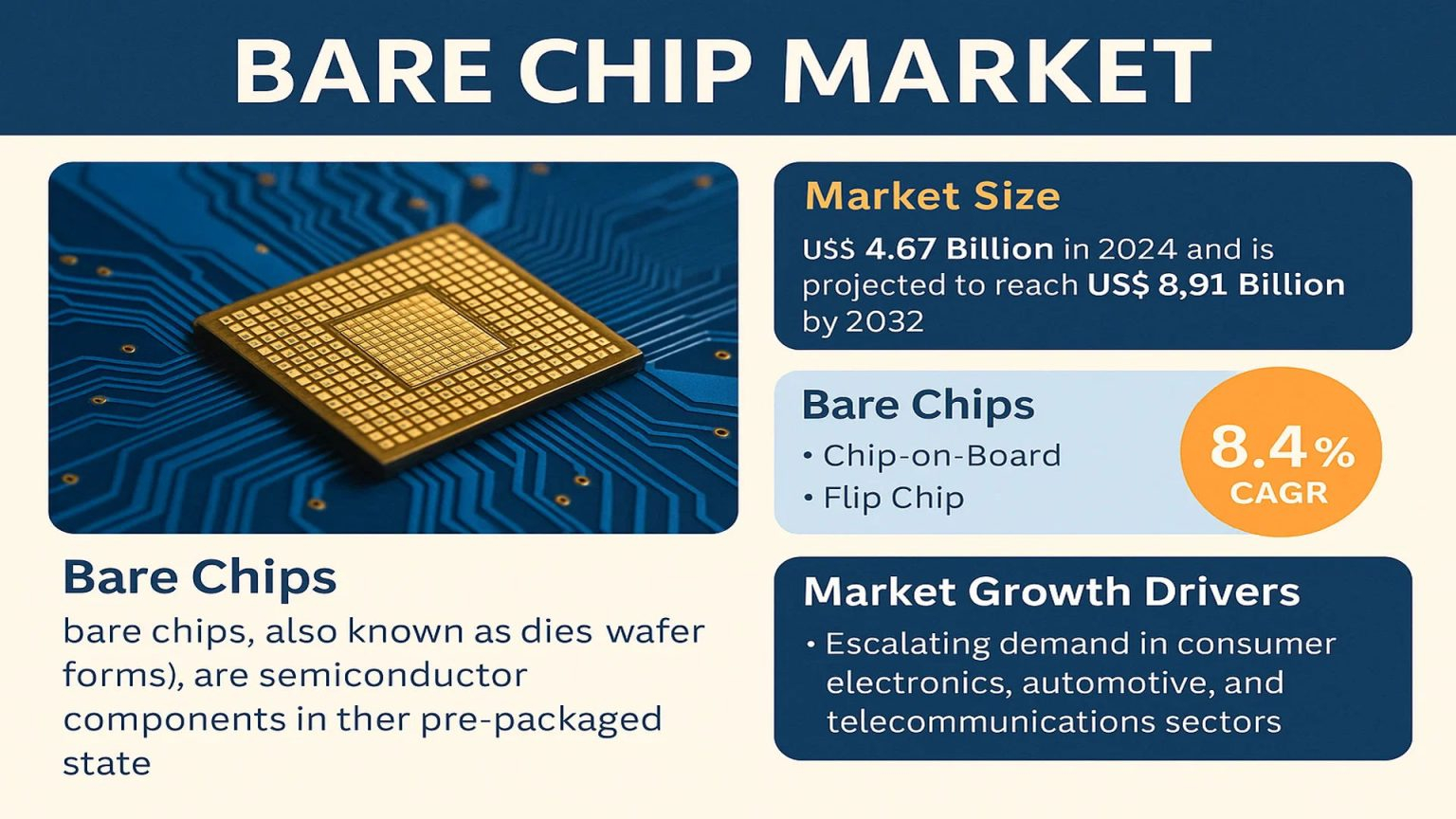

Global Bare Chip Market was valued at USD 4.67 billion in 2026 and is projected to reach approximately USD 10.5 billion by 2034, registering a CAGR of 8.4% during the forecast period 2026–2034. Market expansion is accelerating as advanced packaging, AI hardware, and high-density electronics increase direct die usage across industries.

Bare chips, also known as semiconductor dies or wafer-form chips, are unpackaged semiconductor components used as foundational building blocks for integrated and hybrid circuits. They are deployed in formats such as Chip-on-Board (COB) and Flip Chip, enabling compact, high-performance assemblies across consumer electronics, automotive, telecom, and medical systems before final packaging integration.

👉 Access the complete industry analysis and demand forecasts here: http://semiconductorinsight.com/report/bare-chip-market/

Market Definition and Dynamics

The market is evolving with the broader shift toward heterogeneous integration, miniaturized electronics, and high-performance computing architectures. Bare die deployment is increasing in advanced packaging flows where electrical performance, thermal efficiency, and footprint reduction are critical. Flip chip and wafer-level integration approaches are gaining preference in high-density designs.

Growth is also linked to expanding semiconductor content in vehicles, connected devices, and industrial systems. Foundry output growth and packaging innovation are supporting broader bare chip adoption, although supply chain dependencies on specialty materials and test infrastructure continue to influence production planning and delivery cycles.

Market Drivers

- Rising semiconductor demand across AI, IoT, and high-performance computing devices

- Growth in advanced packaging technologies including Flip Chip and wafer-level packaging

- Increasing semiconductor content in automotive and industrial systems

- Miniaturization trends in consumer and communication electronics

Market Restraints

- Material shortages and price volatility for wafers, gases, and substrates

- High complexity and cost of testing at advanced process nodes

- Supply chain concentration in specialized fabrication inputs

Market Opportunities

- Expansion of 3D IC, SiP, and fan-out wafer-level packaging platforms

- Growing adoption in AI accelerators and edge computing hardware

- Increased use of direct die integration in medical and sensing devices

Competitive Landscape

The competitive landscape includes integrated device manufacturers, specialty die suppliers, and advanced packaging ecosystem participants. Competition centers on die quality, node capability, bumping technology, and packaging compatibility. Vendors are expanding bare die portfolios aligned with AI, automotive, and high-reliability applications.

Strategic focus areas include packaging partnerships, advanced node readiness, and test optimization capabilities to improve yield and turnaround time.

List of Key Bare Chip Companies

- Texas Instruments

- Infineon Technologies

- ROHM Semiconductor

- Shinko Electric Industries

- ON Semiconductor Inc.

- Micron Technology

- Synopsys Inc.

- Micross

- Shanghai Jita Semiconductor Co., Ltd.

- Chengdu Hanxin Guoke Integration Technology Co., Ltd.

- Die Devices

- Box Optronics

- Central Semiconductor Corp.

Segment Analysis

By Type

- Chip-on-Board (COB)

- Flip Chip

- Copper pillar bumps

- Solder bumps

- Others

By Application

- Consumer Electronics Products

- Telecommunications

- Automotive

- Medical

- Others

Regional Insights

Asia-Pacific dominates the global Bare Chip market with more than half of total demand, supported by concentrated semiconductor manufacturing ecosystems across China, Japan, South Korea, and Taiwan. China leads in production and consumption backed by domestic semiconductor investment programs, while Japan remains strong in advanced packaging innovation. North America and Europe maintain stable demand driven by automotive, industrial, and high-performance computing applications. Regional supply chain policies and export controls continue to influence sourcing and capacity allocation strategies.

📄 Download a free sample to explore segment dynamics and competitive positioning: https://semiconductorinsight.com/download-sample-report/?product_id=107235

About Semiconductor Insight

Semiconductor Insight is a global intelligence platform delivering data-driven market insights, technology analysis, and competitive intelligence across the semiconductor and advanced electronics ecosystem. Our reports support OEMs, investors, policymakers, and industry leaders in identifying high-growth markets and strategic opportunities shaping the future of electronics.

🌐 https://semiconductorinsight.com/

🔗 LinkedIn: Follow Semiconductor Insight

📞 International Support: +91 8087 99 2013

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness