Drone Camera Market Growth, Trends, and Demand Forecast 2025–2033

Market Overview:

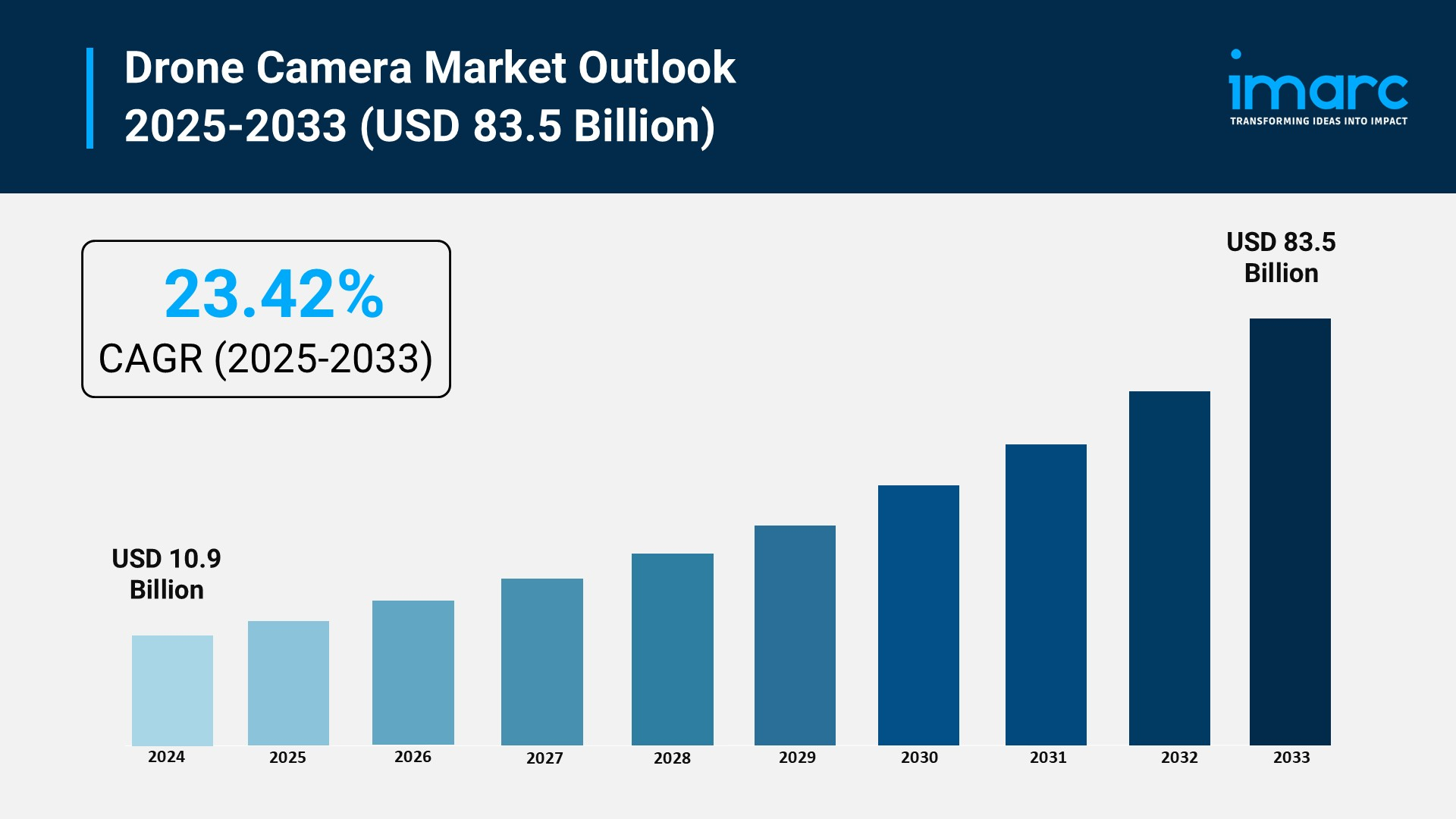

According to IMARC Group's latest research publication, "Drone Camera Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global drone camera market size reached USD 10.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 83.5 Billion by 2033, exhibiting a growth rate (CAGR) of 23.42% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Drone Camera Market

- AI-powered drone cameras enable autonomous flight capabilities with real-time obstacle detection and avoidance, reducing operational costs by 25-30% across surveillance and inspection applications.

- Machine learning algorithms optimize image processing in drone cameras, achieving 40% faster data analysis for agriculture monitoring, infrastructure inspection, and disaster management operations.

- Government initiatives like the U.S. Department of Defense's USD 7 billion UAV modernization program drive AI integration in drone cameras for intelligence, surveillance, and reconnaissance missions.

- Companies like DJI leverage AI subject tracking and intelligent shooting modes in products like the DJI Flip, democratizing aerial photography with automated 48MP photo and 4K video capture capabilities.

- AI-enabled thermal imaging and multispectral cameras in drones reduce crop monitoring costs by 35%, while edge computing modules execute real-time navigation tasks without costly ground stations.

- Autonomous drone cameras powered by AI processors like NVIDIA Jetson Orin NX deliver 100 TOPS neural-network performance, enabling small multirotor drones to complete missions with minimal human oversight.

Download a sample PDF of this report: https://www.imarcgroup.com/drone-camera-market/requestsample

Key Trends in the Drone Camera Market

- Advanced Imaging Technology Integration: Drone cameras now feature ultra-high resolution sensors with 48MP-64MP capabilities and 4K-8K video recording. Thermal imaging adoption has grown 21.67% annually for public safety applications, while multispectral cameras revolutionize precision agriculture with real-time crop health monitoring across 15+ million hectares globally.

- 5G Connectivity and Cloud Analytics: Integration of 5G networks enables real-time high-resolution video streaming and data transmission from drone cameras. Cloud-based analytics platforms process aerial footage instantly, with 38% of enterprises using drones for logistics and 34% of energy sectors leveraging them for pipeline inspections and infrastructure monitoring.

- Miniaturization and Enhanced Portability: Manufacturers focus on lightweight designs with DJI's Flip weighing under 249g while maintaining full-coverage propeller guards. Compact drone cameras now deliver professional-grade imaging in portable formats, driving 42% adoption rate among content creators, vloggers, and social media professionals seeking aerial perspectives.

- Autonomous Flight and AI-Powered Features: AI subject tracking, automated shooting modes, and intelligent flight planning dominate new product launches. Edge computing enables drones to execute missions autonomously, with 41% enterprise adoption in AI-powered imaging and 39% utilization in defense operations for enhanced situational awareness.

- Multi-Sensor Fusion Systems: Advanced drone cameras integrate multiple sensor types including HD, thermal, and LiDAR capabilities in single platforms. The DJI Zenmuse H30 Series combines five sensor modules for all-weather operations, while Quantum-Systems' Q.Fly offers SWIR imaging with seamless DJI integration for specialized industrial applications.

Growth Factors in the Drone Camera Market

- Expanding Commercial Applications: Drone cameras witness 42% adoption across construction, real estate, mining, and logistics sectors. Companies leverage aerial surveys for cost-efficient project monitoring, with infrastructure inspection demand driving 34% productivity gains and reducing manual inspection costs by 30-35% across industrial applications.

- Defense and Security Investments: Military sectors account for 36.7% market share with extensive drone camera deployment for reconnaissance, surveillance, and combat missions. North America's defense spending exceeds USD 7 billion on UAV modernization, while border security and law enforcement applications grow 39% annually for crowd monitoring and search-rescue operations.

- Agricultural Transformation: Precision farming drives demand for drone-mounted multispectral and thermal cameras monitoring crop health across large-scale operations. Farmers achieve 35% cost reduction in monitoring through automated aerial imaging, enabling targeted fertilizer application, pest detection, and irrigation optimization across 14+ million agricultural hectares.

- Media and Entertainment Revolution: Film and media industries rapidly adopt drone cameras as affordable alternatives to helicopters and cranes, with 36% market share in photography and videography applications. Professional cinematography benefits from advanced stabilization systems, 4K/8K capabilities, and creative filming angles, driving 25% growth in entertainment sector adoption.

- Technological Accessibility and Cost Reduction: Manufacturing innovations reduce drone camera production costs through economies of scale and component optimization. Improved supply chain networks decrease retail prices 20-25%, making high-quality HD and 4K cameras accessible to prosumer markets, hobbyists, and small businesses seeking aerial imaging capabilities.

Leading Companies Operating in the Global Drone Camera Industry:

- AiDrones GmbH

- Canon Inc.

- Gopro Inc.

- Guangzhou EHang Intelligent Technology Co.Ltd.

- Kespry Inc.

- Panasonic Corporation

- Parrot SA

- Quantum-Systems GmbH

- Shenzhen Dajiang Lingmou Technology Co.Ltd. (iFlight Technology Company Limited)

- Skydio Inc.

- Sony Group Corporation

- Yuneec International

Drone Camera Market Report Segmentation:

Breakup By Type:

- SD camera

- HD camera

HD camera accounts for the majority of shares in 2024, holding around 59.6% of the market due to superior image quality and sharpness for professional applications.

Breakup By Resolution:

- 12 MP

- 12 to 20 MP

- 20 to 32 MP

- 32 MP and above

12 MP dominates the market as it provides optimal balance between image quality and file size for diverse photography, videography, mapping, and inspection tasks.

Breakup By Application:

- Photography and Videography

- Thermal Imaging

Photography and videography represents the dominant segment driven by growing demand for aerial content in real estate, tourism, entertainment, media production, and event coverage.

Breakup By End User:

- Commercial

- Military

- Homeland Security

Military accounts for the largest share with around 36.7% of the market due to extensive use in reconnaissance, surveillance, intelligence-gathering, and combat missions requiring specialized imaging capabilities.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position with over 32.9% market share owing to strong government and defense investments, advanced technological infrastructure, and widespread adoption across agriculture, real estate, media, and logistics sectors.

Recent News and Developments in Drone Camera Market

- January 2025: DJI launched the DJI Flip, an all-in-one vlog camera drone weighing under 249g with foldable propeller guards, capturing 48MP photos and 4K videos with AI subject tracking and intelligent shooting modes.

- September 2024: Leading Japanese drone maker ACSL announced a new thermal camera featuring 640x512 resolution Boson sensor with 3-axis gimbal, capturing 4K video and 64MP photos for professional fieldwork applications.

- September 2024: Quantum Solutions and TOPODRONE launched Q.Fly, a DJI-compatible SWIR camera for UAVs designed for Matrice 300 and 350 RTK drones with real-time video streaming capabilities.

- May 2024: DJI released the Zenmuse H30 Series, an all-weather multi-sensor aerial payload integrating five modules including thermal and zoom cameras for public safety and energy inspection with enhanced clarity.

- April 2024: DJI launched the DJI Air 3 with enhanced obstacle avoidance systems, extended battery life, and improved camera stabilization technology targeting professional and prosumer markets.

- November 2024: Skydio acquired 114 patent assets from GoPro, boosting self-flying drone capabilities in action and aerial imagery, strengthening its position in AI-powered autonomous drones for military, public safety, and industrial applications.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness