South Korea Mobile Payment Market Size, Share, Industry Overview, Trends and Forecast 2026-2034

IMARC Group has recently released a new research study titled “South Korea Mobile Payment Market Report by Payment Type (Proximity Payment, Remote Payment), Application (Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, and Others), and Region 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Mobile Payment Market Overview

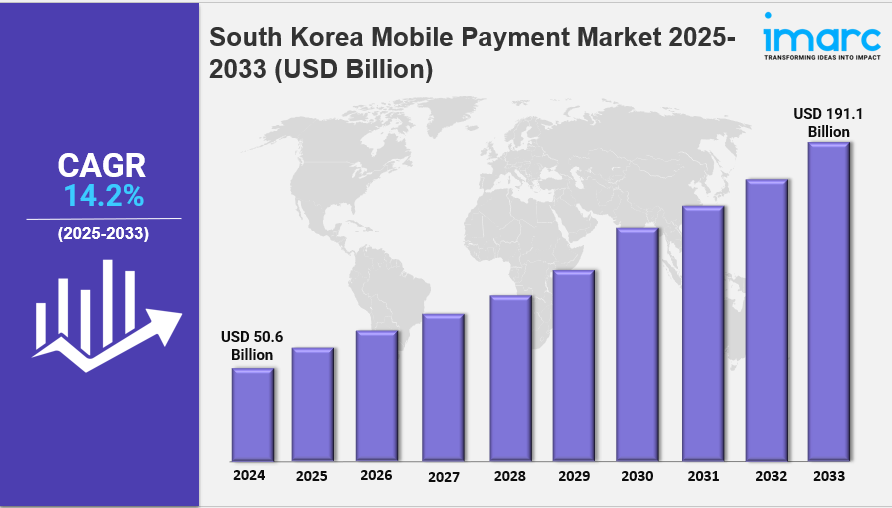

The South Korea Mobile Payment Market size was USD 57.8 Billion in 2025 and is expected to reach USD 193.5 Billion by 2034, growing at a CAGR of 14.36% during 2026-2034. This growth is driven by rapid smartphone adoption across all age groups and an increasing inclination towards online shopping. The market includes payment types such as proximity payment, remote payment, and applications spanning entertainment to utilities.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

South Korea Mobile Payment Market Key Takeaways

- Current Market Size: USD 57.8 Billion (2025)

- CAGR: 14.36%

- Forecast Period: 2026-2034

- Partnerships among fintech startups, banks, and tech giants are enhancing service offerings and user-friendly interfaces.

- A strong culture of online shopping and preference for cashless transactions is accelerating market demand.

- Regulatory support is expanding mobile payments infrastructure across major regions including Seoul Capital Area and Yeongnam.

- Uneven adoption across regions poses growth challenges, yet ongoing digital infrastructure improvements and user education initiatives present opportunities.

Sample Request Link: https://www.imarcgroup.com/south-korea-mobile-payment-market/requestsample

Market Growth Factors

The South Korea mobile payment market is propelled by increasing collaborations between fintech startups, banks, and major technology companies. These alliances focus on offering value-added services and creating user-friendly mobile payment platforms, which significantly bolsters market growth. The trend supports seamless transactions and contributes to enhancing user convenience in both urban and regional areas.

A pronounced rise in smartphone usage among diverse age groups, coupled with the growing culture of online shopping, is a key growth driver. Consumers increasingly prefer quick, contactless, and cashless transactions, further propelling the adoption of mobile payment solutions. This has led to greater acceptance of various payment types, including proximity and remote payments, across retail, entertainment, and utility sectors.

Geographically, regional expansion supported by regulatory frameworks is strengthening the market. The Seoul Capital Area exhibits high usage due to advanced infrastructure and tech-savvy consumers. Yeongnam, characterized by rising e-commerce activities, shows steady growth. Honam and Hoseo are catching up as mobile payment infrastructures evolve, enhancing accessibility. These developments together contribute to an overall positive market outlook with opportunities to overcome adoption challenges.

Market Segmentation

Breakup by Payment Type:

- Proximity Payment

- Near Field Communication (NFC): Enables contactless transactions using NFC technology, offering convenience and speed.

- Quick Response (QR) Code: Provides quick, contactless payment options via scanning QR codes, widely adopted for retail and transit.

- Remote Payment

- Internet Payments: Facilitates online transactions through browsers or apps, supporting e-commerce and digital services.

- Direct Operator Billing: Allows payments charged directly to mobile phone bills, simplifying purchase processes.

- Digital Wallet: Enables storing payment information digitally for seamless mobile-based financial transactions.

- SMS Payments: Permits payments using text messages, offering an alternative channel for mobile users.

Breakup by Application:

- Entertainment: Integration of mobile payments in entertainment venues and services to enhance customer experience.

- Energy and Utilities: Use of mobile payments to facilitate bill payments and transactions in the energy sector.

- Healthcare: Adoption of mobile payments for healthcare services to streamline payments.

- Retail: Extensive use of mobile payments in retail for faster, contactless checkouts and promotions.

- Hospitality and Transportation: Use of mobile payments in hotels, restaurants, and transport for convenience and efficiency.

- Others: Includes mobile payment applications in sectors not specifically categorized above, broadening the market reach.

Breakup by Region:

- Seoul Capital Area: Highest mobile payment usage due to advanced infrastructure and tech-savvy population.

- Yeongnam (Southeastern Region): Steady growth driven by increased e-commerce and digital transactions.

- Honam (Southwestern Region): Growing adoption linked to the evolving mobile payment infrastructure.

- Hoseo (Central Region): Development of mobile payment services improving regional accessibility.

- Others: Other regions progressively adopting mobile payments aided by digital advancements and infrastructure.

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=17683&flag=C

Regional Insights

The Seoul Capital Area dominates the South Korea mobile payment market with the highest usage attributed to its advanced infrastructure and tech-savvy consumers. Yeongnam follows with steady growth fueled by rising e-commerce activities and digital transaction adoption. Honam and Hoseo regions are progressively improving mobile payment infrastructure, increasing accessibility. Other regions are also growing influenced by overall digital advancements, creating a more connected and efficient financial landscape nationwide.

Recent Developments & News

In September 2024, Cambodia and South Korea launched a cross-border payment system enabling Jeonbuk Bank customers to make QR code payments in Cambodia, aiming to boost trade, tourism, and financial inclusion. In August 2024, Naver introduced its first digital asset wallet, Naver Pay Wallet, in collaboration with Chiliz to provide a crypto wallet for managing digital assets and blockchain integration. Busan launched Busan Pay in June 2024, Korea’s first foreigner-only mobile payment service offering local currency payments, multilingual support, and discounts to enhance tourism convenience.

Key Players

- Kakao Pay Corp.

- Naver Corporation

- NHN PAYCO Corp.

- Samsung Electronics Co. Ltd.

- SK pay

- Viva Republica Inc.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness