UAE Diaper Market Size, Report & Analysis 2025-2033

UAE Diaper Market Overview

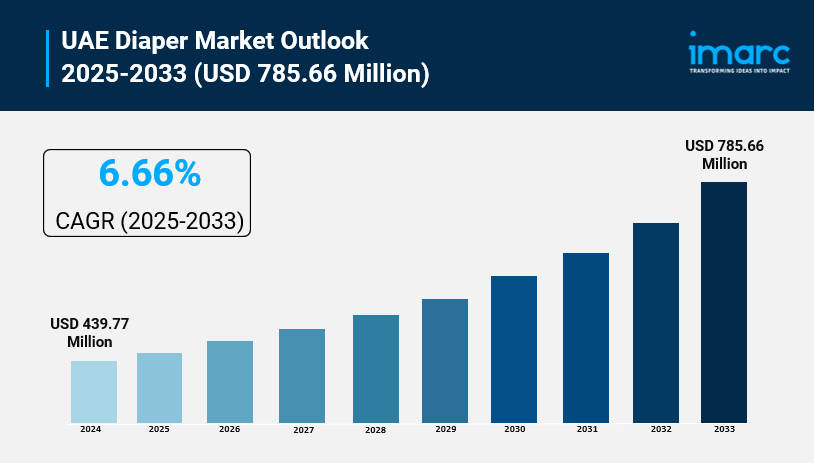

Market Size in 2024: USD 439.77 Million

Market Size in 2033: USD 785.66 Million

Market Growth Rate 2025-2033: 6.66%

According to IMARC Group's latest research publication, "UAE Diaper Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE diaper market size was valued at USD 439.77 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 785.66 Million by 2033, exhibiting a CAGR of 6.66% during 2025-2033.

How Demographics and Sustainability are Reshaping the Future of UAE Diaper Market

- Green Parenting Takes Root: Environmental awareness is driving demand for eco-friendly diapers across the UAE. In November, Ecoma launched plant-based diapers made with 45% biodegradable materials, offering 12-hour leakproof protection starting at AED 49. These products use organic cotton and chlorine-free production processes, addressing growing concerns about plastic waste and landfill impact.

- Aging Population Creates New Demand: The UAE's demographic landscape is shifting dramatically. According to United Nations Population Fund data, the population aged 60 and older is projected to surge from approximately 311,000 in 2020 to 2 million by 2050—jumping from just 3.1% to nearly 20% of the total population.

- Adult Care Market Expands Rapidly: With this demographic shift, adult diapers are becoming essential healthcare products. Manufacturers are responding with improved designs featuring better absorbency, quieter materials, and skin-friendly fabrics that prioritize comfort and dignity for elderly users managing incontinence and mobility challenges.

- Retail Accessibility Multiplies: Adult diapers are now widely available across supermarkets, pharmacies, and online platforms, making these essential products easier to access. This expanded distribution network supports both convenience and discretion for consumers seeking healthcare and hygiene solutions.

- Health-Conscious Innovation Drives Choices: Today's consumers are looking for more than basic functionality. Whether for infants or adults, there's growing demand for skin-friendly, hypoallergenic, and dermatologically tested products that minimize irritation and maximize comfort during extended wear.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-diaper-market/requestsample

UAE Diaper Market Trends & Drivers:

The diaper sector in the UAE is also showing similar signs of establishing itself with a shift in attitude towards disposable diapers with parents becoming more educated towards the environmental impact and more open to greener alternatives in tandem with changing demographics and consumer lifestyles. The company's eco-diapers, which were launched in November, are made from 45 per cent plant-based materials, including biodegradable corn starch fibers for a more eco-minded diaper that looks after their babies and the environment. Retailing from AED 49, the new line would provide affordable, sustainably produced options for consumers. The diapers will offer leakproof protection for a 12-hour period, and will have no harmful chemicals, resulting in the product being a more eco-friendly option than existing offerings within the range. These trends within the movement have been adopted by other families across the Emirates, with a desire for products that are low on plastic and have biodegradable elements to reduce the impact on the environment.

However, the infant diaper market continues to grow with the increase in birth rates and with the increasing awareness of hygiene. Parents are searching for a dermatologically tested diaper that is soft on a baby's soft skin and is also based on a high-technology absorption system. Diaper manufacturers are developing new technology for better leak protection, breathable materials, and comfortable waistbands as a result. Ecommerce is also changing the way families shop for diapers. Parents also find online shopping through subscription services, bulk purchasing, and home delivery convenient as it saves time. They can read reviews, compare brands, and take advantage of deals that are only available through online shopping. Physical retailers still have a role to play with their immediacy and ability to check products in person, but now the balance of retailing operation is truly omnichannel with consumers smoothly switching between online and offline sources to research products.

The United Nations Population Fund reports adult diapers show rapid growth in the UAE economy because the UAE population is ageing rapidly. The number of people aged 60 and over is expected to increase from about 311,000 in 2020 to 2 million until 2050. They will increase from 3.1% in 2020 to nearly represent 20% of the population in 2050. These trends have also led to a corresponding demand for incontinence products such as adult diapers. As a result, the industry has developed products that are quieter, more comfortable, less visible, and more dignified than before. They are capable of holding much greater quantities of liquid, and the material is quieter and less irritating to the skin over prolonged periods of usage. Growing acceptance of active and healthy aging among the older UAE population is driving growth in the adult diaper market. Adult diapers are displayed in supermarkets, sold in pharmacies and widely sold through online stores, which are preferred by consumers for discreet home delivery to meet the growing needs of the aging population. The adult diapers segment is expected to be the high-growth segment of the UAE diaper industry owing to its low cost, product innovation, and changing perceptions towards seniors care.

UAE Diaper Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

Breakup by Region:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Diaper Market

- November 2024: Ecoma launched its eco-friendly, plant-based diaper line in the UAE, crafted with 45% biodegradable materials including corn starch fibers. The diapers offer up to 12 hours of leakproof protection, are free from harmful chemicals, and feature recycled packaging. Prices start at AED 49, making sustainable parenting accessible to UAE families through major retail outlets.

- February 2025: Ontex introduced its innovative Dreamshields diaper technology, focusing on enhanced leak protection and sustainability improvements. This development reflects the industry's ongoing commitment to combining superior performance with environmental responsibility in diaper manufacturing.

- First Quarter 2025: Major global players including Procter & Gamble (Pampers), Kimberly-Clark (Huggies), and Unicharm (MamyPoko) strengthened their UAE market presence through enhanced distribution networks and product innovations. These companies introduced advanced skin-protection technologies and breathable materials to meet evolving consumer demands for premium, skin-friendly products.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness