Oyster Market Growth, Trends, and Demand Forecast 2025–2033

Market Overview:

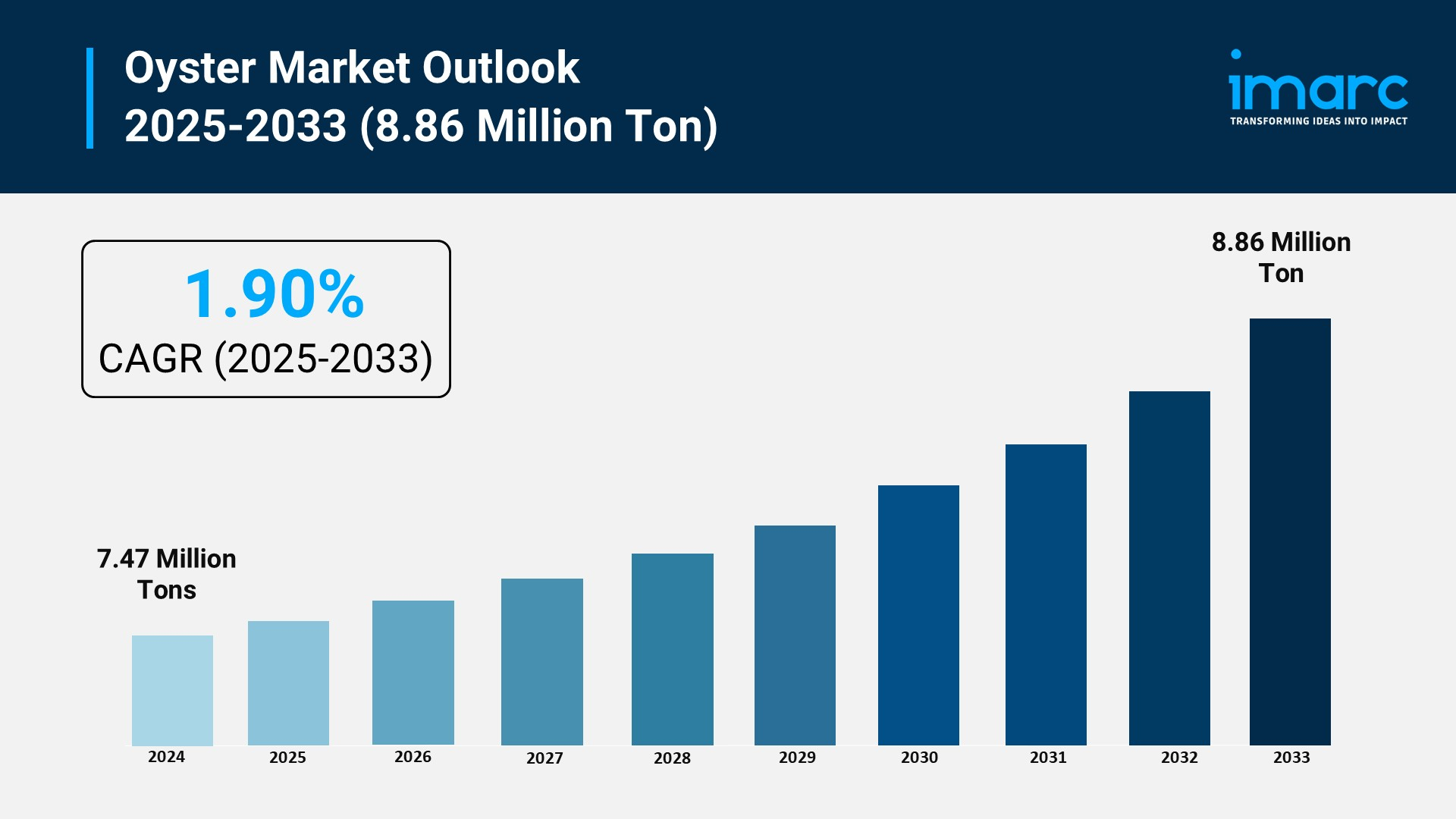

According to IMARC Group's latest research publication, "Oyster Market Report by Oyster Type (Cupped Oyster, Pacific Cupped Oyster, American Cupped Oyster, Penguin Wing Oyster, and Others), End User (Foodservice, Retail), Packaging Form (Fresh, Frozen, Canned, and Others), and Region 2025-2033", The global oyster market size reached 7.5 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 8.9 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.9% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Oyster Market

- AI-powered robotic systems automate oyster farming operations with underwater robots scanning seafloor using high-resolution cameras, promising 10% yield improvements through precise harvesting guidance.

- Aquaculture technology companies deploy IoT sensors and AI algorithms for real-time monitoring of water quality parameters, with 215 research papers documenting AIoT applications improving survival rates by 25-30%.

- Automated feeding systems and disease detection technologies reduce oyster mortality rates, with AI-driven pattern recognition identifying early infection signs and preventing outbreaks that cause $6 billion annual losses in aquaculture.

- Seascape Aquatech develops autonomous robotic boats for full-cycle automation from nursery to harvest, targeting deployment across 3,000 oyster farms in America with 24/7 autonomous operation capabilities.

- Smart aquaculture platforms integrate machine learning for biomass estimation and behavior monitoring, with over 100 oyster hatcheries established globally between 2023-2025 using advanced breeding techniques and triploid farming methods.

Download a sample PDF of this report: https://www.imarcgroup.com/office-supplies-market/requestsample

Key Trends in the Oyster Market

- Sustainable Aquaculture Practices Surge: Eco-certification programs like ASC and BAP adopted across 35 countries improve consumer confidence, with 70% consumers preferring sustainable oyster farming. Global production exceeded 6.2 million metric tons in 2024, supported by 15% increase in aquaculture operations since 2020.

- Premium Gourmet Seafood Demand: High-end oyster brands command premium prices with select varieties like Kumamoto and Belon fetching $2-4 per shell in international markets. Raw bars and half-shell oysters gain popularity with export volumes reaching 1.2 million tons in 2024.

- Technological Innovation in Farming: FlipFarm launches high-capacity Sorter processing 1.5 million oysters per hour and Rigid Mesh Seed Inserts at Oyster South Industry Symposium. Hatchery-bred larvae and triploid oyster farming improve survival rates by 25-30%, with 40% farms adopting advanced techniques.

- Direct-to-Consumer Sales Channels: Online seafood platforms in China and U.S. record 30% rise in oyster sales, with over 500 aquaculture farms supporting direct models allowing buyers to trace product origin, totaling 900,000 tons in 2024.

- Climate-Resilient Farming Methods: 65% farms move toward climate-resilient oyster farming with government-backed aquaculture investments totaling $2.8 billion between 2023-2025 boosting infrastructure. France Naissain invested in Coldep system using microbubbles to purify oysters with low-energy technology.

Growth Factors in the Oyster Market

- Rising Health-Conscious Consumption: Consumers recognize oysters as rich source of protein, omega-3 fatty acids, zinc, copper, vitamins B12, D, and C. Around 42% global consumers seek healthier diets, with oysters contributing to muscle development, cardiovascular health, and immune system support.

- Expanding International Trade: Global seafood exports exceeded $160 billion in 2024, with oysters representing growing share. Japan, South Korea, and France each importing over 200,000 tons annually, creating major opportunities for exporters across Asia-Pacific, Europe, and North America.

- Aquaculture Infrastructure Development: Number of global oyster hatcheries increased by 35% since 2020, with Albany Western Australia expansion producing 40 million spat annually. Taylor Shellfish Company's scheduled seed releases ensure consistent availability for growers.

- Triploid Oyster Dominance: Triploid oysters represent over 50% production with 65% commercial farming share, offering faster growth and consistent meat quality. Sterility ensures year-round availability meeting foodservice sector demand from fine dining establishments and seafood chains.

- Retail Distribution Expansion: Supermarkets represent 25% global consumption totaling 1.5 million tons, with over 8,000 supermarkets introducing private-label oyster products. Frozen oyster sales increased 18% in 2024 through chilled and vacuum-sealed packaging innovations.

Leading Companies Operating in the Global Oyster Industry:

- Chatham Shellfish Company

- France Naissain

- Hog Island Oyster Company

- Hoopers Island Oyster Company

- Huitres Favier Earl

- Huitres Helie

- Mere Point Oyster Company

- Morro Bay Oyster Company

- Murder Point Oysters Company

- Pangea Shellfish & Seafood Company Inc.

- Tomales Bay Oyster Company LLC

- Westcott Bay Shellfish Company

- White Stone Oyster Company

Oyster Market Report Segmentation:

Breakup By Oyster Type:

- Cupped Oyster

- Pacific Cupped Oyster

- American Cupped Oyster

- Penguin Wing Oyster

- Others

American Cupped Oyster leads the market due to its extensive culturing throughout Atlantic and Gulf coasts of America, prized for regular size, deep-cupped shell, and briny-slightly sweet flavor profile.

Breakup By End User:

- Foodservice

- Retail

Retail dominates the market with supermarkets, hypermarkets, convenience stores, specialty outlets, and online channels offering enhanced accessibility and convenience to consumers.

Breakup By Packaging Form:

- Fresh

- Frozen

- Canned

- Others

Fresh oysters lead the packaging segment driven by consumer preference for superior taste and unprocessed seafood quality.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market holding 94.9% market share in 2024, fueled by strong aquaculture infrastructure, rising seafood consumption, growing disposable incomes, and cultural preference for shellfish.

Recent News and Developments in Oyster Market

- February 2025: Willcom and Sanyo Foods fully launched an oyster business in Vietnam, aiming for 100 MT production. This marked Japan's first venture using frozen shucked oysters sourced year-round from Vietnam, leveraging TPP tariff-free shipping.

- December 2024: In Al Faya, Abu Dhabi initiated the first freshwater pearl oyster aquaculture project in the region, promoting sustainable oyster farming. The 10-unit facility can produce 10,000 oysters annually, with 8,500 freshwater oysters cultivated so far.

- July 2024: Jan De Nul and partners initiated Europe's first oyster reef restoration project in the Belgian North Sea, enhancing marine biodiversity and ecosystem health through innovative sustainability efforts.

Note:

If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness