Understanding the SEIS Scheme: Eligibility and Advantages

The Seed Enterprise Investment Scheme (SEIS) is one of the most effective ways the UK government encourages early-stage investment in small businesses. By offering substantial tax reliefs, the SEIS Scheme attracts investors willing to take a risk on startups while supporting entrepreneurship and innovation.

Whether you are an investor considering a SEIS investment or a startup looking to attract funding, understanding the SEIS Scheme, its eligibility criteria, and its benefits is essential. This guide will cover everything, from how to apply for SEIS to the tax advantages and qualifying criteria, giving you a comprehensive overview of this valuable program.

What is the SEIS Scheme?

The SEIS Scheme was introduced by the UK government to help early-stage companies raise capital by incentivizing private investors. The primary aim is to boost economic growth, encourage entrepreneurship, and reduce the risk for investors through tax reliefs.

Under this scheme, eligible companies can receive investment from individuals who, in return, gain income tax relief, capital gains tax exemption, and loss relief. This makes the scheme highly attractive for investors who want to support startups while minimizing financial risks.

For startups, the SEIS Scheme provides access to funding when traditional financing options, like bank loans or venture capital, may not be available.

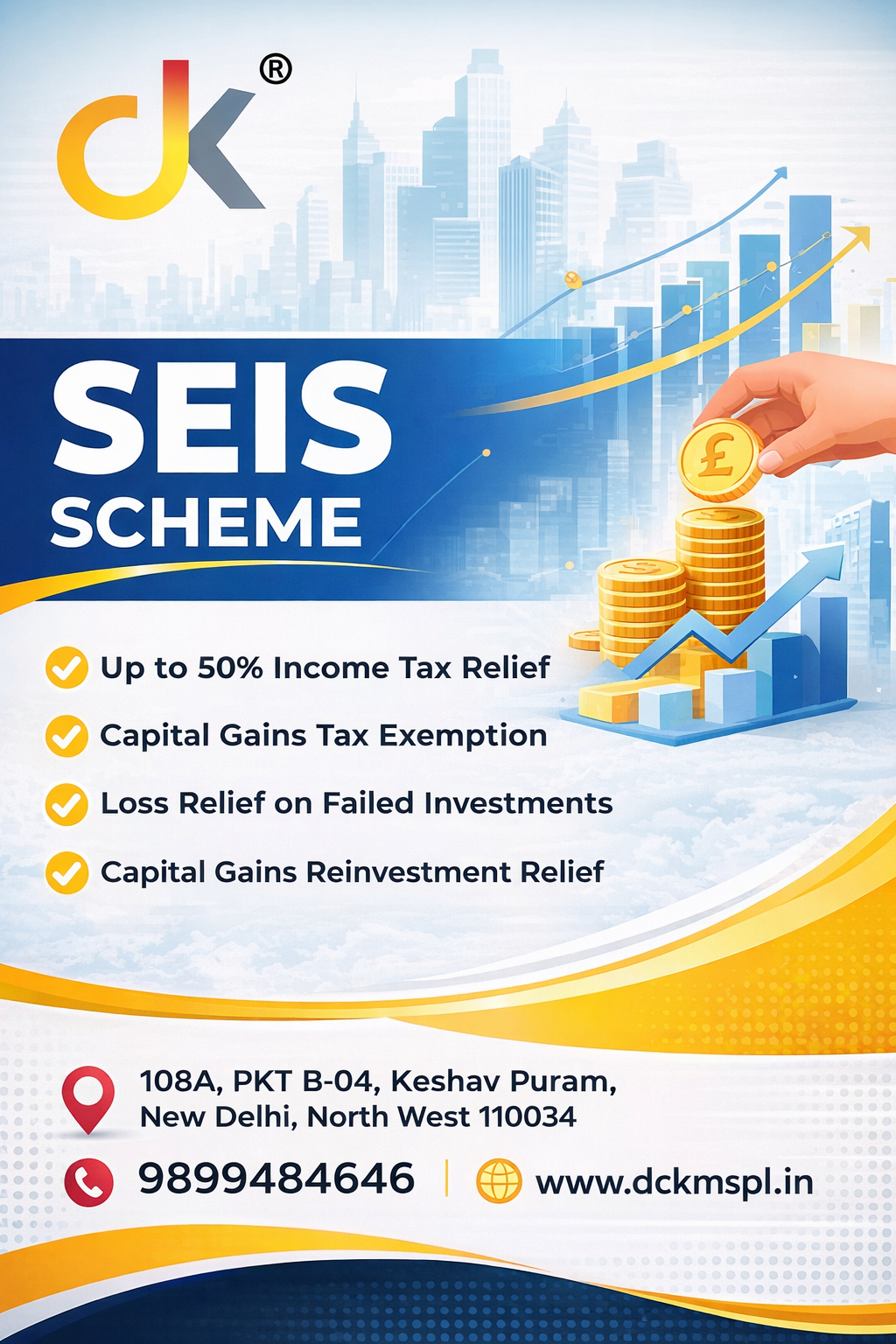

SEIS Scheme Benefits

The SEIS Scheme benefits are designed to make early-stage investment appealing to both individuals and businesses. Here are the main advantages:

1. Income Tax Relief

Investors can claim up to 50% income tax relief on investments of up to £100,000 per tax year. This means if you invest £10,000 in a qualifying company, you could reduce your income tax bill by £5,000.

2. Capital Gains Tax (CGT) Exemption

Any gains made from selling SEIS shares after holding them for at least three years are exempt from Capital Gains Tax. This allows investors to potentially earn profits tax-free, provided the shares are held for the minimum period.

3. Loss Relief

If a SEIS investment fails, investors can claim loss relief. This enables them to offset losses against income tax or capital gains tax, reducing the financial impact of unsuccessful investments.

4. Capital Gains Reinvestment Relief

Investors can use gains from other investments and reinvest them into SEIS-eligible companies to claim 50% relief on the reinvested gain, further enhancing tax efficiency.

5. Support for Startups

The scheme helps startups attract early-stage funding, which is crucial for growth, innovation, and long-term business success.

These benefits collectively make SEIS a low-risk, high-reward opportunity for investors and a vital funding source for startups.

SEIS Eligibility Criteria

Understanding SEIS eligibility is essential to ensure that both investors and companies can benefit fully from the scheme.

Company Eligibility

To qualify for the SEIS Scheme, a company must meet the following SEIS qualifying criteria:

-

Be based in the UK.

-

Have fewer than 25 employees at the time of investment.

-

Possess gross assets of no more than £200,000 before the investment.

-

Be an early-stage company, generally trading for less than two years.

-

Not have received more than £150,000 from SEIS or other government investment schemes previously.

-

Be engaged in a qualifying trade; certain industries such as banking, legal services, and property development are excluded.

Investor Eligibility

Investors must also satisfy certain requirements:

-

Be a UK taxpayer.

-

Not hold more than 30% of the company’s shares.

-

Not have a material connection to the company other than as an investor.

Meeting these criteria ensures that both the company and investor can take advantage of SEIS tax reliefs.

How to Apply for SEIS

Applying for the SEIS Scheme requires careful preparation. Here’s a step-by-step guide to apply for SEIS:

1. Confirm Eligibility

Before starting the application process, verify that both the company and investor meet the SEIS qualifying criteria.

2. Seek Advance Assurance

Companies can apply for Advance Assurance from HMRC. This is an optional step but provides investors confidence that the company is SEIS-eligible.

3. Issue Shares

Once eligibility is confirmed, the company can issue shares to investors. The number and value of shares must comply with HMRC rules to ensure tax reliefs are valid.

4. Complete SEIS3 Form

After issuing shares, the company submits a SEIS3 certificate to HMRC. Investors receive this certificate to claim their SEIS tax relief.

5. Claim Tax Relief

Investors use the SEIS3 certificate to claim relief via their self-assessment tax return. This includes income tax relief, capital gains tax exemption, and loss relief.

Following this process ensures that all parties benefit fully from the scheme.

Read More - 🌟 Complete Guide to the RoSCTL Scheme – Benefits, Process, Application, and More 🚢

SEIS Investment Opportunities

A SEIS investment allows investors to support early-stage businesses while enjoying tax advantages. Sectors that commonly qualify include technology, healthcare, renewable energy, and creative industries.

Investors should conduct due diligence before investing in any startup. Reviewing the business plan, team, and market potential helps reduce risk and ensures the investment aligns with the investor’s financial goals.

The combination of high growth potential and tax reliefs makes SEIS an attractive option for investors who are looking to diversify their portfolio with early-stage companies.

Understanding SEIS Tax Relief

The tax reliefs offered by the SEIS Scheme reduce the risk of investing in startups. Here’s a breakdown of SEIS tax relief:

-

Income Tax Relief: Up to 50% of the invested amount can be claimed as a deduction from income tax.

-

Capital Gains Tax Exemption: Profits on shares held for three years or more are exempt from CGT.

-

Loss Relief: Any losses can be offset against income tax or capital gains tax.

These combined benefits allow investors to make risk-adjusted investments in innovative businesses, encouraging the flow of capital into startups.

Why the SEIS Scheme Matters

The SEIS Scheme is crucial for the UK economy because it:

-

Encourages entrepreneurship and innovation.

-

Provides early-stage funding for companies that might struggle to secure loans.

-

Offers tax incentives to investors, reducing the financial risk of startup investment.

-

Supports job creation and economic growth at the grassroots level.

By reducing barriers to investment, the SEIS Scheme enables small companies to thrive, ultimately contributing to the development of a vibrant startup ecosystem.

Conclusion

The SEIS Scheme is a powerful tool for investors and startups alike. By offering significant tax reliefs, reducing investment risks, and providing early-stage funding, it creates a thriving environment for entrepreneurial success.

Understanding SEIS eligibility, SEIS scheme benefits, and how to apply for SEIS is essential for anyone interested in this opportunity. Whether you are a founder seeking investment or an individual looking to make a SEIS investment, the scheme provides financial advantages while contributing to the growth of innovative UK businesses.

Investing in a startup under the SEIS Scheme not only supports business development but also allows investors to enjoy income tax relief, CGT exemptions, and loss relief

Frequently Asked Questions (FAQs)

1. What is the minimum investment required for SEIS?

There is no strict minimum, but most investors invest between £1,000 and £100,000 per tax year to maximize SEIS tax relief.

2. How long do I need to hold SEIS shares?

To qualify for Capital Gains Tax exemption, SEIS shares must be held for at least three years. Selling earlier may lead to the loss of tax benefits.

3. Can I invest in multiple SEIS companies?

Yes, you can invest in multiple SEIS-eligible companies. However, the total investment eligible for income tax relief cannot exceed £100,000 per tax year.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness