Automotive Airbag ICs Market Trends & Forecast 2026–2034: Safety-Driven Tech Shift to Power USD 1.88 Billion Global Revenue

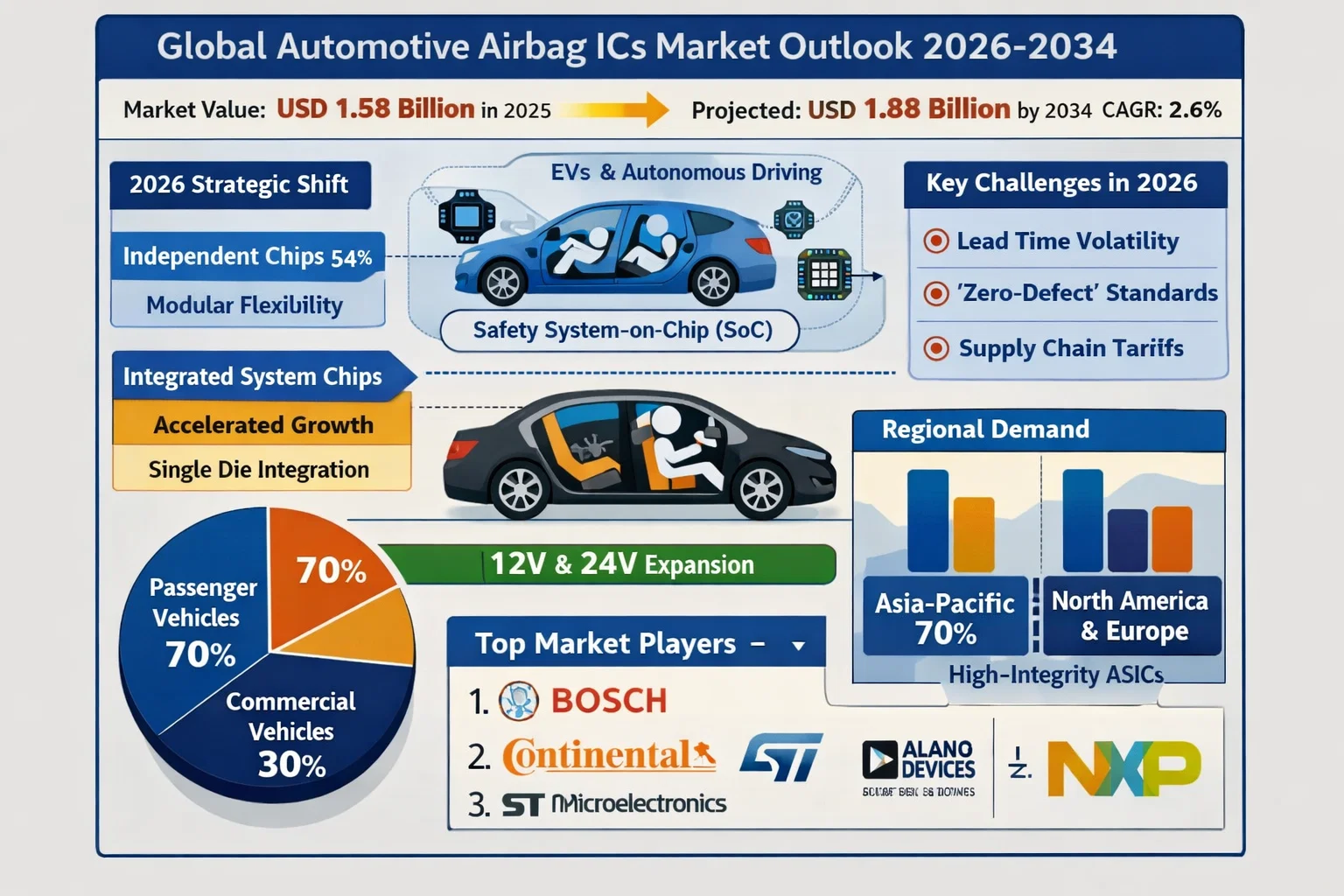

Global Automotive Airbag ICs (Integrated Circuits) Market, valued at USD 1.58 billion in 2025, is projected to reach USD 1.88 billion by 2034. As of early 2026, the industry is transitioning through a critical growth phase. While the market maintains a steady CAGR of 2.6%, the underlying complexity of the silicon is increasing rapidly as vehicle manufacturers move toward "software-defined" safety architectures.

Airbag ICs are no longer just simple trigger mechanisms; they are now sophisticated "Safety System-on-Chips" (SoCs) that handle sensor fusion, millisecond-level diagnostics, and fault-tolerant communication. In 2026, the rise of Electric Vehicles (EVs) and Autonomous Driving is forcing a redesign of these chips to accommodate new cabin layouts where occupants may not be in traditional forward-facing positions.

Sample Report: https://semiconductorinsight.com/download-sample-report/?product_id=91066

2026 Strategic Shift: Integration vs. Independence

A key technical bifurcation has emerged in the current market regarding how safety logic is housed within the vehicle.

- Independent Chips (54% Market Share): These modular ICs remain the industry standard for traditional vehicle platforms. They offer high flexibility for Tier-1 suppliers to mix and match sensors across different car models.

- Integrated System Chips (Accelerated Growth): In 2026, premium OEMs are aggressively adopting integrated solutions. These chips combine the microcontroller (MCU), transceiver, and power management onto a single die. This integration reduces board space by up to 30% and significantly lowers "latency-to-deployment," which is vital as side-impact and curtain airbags require even faster response times than frontal units.

Critical Challenges: Supply Chains and "Zero-Defect" R&D

The market in 2026 is grappling with a new set of economic and technical pressures that are reshaping manufacturing strategies.

- Lead Time Volatility: While the severe semiconductor crisis of previous years has eased, lead times for specialized 32-bit automotive microcontrollers still stretch up to 28 weeks. This has led to a "safety-stock" strategy where manufacturers hold larger inventories of finished ICs.

- The "Zero-Defect" Cost Barrier: Modern safety chips must adhere to the ISO 26262 ASIL-D standard (the highest level of functional safety). Achieving this requires massive R&D investment; in 2026, the escalating costs of pre-silicon validation and software testing have squeezed margins for Tier-2 suppliers.

- Supply Chain Tariffs: New trade policies and tariffs introduced in 2025 have increased the cost of specialized plastics and high-purity silicon, forcing many manufacturers to explore near-shoring assembly operations in regions like Mexico and Eastern Europe to mitigate geopolitical risks.

Market Segmentation: Passenger Dominance and 24V Expansion

The market's structure is heavily weighted toward high-volume consumer vehicles, though heavy-duty sectors are catching up.

- Passenger Vehicles (70% Share): Driven by global NCAP ratings that now practically mandate 8 to 12 airbags per vehicle in high-income markets.

- Commercial Vehicles: Witnessing a surge in IC demand as 2026 safety mandates in Europe and North America extend side-impact requirements to heavy trucks and delivery vans.

- Operating Voltage: While 12V dominates, there is a technical shift toward 24V electrical domains in commercial fleets and high-voltage EVs to handle the increased power demands of multi-sensor safety networks.

Regional Outlook and Competitor Landscape

- Asia-Pacific: Remains the powerhouse of the industry, accounting for nearly 70% of global demand due to the massive manufacturing bases in China, India, and South Korea.

- North America & Europe: These regions are characterized by "Value over Volume," focusing on high-integrity ASICs (Application-Specific Integrated Circuits) for luxury and autonomous vehicles.

Key Market Participants: The market remains highly consolidated, with the top five players controlling over 84% of global revenue:

- Robert Bosch GmbH (Market Leader with ~40% share)

- Continental AG

- STMicroelectronics

- Analog Devices (ADI)

- NXP Semiconductors

Download Full: https://semiconductorinsight.com/report/automotive-airbag-ics-market/

Sample Report: https://semiconductorinsight.com/download-sample-report/?product_id=91066

About Semiconductor Insight

Semiconductor Insight is a premier provider of market intelligence for the wafer fabrication, specialty materials, and precision component industries. We deliver the granular data necessary for procurement and R&D leaders to optimize their supply chain resilience.

Website: https://semiconductorinsight.com/

International: +91 8087 99 2013

LinkedIn: Follow Us

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness