Dialysis Market Size, Share & Growth Analysis 2025-2033

Market Overview:

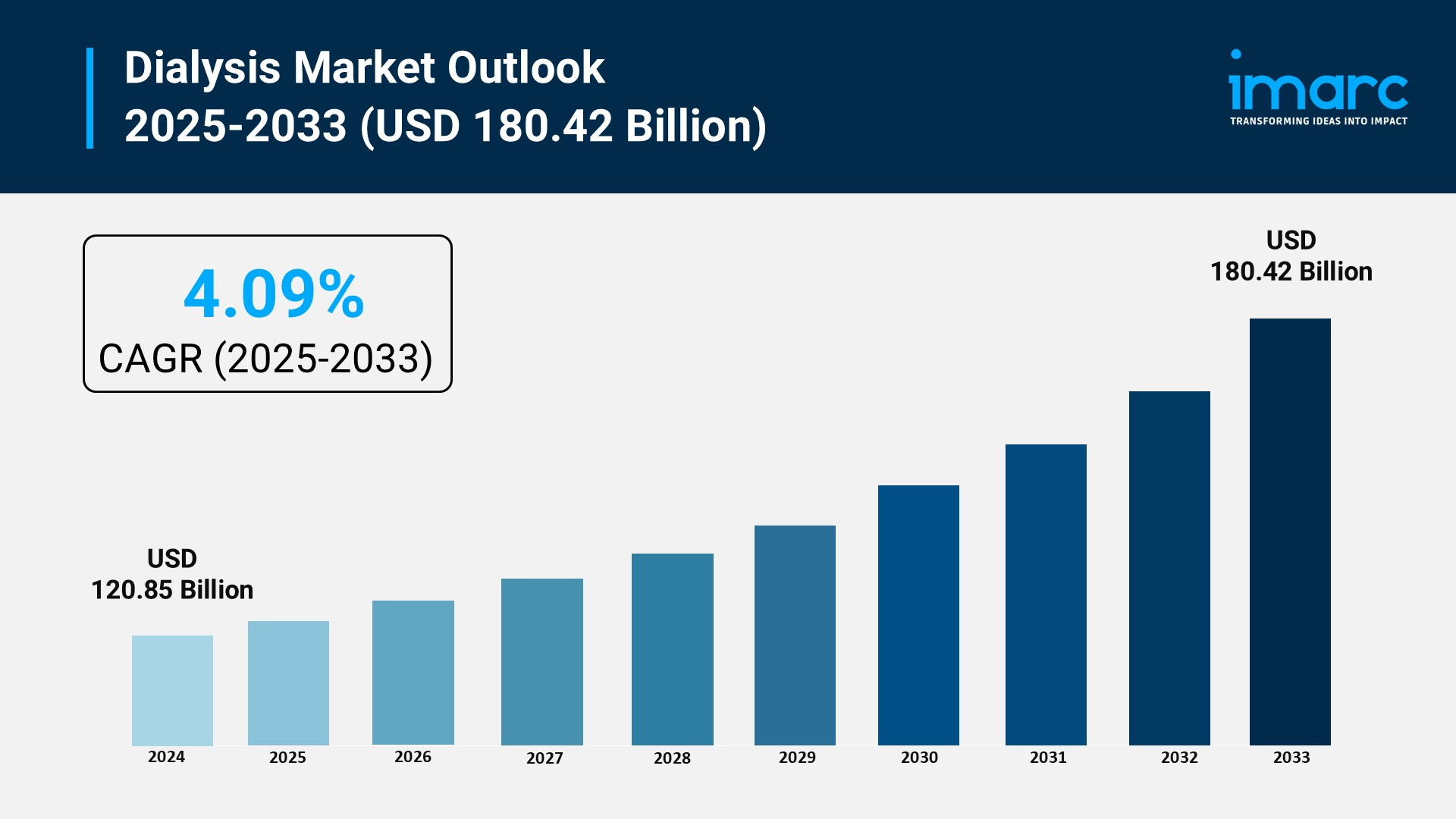

The dialysis market is experiencing rapid growth, driven by rising prevalence of chronic kidney disease, technological advancements in dialysis equipment, and expansion of home dialysis programs. According to IMARC Group's latest research publication, "Dialysis Market Size, Share, Trends and Forecast by Type, Product and Services, End User, and Region, 2025-2033", the global dialysis market size was valued at USD 120.85 Billion in 2024. Looking forward, IMARC Garoup estimates the market to reach USD 180.42 Billion by 2033, exhibiting a CAGR of 4.09% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/dialysis-market/requestsample

Our report includes:

-

Market Dynamics

-

Market Trends and Market Outlook

-

Competitive Analysis

-

Industry Segmentation

-

Strategic Recommendations

Growth Factors in the Dialysis Market

-

Rising Prevalence of Chronic Kidney Disease

The global dialysis market size in 2024 is expanding significantly due to the increasing number of people with chronic kidney disease (CKD). Diabetes and hypertension, major causes of kidney failure, are on the rise globally, pushing demand for dialysis treatments. For instance, over 850 million people worldwide are estimated to have some form of kidney disease, with millions requiring dialysis to manage end-stage renal disease (ESRD). In the U.S., more than 550,000 patients are currently on dialysis, reflecting the growing burden. Government initiatives, like the U.S. Kidney Care Alliance’s push for better CKD screening, further highlight this issue. As lifestyles contribute to higher rates of these conditions, dialysis remains a critical lifeline, fueling market growth as healthcare systems adapt to meet this demand.

-

Advancements in Dialysis Technology

Innovations in dialysis equipment are a major driver for the global dialysis market size in 2024. Companies like Fresenius Medical Care and Baxter are rolling out advanced machines that improve efficiency and patient comfort. For example, Baxter’s AK 98 dialysis machine offers enhanced filtration and user-friendly interfaces, making treatments more effective. Smart dialysis systems with real-time monitoring and AI integration are also gaining traction, reducing complications and improving outcomes. In 2024, investments in portable and wearable dialysis devices have surged, with companies like NxStage Medical reporting increased adoption of their System One for home use. These technological leaps make dialysis more accessible and less invasive, encouraging wider use and boosting market demand as healthcare providers and patients embrace these cutting-edge solutions.

-

Growing Aging Population

The global dialysis market size in 2024 is being propelled by the world’s aging population, which is more prone to kidney-related issues. Over 1.5 billion people globally are aged 60 or older, and this demographic is growing rapidly. Older adults often face declining kidney function, increasing the need for dialysis. In Japan, where nearly 30% of the population is over 65, dialysis centers are seeing record patient numbers. Government schemes, such as Japan’s universal healthcare coverage for dialysis, support this demand by ensuring affordability. Companies like Nipro Medical are responding with specialized equipment tailored for elderly patients, such as the Surdial Dx Hemodialysis System. This demographic shift, coupled with better access to healthcare, is a key force driving the dialysis industry’s growth worldwide.

Key Trends in the Dialysis Market

-

Surge in Home-Based Dialysis

Home dialysis is reshaping the global dialysis market size in 2024, offering patients flexibility and comfort. Peritoneal dialysis (PD) and home hemodialysis are gaining popularity due to their convenience. For example, Baxter’s AMIA APD system allows patients to perform dialysis at home, with over 50,000 users globally. In the U.S., the National Kidney Foundation reports that home dialysis use has grown by 20% in recent years, driven by patient preference for independence. Government programs, like Medicare’s coverage for home dialysis training, further encourage this shift. This trend reduces the strain on dialysis centers and improves quality of life, making it a game-changer for the industry as more patients opt for home-based care.

-

Integration of AI and Smart Technology

The global dialysis market size in 2024 is being transformed by AI and smart technology integration. Smart dialysis machines, like Fresenius Medical Care’s 6008 CAREsystem, use AI to monitor patient vitals in real time, reducing errors and improving outcomes. In 2024, over 10,000 such systems are in use across Europe and North America. These machines analyze data to optimize treatment plans, enhancing efficiency. Companies like Medtronic are also developing IoT-enabled devices that connect to mobile apps, allowing remote monitoring by healthcare providers. This trend is revolutionizing patient care by enabling personalized treatments and early intervention, driving market growth as hospitals and clinics invest in these advanced systems to improve care quality.

-

Focus on Sustainable Dialysis Solutions

Sustainability is an emerging trend in the global dialysis market size in 2024, as environmental concerns gain traction. Dialysis treatments generate significant waste, with each session producing up to 8 kg of disposable materials. Companies like Fresenius Medical Care are introducing eco-friendly dialysis machines that reduce water and energy consumption by 30%. In Europe, initiatives like the EU’s Green Healthcare Directive are pushing dialysis centers to adopt sustainable practices. For example, Sweden’s Karolinska University Hospital has implemented water-saving dialysis systems, cutting usage by 25%. This trend aligns with global environmental goals, encouraging manufacturers to innovate and healthcare providers to adopt greener solutions, which is reshaping the market while addressing ecological challenges.

Leading Companies Operating in the Global Dialysis Industry:

-

Asahi Kasei Corporation

-

B. Braun Melsungen AG

-

Baxter International Inc.

-

Becton Dickinson and Company

-

DaVita Inc.

-

Fresenius Medical Care AG & Co. KGaA

-

JMS Co. Ltd.

-

Medtronic plc

-

Nikkiso Co. Ltd.

-

NIPRO Corporation

-

Satellite Healthcare Inc.

-

Toray Industries Inc.

Dialysis Market Report Segmentation:

By Type:

-

Hemodialysis

-

Conventional Hemodialysis

-

Short Daily Hemodialysis

-

Nocturnal Hemodialysis

-

Peritoneal Dialysis

-

Continuous Ambulatory Peritoneal Dialysis (CAPD)

-

Automated Peritoneal Dialysis (APD)

Hemodialysis represents the largest segment due to its effectiveness in treating end-stage renal disease (ESRD), a condition affecting millions worldwide.

By Product and Services:

-

Services

-

Equipment

-

Dialysis Machines

-

Water Treatment Systems

-

Others

-

Consumables

-

Dialyzers

-

Catheters

-

Others

-

Dialysis Drugs

Services dominate the market in 2024 with a 79.0% share, encompassing essential offerings that enhance patient care, treatment accessibility, and industry growth, driven by medical providers and specialized clinics that facilitate comprehensive patient management from diagnosis to ongoing support, thereby attracting timely interventions for kidney-related issues.

By End User:

-

In-center Dialysis

-

Home Dialysis

In-center dialysis holds the biggest market share owing to its reliability, accessibility, and quality of care.

Regional Insights:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

North America enjoys the leading position in the dialysis market on account of advanced healthcare infrastructure and a high prevalence of chronic kidney diseases (CKD).

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness