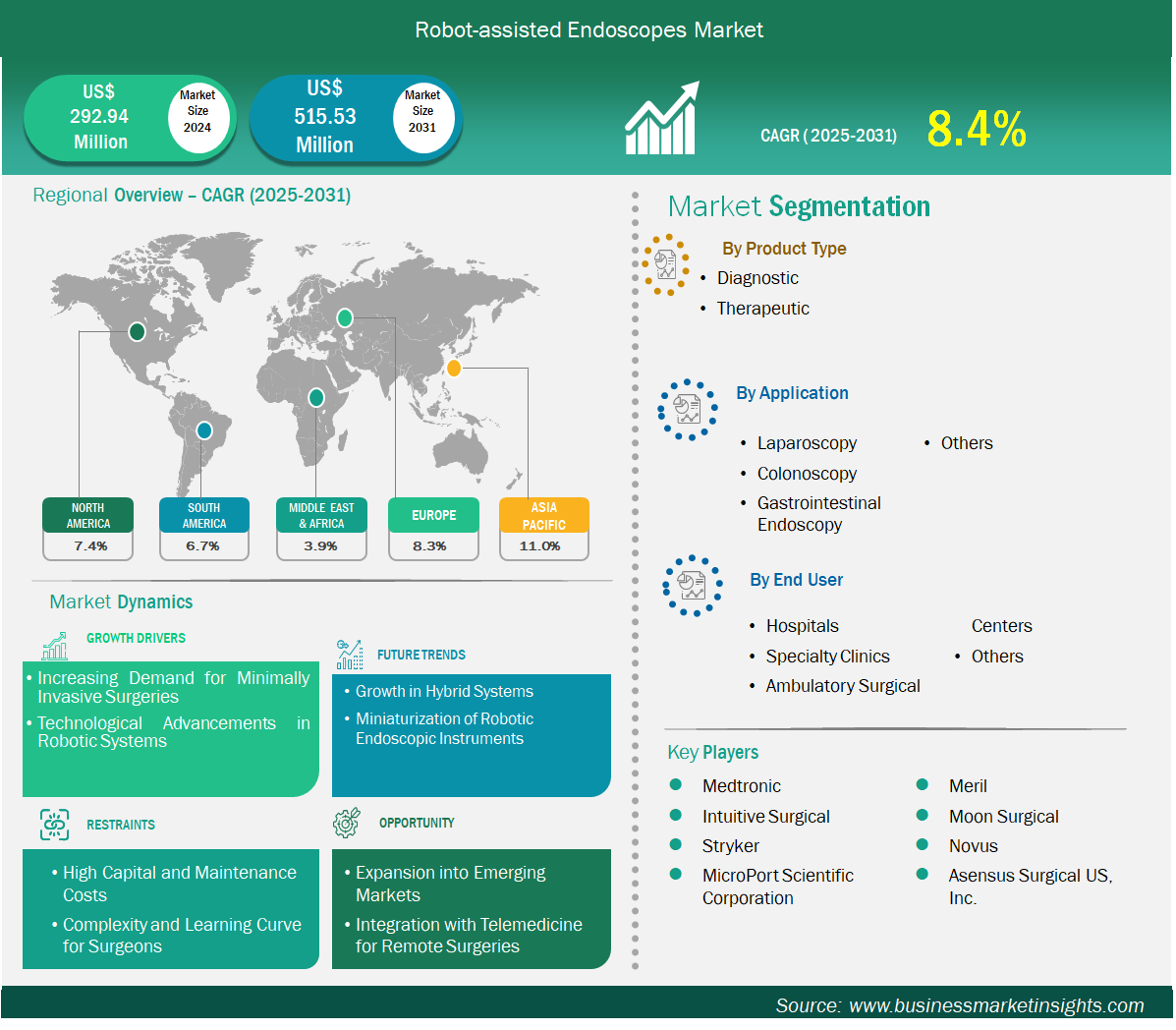

Robot-Assisted Endoscopes Market Poised for Robust Growth: Projected to Reach US$ 515.53 Million by 2031 at 8.4% CAGR

According to The Business Market Insights The Global Robot-Assisted Endoscopes Market, a cornerstone of minimally invasive medical procedures, is experiencing accelerated expansion driven by technological innovations and rising demand for precision diagnostics. Valued at US$ 292.94 million in 2024, this dynamic sector is forecasted to surge to US$ 515.53 million by 2031, reflecting a compound annual growth rate (CAGR) of 8.4% from 2025 to 2031.

Market Overview and Growth Projections

Robot-assisted endoscopes integrate robotics with traditional endoscopy to enhance maneuverability, precision, and safety in procedures like gastrointestinal (GI) examinations, bronchoscopy, and neurosurgery. This growth trajectory aligns with broader trends in robotic surgery, where global advancements are transforming patient outcomes through reduced recovery times and fewer complications.

Download Sample Report - https://www.businessmarketinsights.com/sample/BMIPUB00031684

Key forecasts underscore the market's momentum. Hospitals, a dominant end-use segment, are expected to lead with higher CAGRs due to their capacity for complex interventions, while outpatient facilities gain traction for cost-effective, same-day procedures. North America holds a significant share, bolstered by advanced healthcare infrastructure, with the U.S. alone estimated at substantial valuations in 2024.

Driving Forces Behind Expansion

Several factors propel the Robot-Assisted Endoscopes market forward. The rising prevalence of chronic conditions like GI disorders, lung cancer, and obesity-related diseases necessitates advanced diagnostic tools capable of accessing hard-to-reach areas. Minimally invasive procedures, facilitated by robotics, reduce hospital stays and infection risks, appealing to value-based care models.

AI and machine learning integrations are game-changers, enabling real-time image enhancement, automated polyp detection, and haptic feedback for surgeons. Favorable reimbursements for robotic GI and pulmonary interventions further accelerate adoption, particularly in North America and Europe. Additionally, the post-pandemic emphasis on single-use endoscopes to prevent infections boosts demand for disposable robotic components.

Key Applications and Innovations

Gastroenterology leads applications, with robotic systems excelling in polypectomy, biopsies, and submucosal dissections. Bronchoscopy emerges as a high-growth area, achieving up to 90% diagnostic yields for peripheral lung nodules via AI-guided navigation. Other uses span urology, gynecology, and neurosurgery, where precision minimizes trauma.

Recent innovations highlight progress. In May 2025, Olympus received FDA clearance for EZ1500 series endoscopes with extended depth-of-field imaging for superior GI lesion detection. Johnson & Johnson’s MONARCH QUEST platform added AI upgrades for bronchoscopy in March 2025, while EndoQuest and Virtuoso Surgical launched trials for colorectal and ENT robots. These developments exemplify how robotics enhances endoscopic capabilities beyond manual limits.

Trending Keywords –

Rehabilitation Robots Market - Outlook (2022-2033)

Medical Robots Market - Outlook (2022-2033)

Surgical Robots Market - Report Outlook (2022-2033)

Major Players and Competitive Landscape

Industry leaders are investing heavily to capture market share. Intuitive Surgical dominates with platforms like da Vinci, expanding into endoscopy. Johnson & Johnson, Olympus, and Medtronic drive competition through FDA-cleared innovations and AI integrations.

Other key players include Boston Scientific, Stryker, Fujifilm, Karl Storz, and emerging firms like EndoQuest Robotics and CMR Surgical. Strategies focus on modular systems, subscription models for accessories, and partnerships for cloud-based analytics, addressing high capital costs (US$1.5-2.5 million per system). Chinese manufacturers offer cost-competitive alternatives, intensifying global rivalry.

Regional Insights

North America commands the largest share (around 40%), fueled by reimbursement policies and surgeon training. Europe grows steadily despite regulatory hurdles like MDR, with Germany and the UK leading.

Asia-Pacific posts the fastest CAGR, driven by China's domestic production, Japan's telesurgery trials, and India's medical tourism. Emerging markets in the Middle East and Latin America adopt via financing models, bridging infrastructure gaps.

Challenges and Future Outlook

High upfront costs and surgeon training shortages pose restraints, particularly in emerging regions. Regulatory scrutiny and sustainability concerns around disposables add complexity.

Yet, the outlook remains bright. With a projected CAGR of 8.4%, the market will benefit from telemedicine expansion and preventive screening mandates. By 2031, robot-assisted endoscopes will likely become standard in outpatient settings, reducing global healthcare burdens.

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness