Personal Mobility Devices Market Size, Share, Growth, and Forecast 2025–2033

Market Overview:

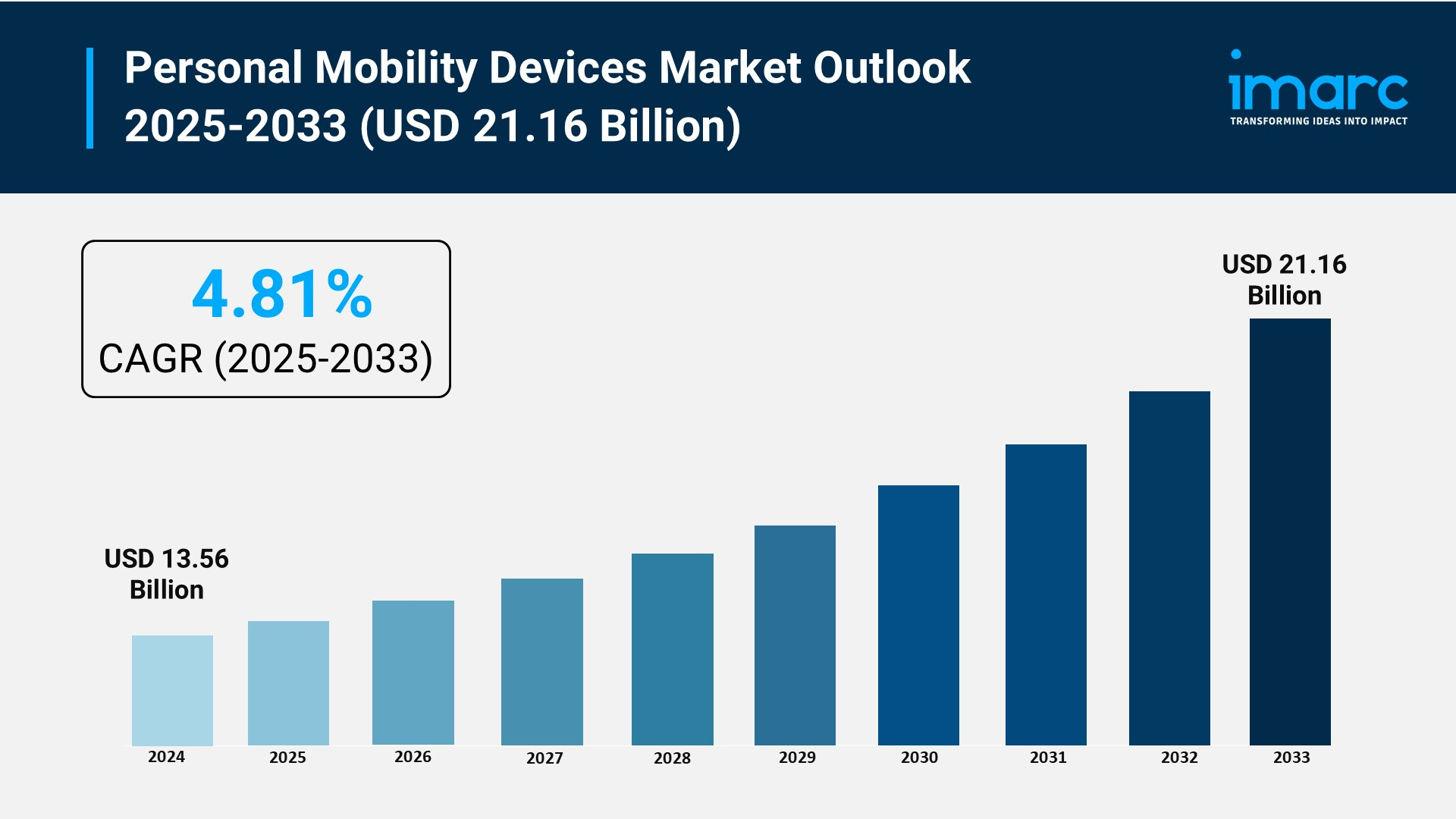

According to IMARC Group's latest research publication, "Personal Mobility Devices Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global personal mobility devices market size was valued at USD 13.56 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.16 Billion by 2033, exhibiting a growth rate (CAGR) of 4.81% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Personal Mobility Devices Market

- AI-powered navigation systems in smart wheelchairs utilize machine learning algorithms to map indoor environments, detect obstacles in real-time, and optimize routes with 95% accuracy, reducing collision risks by 40% for users with visual impairments.

- Artificial intelligence enables predictive maintenance in motorized mobility devices, analyzing usage patterns and battery performance to alert users 72 hours before potential failures, cutting unexpected breakdowns by 35% across healthcare facilities.

- Companies integrate AI-driven health monitoring into mobility aids, with sensor-equipped wheelchairs tracking vital signs, posture alignment, and movement patterns, transmitting telemetry data to clinicians for evidence-based care adjustments and fall prevention protocols.

- Machine learning algorithms personalize device settings by analyzing user behavior over 30-day periods, automatically adjusting speed limits, braking sensitivity, and suspension firmness to match individual mobility capabilities, improving safety outcomes by 28%.

- AI-enhanced voice control systems process natural language commands in 15 languages, enabling hands-free operation of wheelchairs and scooters with 98% accuracy, particularly benefiting users with limited upper-body mobility and cognitive impairments.

- Deep learning models accelerate rehabilitation progress by analyzing gait patterns and movement quality in real-time, providing instant feedback through haptic signals and reducing physical therapy duration by 25% for post-surgery patients.

Download a sample PDF of this report: https://www.imarcgroup.com/personal-mobility-devices-market/requestsample

Key Trends in the Personal Mobility Devices Market

- Smart Technology Integration in Wheelchairs: Advanced motorized wheelchairs now feature GPS navigation, remote control capabilities, and smart sensors for enhanced safety. In January 2025, Strutt introduced the Strutt ev¹ with Co-Pilot 3D sensor navigation and intelligent drive modes, transforming personal mobility in complex spaces. Similarly, Sunrise Medical launched the Switch-It Vigo wireless head control system in January 2024, enabling intuitive wheelchair operation through head movements for individuals with complex mobility requirements.

- Rising Demand for Lightweight and Foldable Designs: Consumers increasingly prefer portable mobility devices that fit compact urban housing and public transport systems. Mid-market growth is driven by widespread adoption of foldable frames with recyclable composites and low-energy propulsion systems, aligning with circular economy goals. These ergonomically designed models accommodate both indoor and outdoor use, catering to the 12.2% of U.S. adults reporting mobility disabilities involving serious difficulty walking or climbing stairs.

- Expansion of Home-Based Healthcare Solutions: The global shift toward personalized, home-based healthcare for individuals with mobility issues is accelerating market growth. Remote healthcare consultation services and home rehabilitation programs increase demand for user-friendly devices designed for small indoor spaces. Insurance coverage, reimbursement policies, and government initiatives supporting independent living drive amplified demand, with manufacturers introducing safety features and convenience solutions specifically for domestic environments.

- Growth in All-Terrain Mobility Capabilities: 2025 mobility aids feature upgraded suspension systems and all-terrain wheels, enabling comfortable travel over gravel, grass, and uneven pavement. This improved adaptability benefits users seeking outdoor recreation and participation in adaptive sports like wheelchair basketball and para-cycling. Manufacturers respond with sports-specific equipment offering performance, durability, and customization, normalizing mobility devices through public events and competitions.

- E-Commerce Platform Proliferation: The global e-commerce market reached USD 26.8 trillion in 2024, significantly improving mobility device accessibility. Online platforms enable users with limited mobility to compare products, read customer reviews, and arrange doorstep delivery without leaving home. Digital channels promote niche and specialized items with detailed specifications and video demonstrations, while return policies and online customer support enhance satisfaction, expanding market reach to urban and rural areas.

Growth Factors in the Personal Mobility Devices Market

- Aging Population Surge: The global geriatric population is expanding rapidly, driving sustained demand for mobility support solutions. With improved healthcare and rising life expectancy, elderly individuals increasingly require long-term mobility assistance for conditions like arthritis, osteoporosis, and musculoskeletal diseases. In Europe, almost one in five people in England are aged 65 and over, while nearly two in five are 50 and over, reflecting a sizable base seeking mobility support. Government investments in accessibility policies and infrastructure further enhance device availability.

- Rising Chronic Illness Prevalence: As of March 2024, osteoarthritis affected approximately 7.6% of the worldwide population, with anticipated rises of 60-100% by 2050. Chronic conditions such as diabetes and multiple sclerosis result in reduced mobility and fatigue, making wheelchairs, walkers, and scooters essential for daily functioning. Health professionals frequently recommend these aids to manage symptoms, while patients with progressive illnesses seek assistive devices to maintain autonomy in home environments.

- Increasing Injury and Accident Rates: Urbanization activities and fast-paced lifestyles in emerging economies contribute to rising traffic accidents and workplace injuries. In Maharashtra, India, total highway accidents increased from 35,243 in 2023 to 36,084 in 2024. Temporary or permanent mobility issues from fractures, surgeries, or spinal cord injuries require assistive devices during recovery phases. Rehabilitation centers and hospitals frequently prescribe wheelchairs, crutches, and walkers to aid post-injury mobility and functional recovery.

- Favorable Government Policies and Reimbursements: Comprehensive social welfare programs and robust universal healthcare coverage lower out-of-pocket costs across Europe. The New Living Without Limits Plan in Latin America earmarks USD 446 million for accessibility and assistive technology, signaling sustained public funding. The Americans with Disabilities Act (ADA) implements accessibility requirements for public and private environments, propelling demand. Favorable reimbursement policies within value-based care frameworks incentivize providers to prescribe high-function aids.

- Technological Advancements in Device Design: Innovations in materials science produce lightweight, battery-powered devices with extended range and minimal physical effort requirements. Smart devices connect to mobile apps for health tracking, route planning, and emergency alerts, while modular designs offer swappable batteries and adjustable frames. In the Middle East and Africa, a USD 22.1 million social-care project in Saudi Arabia's Qassim Region aims to transform support services for people with disabilities, highlighting commitment to advanced mobility solutions.

We explore the factors propelling the personal mobility devices market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Personal Mobility Devices Industry:

- Arjo

- Carex Health Brands Inc. (Compass Health Brands Corp.)

- Drive Medical Inc.

- GF Health Products Inc.

- Invacare Corporation

- Kaye Products Inc.

- Medline Industries Inc.

- Performance Health Supply Inc. (Patterson Medical)

- Pride Mobility Products Corp.

- Rollz International

- Stryker Corporation

- Sunrise Medical (US) LLC

Personal Mobility Devices Market Report Segmentation:

Breakup By Product:

- Walking Aids

- Wheelchairs

- Scooters

- Others

Wheelchairs account for the majority of shares with approximately 45.9% in 2024, driven by their wide scope of applications meeting users with both long-term and short-term mobility issues, availability in various forms including manual, electric, transport, and lightweight models, and technological advances like powered controls, recline features, and safety sensors.

Breakup By End Use:

- Hospitals and Clinics

- Home Care Settings

- Others

Home care settings dominate the market due to the worldwide shift toward individualized, home-based healthcare for individuals with mobility issues, particularly among the elderly, with equipment designed to be lightweight, simple to use, and suitable for small indoor areas, supported by insurance coverage, reimbursement policies, and government initiatives promoting independent living.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position with 35.8% market share in 2024, propelled by sophisticated healthcare infrastructure, high prevalence of mobility disorders, a fast-growing geriatric population, strong regulatory frameworks like the ADA implementing accessibility requirements, and high consumer inclination toward technologically sophisticated products integrating function, style, and digital connectivity.

Recent News and Developments in Personal Mobility Devices Market

- January 2024: Sunrise Medical introduced the Switch-It Vigo, a wireless head control system enabling intuitive power wheelchair operation via head movements, promoting independence and communication for individuals with complex mobility requirements.

- January 2025: Strutt launched the Strutt ev¹ featuring Co-Pilot 3D sensor navigation, intelligent drive modes, and extended battery range, transforming smart personal mobility for navigating complex indoor and outdoor spaces.

- March 2025: Leading manufacturers showcased advanced all-terrain mobility devices with upgraded suspension systems at international mobility expos, addressing growing consumer demand for outdoor recreation capabilities and adaptive sports participation.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness