Polyolefin Catalyst Market Growth, Size, Trends, and Forecast 2025–2033

Market Overview:

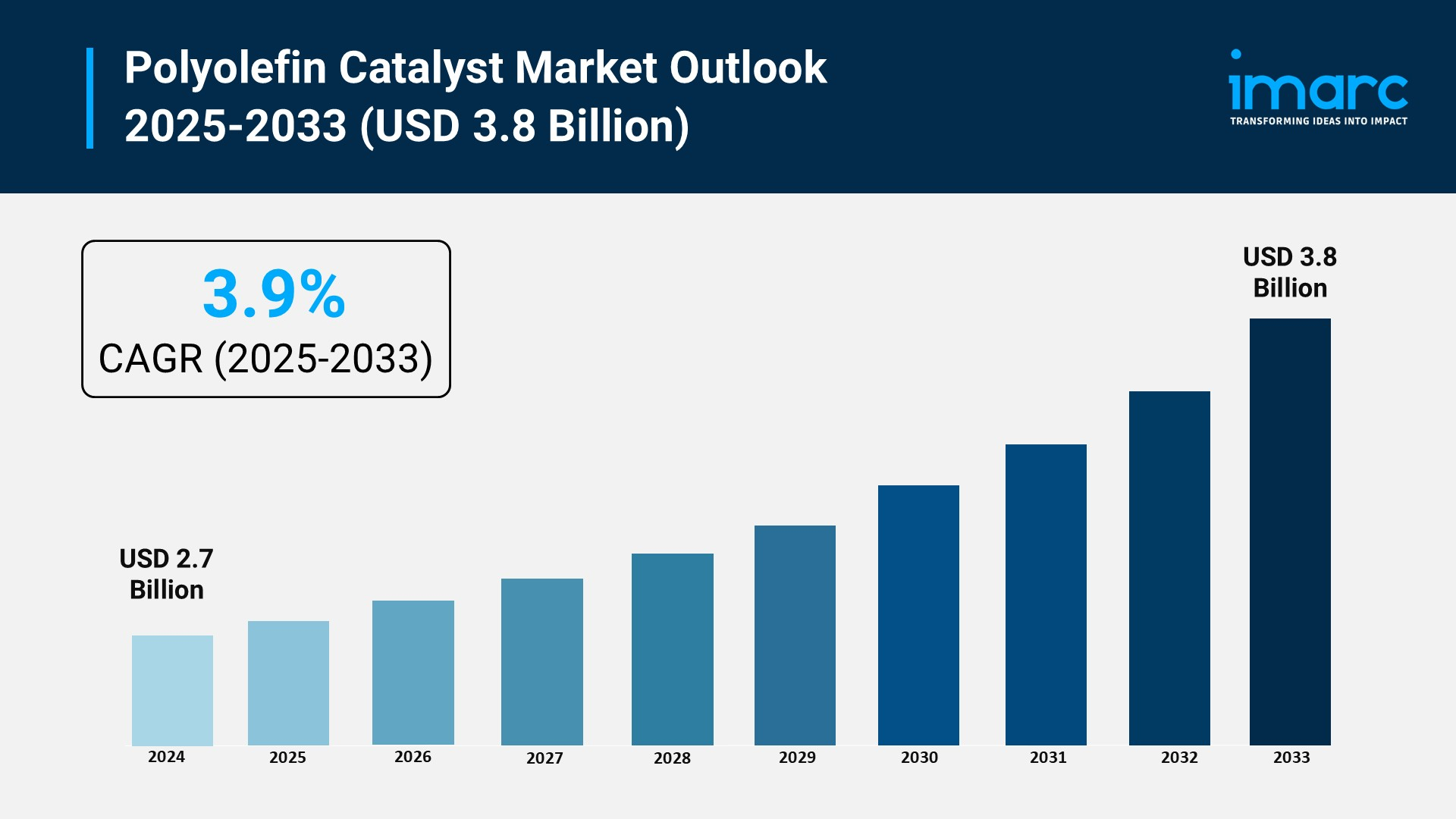

According to IMARC Group's latest research publication, "Polyolefin Catalyst Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global polyolefin catalyst market size reached USD 2.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Polyolefin Catalyst Market

- AI enhances catalyst development by optimizing molecular designs, reducing development time by 30% through predictive modeling and simulation techniques.

- Machine learning algorithms improve polymerization process efficiency, enabling manufacturers to achieve higher yields and reduce energy consumption by 15-20%.

- Companies like BASF and LyondellBasell use AI-powered analytics to monitor catalyst performance in real-time, ensuring consistent polymer quality and reducing production waste by 12%.

- AI-driven quality control systems detect catalyst deactivation patterns early, preventing production disruptions and saving manufacturers millions in downtime costs annually.

- Advanced computational chemistry powered by AI accelerates the discovery of next-generation metallocene and single-site catalysts, supporting the development of specialty polyolefins with enhanced properties.

Download a sample PDF of this report: https://www.imarcgroup.com/polyolefin-catalyst-market/requestsample

Key Trends in the Polyolefin Catalyst Market

- Rising Adoption of Metallocene Catalysts: Manufacturers are increasingly shifting towards metallocene and single-site catalysts for their superior control over polymer properties. These advanced catalysts enable production of high-performance polyolefins with precise molecular weight distribution. About 35% of new polyolefin production facilities now incorporate metallocene technology, driven by demand for specialty applications in packaging and automotive sectors.

- Sustainable Catalyst Development: Industry focus on eco-friendly production drives development of catalysts that support recyclable polyolefins. Companies like Clariant and W.R. Grace are innovating catalysts that work efficiently with bio-based feedstocks. Environmental regulations in Europe and North America push manufacturers towards catalysts that reduce emissions and energy consumption by 15-25%.

- Growth in Packaging Applications: Films and packaging dominate with 43.6% market share, fueled by e-commerce expansion and food safety requirements. Polyolefin catalysts enable production of lightweight, durable packaging materials that reduce shipping costs. Asia-Pacific packaging industry growth of 8% annually drives increased catalyst demand.

- Technological Advancements in Ziegler-Natta Catalysts: Despite newer technologies, Ziegler-Natta catalysts maintain market leadership with 54% share due to cost-effectiveness and reliability. Innovations improve their thermal stability and increase melt flow rates. Manufacturers invest in enhancing traditional catalysts to meet evolving performance requirements.

- Automotive Lightweight Materials Trend: Automotive industry's push for fuel efficiency drives demand for lightweight polyolefin components in bumpers, dashboards, and interior trims. Catalysts enabling production of high-strength, low-weight polypropylene grades see 20% demand growth. India's automotive component industry reaching Rs. 3.32 lakh crore (USD 38.4 billion) in H1 FY25 highlights sector expansion.

Growth Factors in the Polyolefin Catalyst Market

- Expanding Packaging Industry Demand: Packaging sector accounts for largest market share, driven by rising demand for flexible and rigid packaging solutions. India's packaging market projected to reach USD 204.81 billion by 2025, according to PIAI. Growing food and beverage industry requires advanced catalysts for producing food-grade polyolefins with superior barrier properties.

- Infrastructure and Construction Growth: Urbanization and infrastructure investments drive demand for polyethylene pipes and construction materials. High-density polyethylene (HDPE) holds 35% market share, essential for water distribution and sewage systems. Major projects like Riyadh's Tilal Khuzam with 3,500 homes spanning 630,000 square meters demonstrate construction sector's polyolefin requirements.

- Automotive Sector Expansion: Vehicle production growth increases demand for polyolefin-based components offering weight reduction and durability. Automotive applications contribute 30% to global polyolefin catalyst market revenue. Manufacturers require specialized catalysts producing polymers that withstand high temperatures and mechanical stress in automotive environments.

- Technological Innovation in Catalyst Design: Investment in research and development leads to catalysts with enhanced activity, selectivity, and longevity. Advanced catalyst formulations enable producers to achieve 25% higher yields while reducing energy consumption. Digital technologies and automation in catalyst manufacturing ensure consistent quality and faster commercialization.

- Asia-Pacific Manufacturing Dominance: Region accounts for largest market share with rapid industrialization and expanding petrochemical infrastructure. China and India lead with supportive government policies and substantial investments in polymer production facilities. Asia-Pacific's e-commerce boom drives flexible packaging demand, escalating catalyst requirements for polyolefin production.

Leading Companies Operating in the Global Polyolefin Catalyst Industry:

- Albemarle Corporation

- Clariant AG

- Honeywell International Inc.

- INEOS Capital Limited

- Japan Polypropylene Corporation (Mitsubishi Chemical Corporation)

- LyondellBasell Industries N.V.

- Mitsui Chemicals Inc.

- Nova Chemicals Corporation

- Sinopec Catalyst Co. Ltd. (China Petroleum & Chemical Corporation)

- Toho Titanium Co. Ltd. (JX Nippon Mining & Metals Corporation)

- W. R. Grace and Company

- Zeochem AG

Polyolefin Catalyst Market Report Segmentation:

Breakup By Type:

- Ziegler-Natta Catalyst

- Single Site Catalyst

- Chromium Catalyst

- Others

Ziegler-Natta catalyst dominates the market due to its cost-effectiveness, reliability, and established presence in polyolefin production.

Breakup By Classification:

- Polypropylene

- Polyethylene

- Others

Polyethylene accounts for the majority of shares due to its versatility and widespread applications across packaging, construction, and consumer goods sectors.

Breakup By Application:

- Injection Molding

- Blow Molding

- Films

- Fibers

- Others

Films hold the largest market share, driven by extensive use in packaging applications including food, pharmaceuticals, and consumer products.

Breakup By End Use Industry:

- Automobile

- Construction

- Healthcare

- Electronics

- Packaging

- Others

Packaging dominates the market owing to rising demand for flexible and rigid packaging materials in food and beverage, pharmaceuticals, and e-commerce sectors.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to rapid industrialization, expanding petrochemical infrastructure, and strong demand from packaging, automotive, and construction industries.

Recent News and Developments in Polyolefin Catalyst Market

- June 2025: SIBUR began constructing Russia's largest catalyst production facility in Kazan, focusing on polyolefin applications. The first phase targets chromium catalysts for polyethylene, with completion expected in 2027.

- June 2025: SHCCIG Yulin Chemical selected LyondellBasell's polyolefin technologies for a major petrochemical complex in Yulin, China, including licenses for Spheripol, Spherizone, Hostalen ACP, and Lupotech T technologies.

- June 2025: Clariant launched its PFAS-free AddWorks PPA product line for sustainable polyolefin extrusion at the K' 2025 trade fair, meeting global regulatory standards and supporting recyclability in food packaging.

- June 2024: W. R. Grace & Co. announced that Bharat Petroleum Corporation Limited (BPCL) expanded its licenses for Grace's UNIPOL® polypropylene process technology with new reactor units of 400 KTA in Kochi and 550 KTA in Bina.

- March 2024: Albemarle Corporation acquired Huntsman's polyolefin catalyst business, reinforcing its position in catalyst technology development and improving efficiency in polyolefin production.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness