Binance Clone Script Pricing: What Affects the Cost in 2026?

Building a cryptocurrency exchange in 2026 looks very different from just a few years ago. Regulations are tighter, users are more cautious, and expectations around security and performance are much higher.

For many founders, a Binance Clone Script has become a practical starting point—but pricing often feels unclear or inconsistent. Some quotes seem surprisingly low, while others feel far out of reach.

This guide focuses on clarity, not selling. It explains what actually influences cost, what’s reasonable to expect in today’s market, and how to think about pricing from a long-term business perspective.

Why Binance Clone Script Pricing Varies So Much

There isn’t a single price because there isn’t a single type of exchange.

Two platforms may both be called a “Binance clone,” yet differ significantly in:

-

Architecture quality

-

Security depth

-

Compliance readiness

-

Scalability

-

Customization

Pricing reflects what’s included, how it’s built, and how future-ready it is.

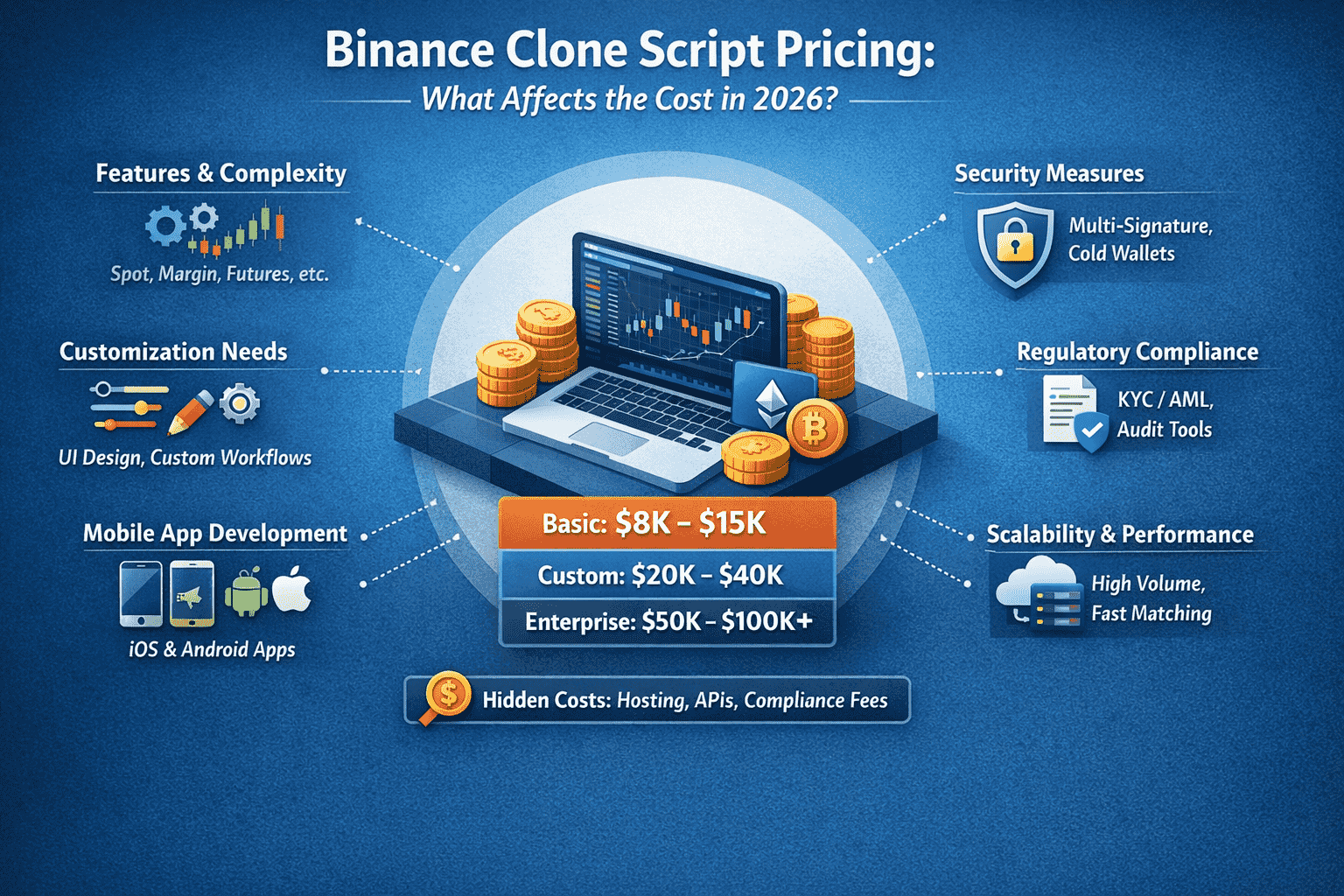

Typical Cost Ranges in 2026 (Realistic View)

Based on current development standards:

-

Basic MVP setup: $8,000 – $15,000

-

Custom-feature exchange: $20,000 – $40,000

-

Enterprise-grade platform: $50,000 – $100,000+

These ranges aren’t arbitrary. Each level adds measurable technical and operational depth.

Core Factors That Influence Binance Clone Script Cost

1. Functional Scope and Exchange Type

A simple spot trading exchange costs significantly less than one offering:

-

Margin trading

-

Futures contracts

-

P2P modules

-

Staking or launchpad features

Each additional module increases development, testing, and long-term maintenance effort.

2. Customization vs Standard Implementation

A standard setup uses prebuilt workflows. Costs rise when you need:

-

Custom trading logic

-

Unique admin controls

-

Tailored dashboards

-

Modified order-matching behavior

This is where Binance Clone Software pricing often diverges most between providers.

3. Security Depth (Non-Negotiable in 2026)

Security is no longer a “premium add-on.” It’s expected.

Pricing increases with:

-

Cold and hot wallet segregation

-

Multi-signature transaction approval

-

Advanced DDoS protection

-

Encrypted key management

-

Continuous security monitoring

Lower-cost solutions often cut corners here, which becomes visible only after launch.

4. Compliance & Regulatory Readiness

If your exchange serves users across regions, compliance tooling is essential.

This may include:

-

KYC/AML integrations

-

Transaction monitoring

-

Audit logs

-

Region-based access controls

Compliance-ready platforms require additional engineering and testing, affecting the overall budget.

5. Mobile App Development Considerations

Web-only exchanges cost less. Adding mobile apps changes the scope.

Costs depend on:

-

Android-only vs Android + iOS

-

Native or cross-platform builds

-

Real-time price sync

-

Push notifications

For teams planning serious user growth, Binance Clone App Development is often a practical—but budget-impacting—decision.

6. Scalability & Performance Engineering

An exchange handling 100 users is very different from one handling 100,000.

Scalability pricing is influenced by:

-

Matching engine efficiency

-

Load balancing

-

Cloud-native infrastructure

-

Microservices architecture

These elements are invisible to users but critical to stability.

7. Liquidity Integration

Liquidity directly affects user trust and trading experience.

Costs vary based on:

-

Third-party liquidity providers

-

Internal liquidity tools

-

Market-making automation

Many providers price this separately, so it’s important to ask upfront.

8. Post-Launch Support & Updates

Pricing isn’t just about launch day.

Ongoing costs may include:

-

Bug fixes

-

Security patches

-

Feature upgrades

-

Infrastructure monitoring

Clear support terms matter more than low upfront pricing.

Common Hidden Costs to Be Aware Of

Even with a clone script, additional expenses often appear later:

-

Hosting and cloud services

-

API usage fees

-

Compliance verification tools

-

Periodic security audits

Transparent planning reduces surprises.

Clone Script vs Custom Development: Cost Perspective

Custom exchange development in 2026 often exceeds $150,000 and takes close to a year.

A Binance Clone Script reduces both cost and development time by using proven architecture—while still allowing room for customization where it matters.

How to Think About Pricing Strategically

Instead of asking “What’s the cheapest option?”, better questions are:

-

What features are essential now vs later?

-

How much security risk is acceptable?

-

Is compliance needed at launch or phase two?

-

How fast do we expect to scale?

Clear answers lead to realistic pricing.

Final Thoughts

In 2026, Binance Clone Script pricing reflects preparedness, not branding.

A well-priced solution:

-

Reduces operational risk

-

Supports future growth

-

Meets user trust expectations

-

Avoids costly rebuilds later

Spending wisely upfront often costs less than fixing shortcuts after launch.

FAQs

How much does a Binance Clone Script cost in 2026?

Most projects fall between $8,000 and $100,000+, depending on features, security, and compliance needs.

What factor impacts cost the most?

Security depth and scalability architecture have the biggest influence on pricing.

Is a clone script suitable for long-term use?

Yes, when built with modular architecture and proper security practices.

Does pricing include mobile apps?

Not always. Mobile apps are often scoped and priced separately.

Can features be added later?

Yes. Many teams launch with a core setup and expand based on user demand.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness