Fungible vs Non-Fungible Tokens on Ethereum: Which One Should You Build?

When building a blockchain product on Ethereum, one of the earliest and most important decisions is choosing between fungible tokens and non-fungible tokens (NFTs).

This choice influences everything—from how users interact with your platform to how value is created, exchanged, and sustained over time. Many founders explore this question while consulting an Ethereum Token Development Company, simply because the implications go beyond writing smart contract code.

This guide explains the differences clearly and practically, without hype or promotional language, so you can decide what fits your idea best.

Understanding Ethereum Tokens in Simple Terms

Ethereum allows developers to create tokens using standardized frameworks called token standards. Among them, fungible and non-fungible tokens serve very different purposes.

What Are Fungible Tokens?

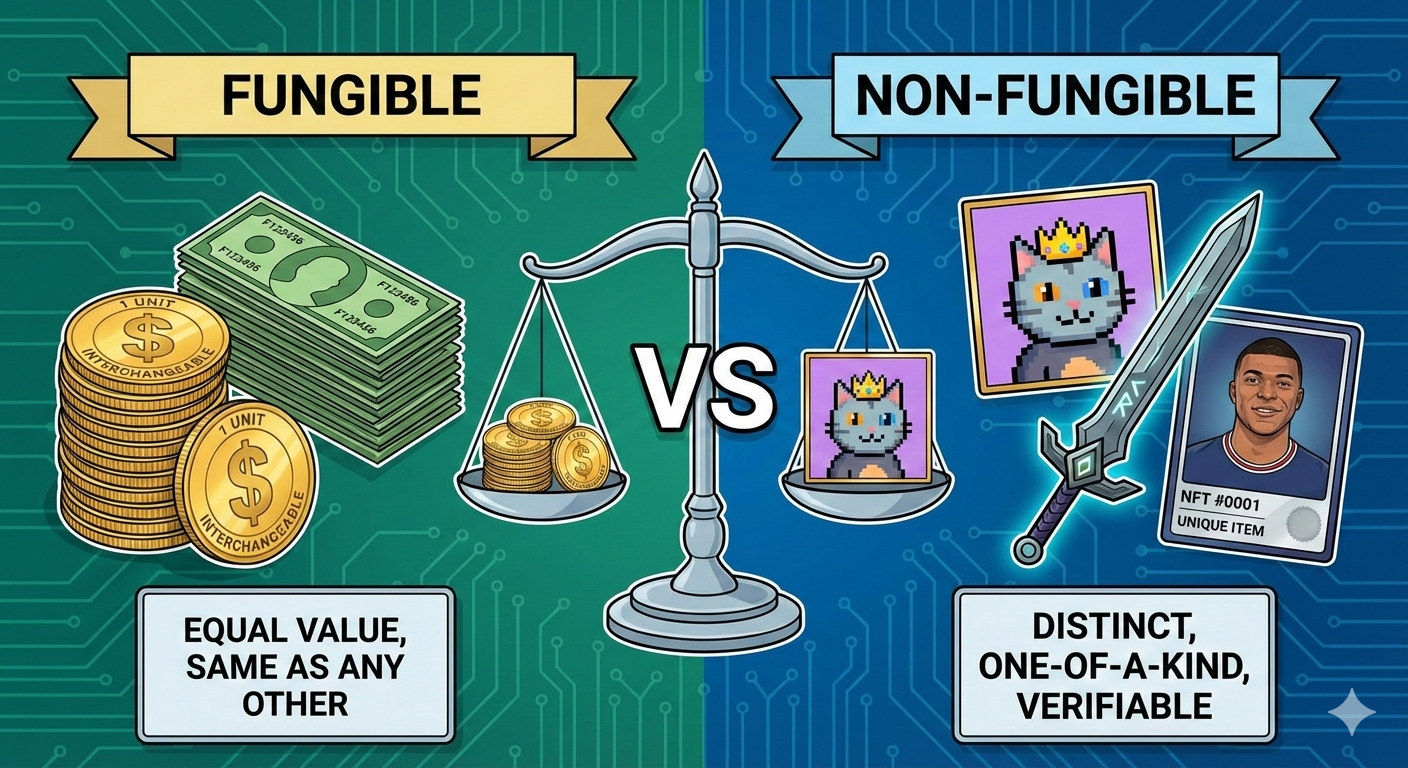

Fungible tokens are interchangeable. Each unit holds the same value and functionality as another unit of the same token.

If you send or receive one fungible token, it’s identical to any other unit in circulation.

They are commonly used for:

-

Cryptocurrencies and digital money

-

Governance and voting systems

-

Utility tokens within applications

-

Stablecoins and reward points

Most fungible tokens follow the ERC-20 standard, which is widely supported across wallets, exchanges, and decentralized applications.

What Are Non-Fungible Tokens (NFTs)?

Non-fungible tokens represent unique items. Each NFT has distinct metadata and cannot be replaced by another token on a one-to-one basis.

NFTs are typically built using ERC-721 or ERC-1155 standards and focus more on ownership than exchange.

They are commonly used for:

-

Digital art and collectibles

-

Gaming assets such as skins or characters

-

Event tickets and memberships

-

Certificates, licenses, and credentials

Key Differences Between Fungible Tokens and NFTs

Instead of thinking in technical terms alone, it helps to compare them based on how they behave in real-world applications.

Fungible tokens:

-

Are interchangeable and equal in value

-

Primarily designed for value transfer and liquidity

-

Scale efficiently for high transaction volumes

-

Generally have lower gas costs per transfer

-

Work well for payments, DeFi, and governance

Non-fungible tokens:

-

Are unique and non-interchangeable

-

Focus on ownership, identity, or access

-

Scale moderately due to metadata complexity

-

Often involve higher minting and transfer costs

-

Are best suited for assets, proof, and exclusivity

Understanding these distinctions early can prevent mismatched token models later in development.

When Fungible Tokens Are the Right Choice

Fungible tokens are a strong fit when your platform relies on frequent transactions, shared value, or liquidity.

They are commonly used in:

-

Decentralized finance platforms

-

Token-based reward or loyalty systems

-

DAO governance and voting mechanisms

-

In-app or in-game currencies

Because ERC-20 tokens are well established, many teams find them easier to deploy and integrate. During this stage, Ethereum Token Development Services are often used to refine token logic, improve gas efficiency, and reduce security risks.

When NFTs Make More Sense

NFTs are better suited for platforms where individual ownership and uniqueness are central to the user experience.

They are often used in:

-

Creator and art platforms

-

Games with tradable digital assets

-

Access-based communities and memberships

-

Real-world asset representation

NFT development introduces additional considerations such as metadata storage, royalty logic, and marketplace compatibility. This is where practical experience in Ethereum Token Development becomes especially important.

Development Complexity and Cost Considerations

Both token types involve smart contract development, but the level of complexity differs.

Fungible token development typically involves:

-

Simpler contract logic

-

Lower auditing and maintenance overhead

-

Faster deployment timelines

-

Predictable transaction behavior

NFT development usually involves:

-

More complex contract structures

-

Decisions around on-chain vs off-chain metadata

-

Higher gas costs for minting and transfers

-

Additional UX considerations for users

An experienced Ethereum Token Development Company can help teams evaluate these factors early, avoiding unnecessary features and long-term inefficiencies.

Using Fungible Tokens and NFTs Together

Many modern Web3 platforms don’t limit themselves to a single token type.

Common hybrid approaches include:

-

Games using fungible tokens for currency and NFTs for assets

-

Membership platforms combining access NFTs with reward tokens

-

Metaverse ecosystems using NFTs for land and tokens for governance

While flexible, these models require careful planning to ensure smart contracts interact securely and predictably.

Security, Compliance, and Long-Term Planning

Token design also intersects with broader concerns such as:

-

Smart contract security and audits

-

Regulatory interpretation of token utility

-

Upgradeability and future changes

-

Scalability and Layer-2 compatibility

These considerations often lead teams to seek guidance from an Ethereum Token Development Company, particularly when moving from experimentation to production.

How to Decide Which Token to Build

A few practical questions can guide your decision:

-

Do users need interchangeable value or unique ownership?

-

Will transactions happen frequently or occasionally?

-

Is liquidity more important than scarcity?

-

Does your product rely on access, identity, or proof?

Clear answers usually point toward fungible tokens, NFTs, or a combination of both.

Conclusion: Choose Utility Over Trends

Fungible tokens and NFTs are tools designed for different outcomes. Neither is inherently better.

Strong Ethereum projects succeed by matching token design to real user needs, not market hype. Whether you’re in early research or preparing to launch, understanding these fundamentals leads to more resilient products.

If you’re assessing standards, security, or scalability, working with an experienced Ethereum Token Development Company can help clarify decisions without adding unnecessary complexity.

FAQs: Fungible vs Non-Fungible Tokens on Ethereum

What is the main difference between fungible tokens and NFTs?

Fungible tokens are interchangeable and equal in value, while NFTs are unique and represent individual ownership.

Are NFTs suitable for payments?

NFTs can be transferred, but they are inefficient for payments. Fungible tokens are better for transactional use cases.

Which token type scales better on Ethereum?

Fungible tokens generally scale better due to simpler contract logic and lower gas costs.

Can a project use both fungible tokens and NFTs?

Yes. Many platforms use both to support different functions within the same ecosystem.

When should I involve an Ethereum Token Development Company?

When planning token standards, security audits, scalability, or compliance beyond basic experimentation.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness