Finance Cloud Market, Growth, Size, Share, Trends and forecast (2024-2032)

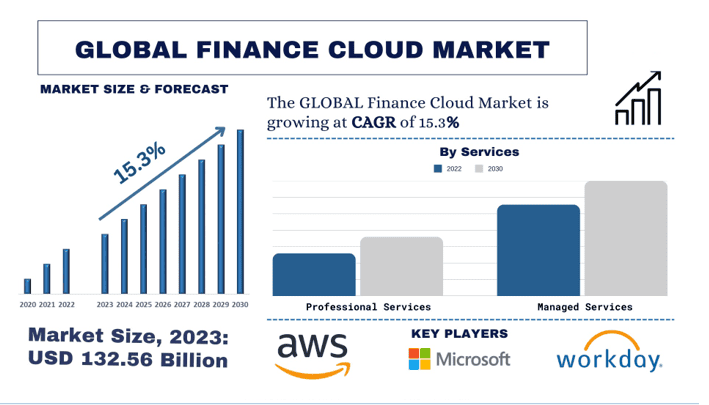

According to a new report by UnivDatos, the “Finance Cloud Market” is expected to reach USD 477.39 Billion in 2032 by growing at a CAGR of 15.30%.

Digital-only banks are disrupting traditional banking by offering customer-centric, AI-powered services that are operationally efficient and profitable at scale. Successful neobanks leverage AI to deepen customer relationships, personalize services, automate processes, and manage risk.

The past 18 months have been the best period for global banking overall since at least 2007, as rising interest rates boosted profits and lifted return on equity (ROE) to 12% in 2022 and an expected 13% in 2023.

Between 2015 and 2022, more than 70% of the net increase in financial funds ended up off traditional banking balance sheets, held by insurance and pension funds, sovereign wealth funds, private capital, alternative investments, and retail and institutional investors.

Consumer digital payment processing conducted by payments specialists grew by more than 50% between 2015 and 2022.

Digital-only banks are gaining popularity among retail customers and SMEs by offering features like free debit cards, digitized account opening, personal finance advisory, instant payments, and GST-compliant invoicing.

The global financial services industry is witnessing an unprecedented surge in the demand for cloud-based solutions and services. As digitalization continues to reshape the financial landscape, an increasing number of institutions are embracing the cloud to streamline operations, enhance scalability, and optimize cost structures. Furthermore, the ever-changing financial landscape demands agility and scalability, which cloud solutions offer in abundance. Traditional on-premises systems often struggle to keep pace with rapidly evolving market conditions, regulatory requirements, and customer expectations.

The report suggests that furthermore, optimizing operational costs while providing personalized services to consumers are some of the major factors driving the growth of digital banking, leading to increased demand for finance cloud. The financial services industry generates vast amounts of data, and cloud-based solutions provide the infrastructure and tools necessary to harness this data effectively. By leveraging cloud-based analytics platforms, financial institutions can gain valuable insights into customer behavior, market trends, and risk management, enabling them to make data-driven decisions and develop innovative products and services. These advances along with others are creating a favorable environment for the adoption of finance cloud across various markets.

Access sample report (including graphs, charts, and figures)- https://univdatos.com/reports/finance-cloud-market?popup=report-enquiry

Driving on tyres with tread below the legal limit can be incredibly dangerous, as well as illegal. It’s even worse driving with bald tyres where the tread has worn away altogether.

Hazards of driving with worn tyres include:

• Less grip on wet roads.

• Longer stopping distances.

• A greater risk of aquaplaning.

• Less traction on icy roads or snow.

• More chance of punctures, which can lead to a sudden blowout.

Worn tyres or flat spots may also cause your steering wheel to shake or vibrate.

Furthermore, if involved in an accident and persons tyres don’t meet the legal minimum standards, any insurance claim you make could be invalidated.

Moreover, if driven with tyres that are dangerous because they’re worn or bald, you could be prosecuted for using a vehicle in a dangerous condition.

The Security and Governance, Risk & Compliance segment has established itself as a major end-user segment for the Finance Cloud in the market.

Primarily driven by the need to ensure compliance with regulatory framework. Financial institutions are subject to stringent regulations, such as the Basel III framework, the Dodd-Frank Act, and the General Data Protection Regulation (GDPR). Failure to comply with these regulations can result in hefty fines, reputational damage, and legal implications. Furthermore, the financial sector is a prime target for cyber attacks, including data breaches, phishing scams, and ransomware attacks. These threats can lead to financial losses, disruption of operations, and erosion of customer trust. GRC solutions offer robust security features, such as encryption, access controls, and intrusion detection systems, to protect sensitive financial data and systems. GRC solutions help organizations maintain compliance by automating processes, monitoring controls, and providing real-time reporting capabilities. Additionally, Financial institutions face various risks, including credit risk, market risk, operational risk, and reputational risk. Effective risk management is crucial for maintaining financial stability and making informed business decisions. GRC solutions provide risk assessment tools, risk modeling capabilities, and real-time risk monitoring to identify, analyze, and mitigate potential risks.

Conclusion

In conclusion, the growing demand for Finance Cloud is driven by a combination of expanding consumption, technological advancements, economic factors, and a rapidly growing demand for digitally curated financial services. As the world continues to advance in technology in the areas of artificial intelligence and power data analytics, the demand for cloud services is only going to surge from here.

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness