Air Defense Systems Market Size, Share and Trends Forecast 2025-2033

Market Overview:

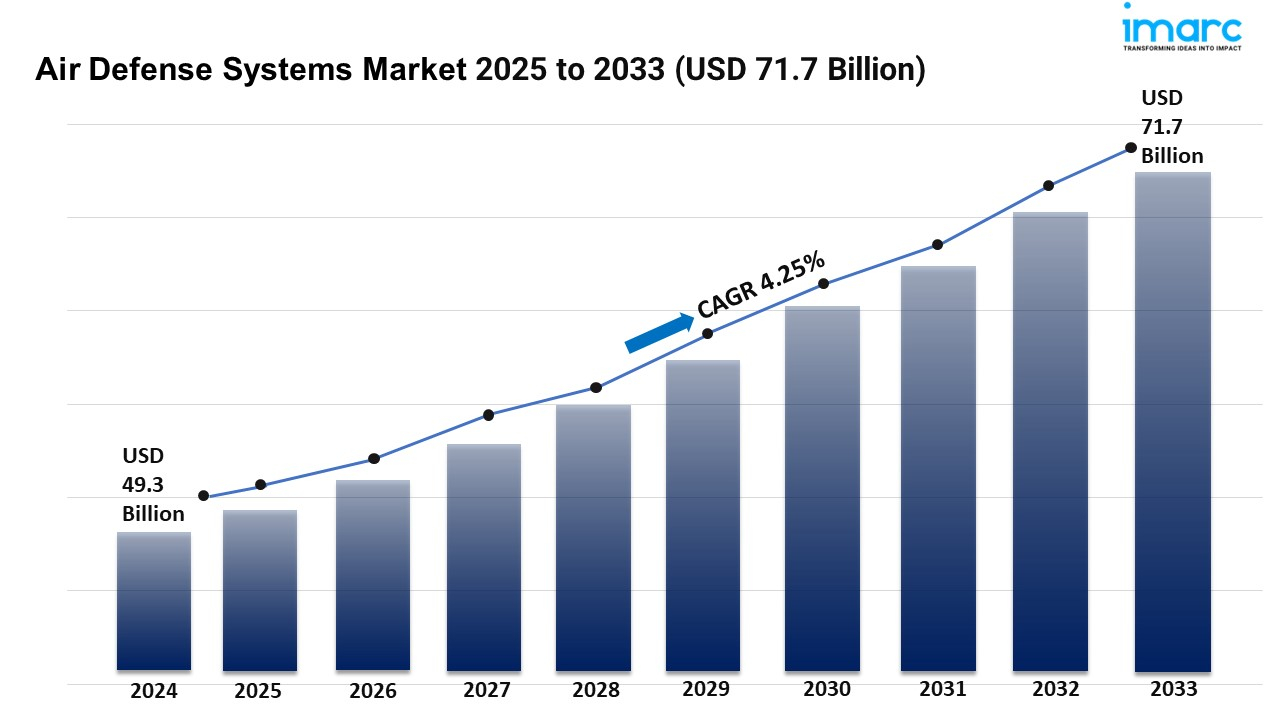

The Air Defense Systems Market is experiencing steady expansion, driven by Rising Defense Budgets, Defense Partnerships and Alliances and Technological Advancements. According to IMARC Group's latest research publication, "Air Defense Systems Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033", The global air defense systems market size reached USD 49.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 71.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.25% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/air-defense-systems-market/requestsample

Our Report Includes:

- Market Dynamics

- Market Trends and Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Air Defense Systems Industry:

- Rising Defense Budgets

In 2025, global defense spending has reached a historic zenith, driven by protracted conflicts in Eastern Europe and escalating tensions in the Indo-Pacific. Defense budgets have expanded significantly, with the U.S. Army nearly doubling its air and missile defense budget to $5.6 billion this year to accelerate the deployment of mixed-capability formations. European nations, particularly those on NATO’s eastern flank, are prioritizing the procurement of Patriot, IRIS-T, and SAMP/T systems to safeguard critical infrastructure. This surge in capital expenditure is fueling a CAGR of over 7%, as nations move away from legacy systems in favor of advanced, high-readiness platforms capable of 24/7 autonomous surveillance.

- Defense Partnerships and Alliances

Collaborative defense is no longer optional in 2025; it is the industry’s primary catalyst. The launch of the NATO "Eastern Sentry" initiative and the expansion of the European Sky Shield Initiative (ESSI) have created standardized procurement cycles for allied nations. Major partnerships, such as the Boeing-Anduril team developing the U.S. Army’s next-generation midrange interceptor, highlight a shift toward "disruptive and agile" industrial alliances. These collaborations facilitate the sharing of high-cost R&D and ensure interoperability, allowing disparate national systems to plug into a unified command-and-control (C2) architecture. By pooling resources, allied nations are rapidly closing capability gaps while reducing the individual financial burden of developing complex interception technologies.

- Technological Advancements

The 2025 technological landscape is dominated by the integration of Responsible Artificial Intelligence and Gallium Nitride (GaN)-based AESA radars. Modern systems now use AI-enhanced detection to identify stealth aircraft and low-flying cruise missiles that evade traditional sensors. In late 2025, India’s Project Akashteer showcased the power of a fully automated, cohesive air defense network that optimizes decision-making in milliseconds. These advancements provide "predictive tracking," where algorithms calculate intercept points for multiple simultaneous threats with sub-meter precision. The falling cost of GaN-based modules has also made high-performance, long-range radar more accessible, allowing for the mass deployment of 360-degree surveillance across vast border regions.

Key Trends in the Air Defense Systems Market

- Integration of Counter-Drone and Directed Energy Weapons

In 2025, the proliferation of "low-cost, high-impact" drone swarms has made Counter-UAS (C-UAS) the fastest-growing market sub-segment. The industry is pivoting from expensive kinetic missiles to Directed Energy Weapons (DEWs), such as high-energy lasers and high-power microwave (HPM) trucks. These systems provide a "virtually infinite magazine" at a cost of less than $1 per shot, making them the most economically viable defense against saturation attacks by $1,000 drones. In recent 2025 naval trials, shipboard lasers successfully neutralized multiple incoming drones in seconds, proving that DEWs are no longer experimental but are now a critical, scalable layer of modern air defense.

- Development of Hypersonic and Glide-Phase Interceptors

The 2025 threat landscape is increasingly defined by Hypersonic Glide Vehicles (HGVs) that travel at speeds exceeding Mach 5. To counter this, the market is shifting toward Glide-Phase Interception (GPI) and space-based infrared sensors. Advanced systems like Russia’s S-500 Prometheus and the U.S. THAAD are being upgraded with AI-driven software to track the non-ballistic, highly maneuverable flight paths of hypersonic weapons. Defense contractors are heavily investing in "hit-to-kill" kinetic technology that can engage targets in the upper atmosphere. This trend is driving a surge in space-integrated defense, where low-earth orbit (LEO) satellites provide the early warning data necessary to intercept threats before they enter their terminal descent phase.

- Focus on Multi-Layered and Integrated Defense Networks

A defining trend of 2025 is the move toward Integrated Air and Missile Defense (IAMD), which replaces "siloed" batteries with a unified digital backbone. These networks utilize C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) frameworks to coordinate short, medium, and long-range interceptors into a holistic shield. This "plug-and-fight" capability allows a naval radar to guide a land-based missile, maximizing the use of every available sensor in the battlespace. With AI-based threat assessment tools now embedded in over 40% of current R&D projects, these integrated networks can prioritize targets autonomously, ensuring that high-value interceptors are reserved for ballistic missiles while lower-cost options engage secondary threats.

Our report provides a deep dive into the air defense systems market analysis, outlining the current trends, underlying market demand, and growth trajectories.

Leading Companies Operating in the Global Air Defense Systems Industry:

- Aselsan A.S.

- BAE Systems

- Israel Aerospace Industries Ltd. (IAI)

- Kongsberg Defence & Aerospace

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rheinmetall AG

- RTX Corporation

- Saab AB

- Thales Group

- The Boeing Company

Air Defense Systems Market Report Segmentation:

Breakup by Component:

- Weapon System

- Fire Control System

- Command and Control System

- Others

Weapon system currently exhibits a clear dominance in the market as it refers to a combination of weapons, equipment, and technology designed to perform specific military functions with direct impact from government budgets and defense spending.

Breakup by Type:

- Missile Defense Systems

- Anti-aircraft Systems

- Counter Unmanned Aerial Systems (C-UAS)

- Counter Rocket, Artillery and Mortar (C-RAM) Systems

Missile defense systems account for the majority of the global market share driven by rising geopolitical tensions and proliferation of ballistic and cruise missiles increasing demand for advanced missile defense capabilities.

Breakup by Platform:

- Airborne

- Land

- Naval

Land currently exhibits a clear dominance in the market due to strategic deployment capabilities across borders, military bases, and critical infrastructure, providing comprehensive coverage with advanced radar and targeting technologies.

Breakup by Range:

- Long-range Air Defense System (LRAD)

- Medium-range Air Defense System (MRAD)

- Short-range Air Defense System (SHORAD)

Long-range Air Defense System (LRAD) holds the largest market share driven by increasing sophistication of aerial threats and need for broader defense perimeters to protect critical infrastructure from distant threats.

Breakup by Region:

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific currently dominates the global market driven by increased geopolitical tensions, military modernization programs, and significant defense investments, with India announcing plans to invest US$ 522 million in homegrown missiles and air defense systems.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness