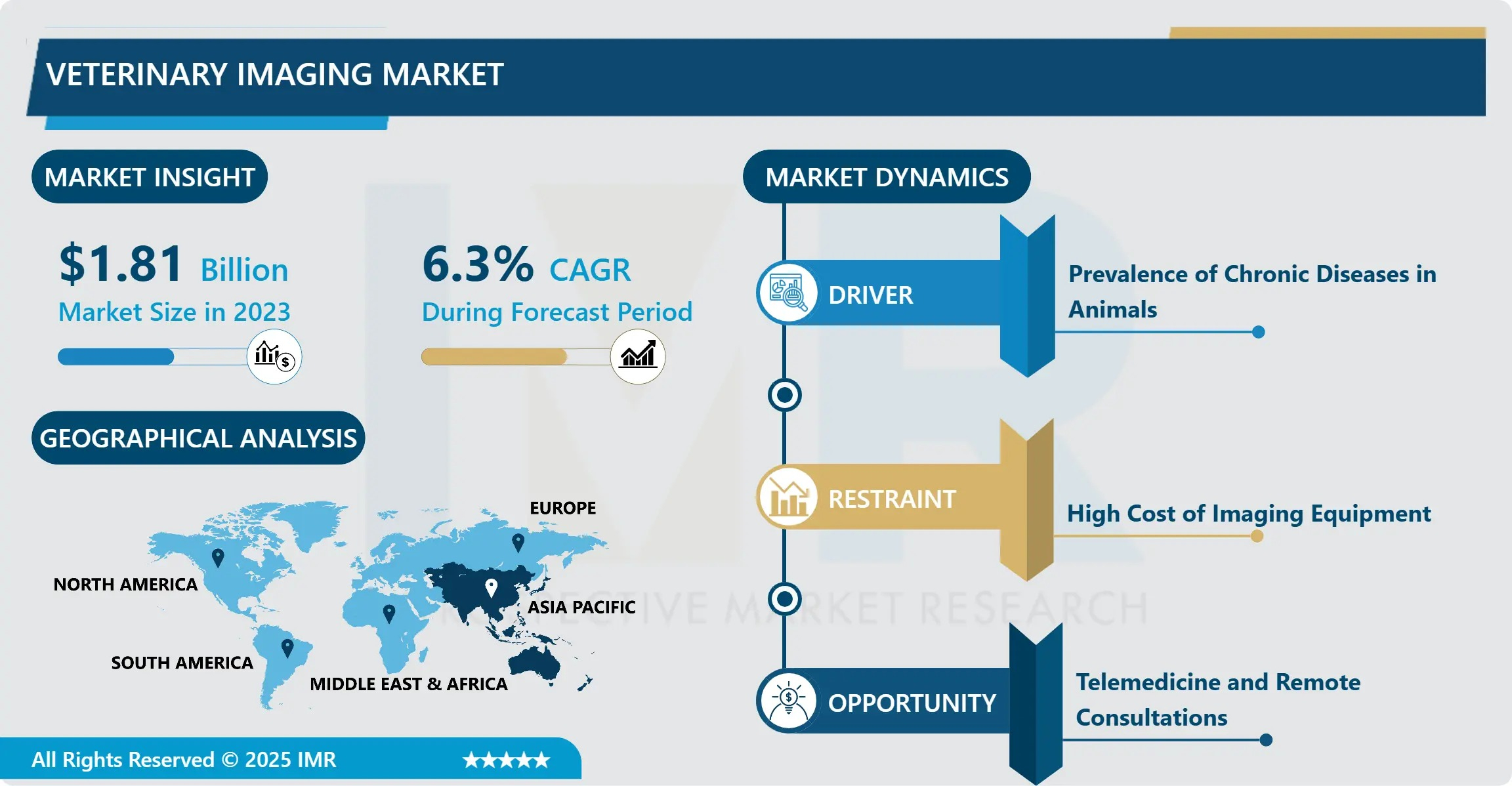

Veterinary Imaging Market to Grow at a CAGR of 6.30% Through 2032

According to a new report published by Introspective Market Research, Veterinary Imaging Market by Product Type, Animal Type, and End User, The Global Veterinary Imaging Market Size Was Valued at USD 1.81 Billion in 2023 and is Projected to Reach USD 3.13 Billion by 2032, Growing at a CAGR of 6.30%.

Introduction / Market Overview

The Veterinary Imaging Market plays a crucial role in modern animal healthcare by enabling accurate diagnosis and monitoring of medical conditions in companion and livestock animals. Veterinary imaging technologies include X-ray systems, ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), and nuclear imaging solutions used across veterinary clinics and hospitals.

Compared to traditional diagnostic methods, advanced imaging solutions offer non-invasive, precise, and faster diagnostic capabilities, improving treatment outcomes and animal welfare. Growing pet adoption, increasing expenditure on animal healthcare, and rising awareness about early disease detection are driving demand for sophisticated veterinary imaging systems across developed and emerging markets.

Growth Driver

A key growth driver of the veterinary imaging market is the rapid increase in pet ownership and the rising humanization of companion animals. Pet owners are increasingly seeking advanced medical care comparable to human healthcare, driving demand for accurate diagnostic imaging solutions. Additionally, the growing prevalence of chronic diseases, orthopedic conditions, and age-related disorders in animals has increased reliance on imaging technologies. Technological advancements such as digital radiography and portable imaging systems are further enhancing diagnostic efficiency, contributing significantly to market growth.

Market Opportunity

The market presents strong opportunities through the expansion of veterinary services in emerging economies and the increasing adoption of advanced imaging technologies in rural and semi-urban areas. Growing investments in veterinary infrastructure, along with government initiatives supporting animal health and livestock productivity, are creating favorable conditions for market expansion. Furthermore, the development of AI-enabled imaging software and compact imaging systems tailored for veterinary applications is expected to unlock new growth avenues for manufacturers and service providers.

Veterinary Imaging Market, Segmentation

Segment A – By Product Type

Sub Segment A1: X-ray Systems

Sub Segment A2: Ultrasound Systems

Sub Segment A3: CT & MRI Systems

Highest Market Share (2023): X-ray Systems

X-ray systems accounted for the highest market share in 2023 due to their widespread use as a primary diagnostic tool in veterinary practices. These systems are essential for diagnosing fractures, dental issues, respiratory conditions, and internal abnormalities. The availability of digital X-ray systems offering faster image acquisition, improved clarity, and reduced radiation exposure has further strengthened their adoption across veterinary clinics and hospitals.

Segment B – By Animal Type

Sub Segment B1: Companion Animals

Sub Segment B2: Livestock Animals

Sub Segment B3: —

Highest Market Share (2023): Companion Animals

Companion animals dominated the animal type segment in 2023, driven by increasing pet ownership and higher spending on pet healthcare. Dogs and cats account for the majority of veterinary imaging procedures due to frequent health check-ups and rising incidence of chronic conditions. The growing emotional attachment between pet owners and their animals continues to drive investments in advanced diagnostic solutions for companion animals.

Some of The Leading/Active Market Players Are-

- IDEXX Laboratories, Inc. (USA)

- Fujifilm Holdings Corporation (Japan)

- GE HealthCare (USA)

- Canon Medical Systems Corporation (Japan)

- Esaote S.p.A. (Italy)

- Carestream Health (USA)

- Mindray Animal Medical Technology (China)

- Heska Corporation (USA)

- Samsung Medison (South Korea)

- Agfa-Gevaert Group (Belgium)

and other active players.

Key Industry Developments

News 1:

In April 2024, IDEXX Laboratories introduced enhanced digital radiography solutions for veterinary clinics.

The new systems focus on faster diagnostics and cloud-based image management, helping veterinarians improve workflow efficiency and diagnostic accuracy.

News 2:

In September 2024, Fujifilm expanded its veterinary imaging portfolio with advanced ultrasound systems.

This development aims to address growing demand for high-resolution, portable imaging solutions in companion animal diagnostics.

Key Findings of the Study

- X-ray systems dominate the product segment

- Companion animals represent the largest application area

- North America leads the global market

- Rising pet ownership is a key growth driver

- Digital and portable imaging are major trends

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness