Fat-Filled Milk Powder Market Growth, Size, Trends, and Forecast 2025–2033

Market Overview:

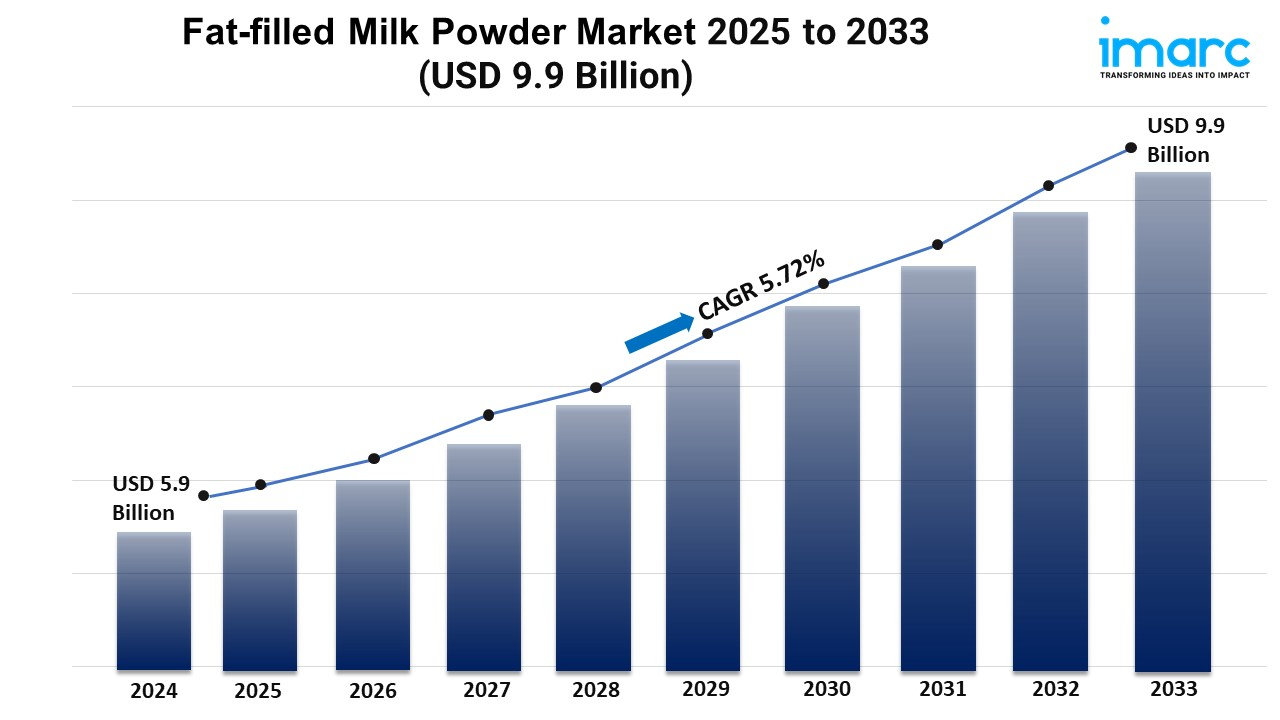

According to IMARC Group's latest research publication, "Fat-filled Milk Powder Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global fat-filled milk powder market size reached USD 5.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.72% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Fat-filled Milk Powder Market

- AI enhances dairy production efficiency by optimizing spray drying processes, reducing production costs by 8-12% through predictive maintenance and automated quality control systems in milk powder manufacturing facilities.

- Machine learning algorithms analyze real-time data from sensors to monitor fat content consistency, moisture levels, and particle size distribution, ensuring product quality standards are met with 95% accuracy across batches.

- Government initiatives like the EU's Farm to Fork Strategy allocate €10 billion for digital agriculture, supporting AI adoption in dairy processing plants to improve operational efficiency and sustainability metrics.

- Companies like Fonterra and FrieslandCampina deploy AI-powered supply chain management systems to reduce fat-filled milk powder spoilage by 10-15%, optimizing inventory levels and distribution networks across 50+ countries globally.

- Artificial intelligence enables precision blending of skimmed milk powder with vegetable fats, achieving consistent 26% and 28% fat content formulations while reducing material waste by 18% in production processes.

- AI-driven demand forecasting helps manufacturers predict seasonal fluctuations in bakery and confectionery sectors, enabling 20% better production planning and reducing stockouts by analyzing consumption patterns from 200+ food processing clients.

Download a sample PDF of this report: https://www.imarcgroup.com/fat-filled-milk-powder-market/requestsample

Key Trends in the Fat-filled Milk Powder Market

- Rising Demand for Cost-Effective Dairy Alternatives: Manufacturers increasingly prefer fat-filled milk powder over whole milk powder due to 30-40% cost savings. The product blends skimmed milk powder with palm, coconut, or soybean oils, offering similar functionality at lower prices. Food processors across Asia and Africa, accounting for 45% of global consumption, adopt this alternative to maintain product quality while managing volatile dairy prices.

- Expansion in Bakery and Confectionery Applications: Fat-filled milk powder dominates the bakery sector with a 31.2% application share, enhancing texture, creaminess, and shelf life in cakes, pastries, and biscuits. Large-scale manufacturers utilize this ingredient for producing 2.5 million tons of confectionery products annually. The 28% fat content variant particularly suits chocolate manufacturing, providing rich mouthfeel comparable to premium dairy ingredients.

- Growth in B2B Distribution Channels: Business-to-business sales represent 75% of market distribution, serving dairy products, bakery operations, and ice cream manufacturers. Industrial clients prefer bulk packaging formats, with average order sizes of 25-50 metric tons. Confectionery manufacturers alone consume approximately 180,000 metric tons annually for candy, chocolate, and milk-based sweets production.

- Increasing Adoption of Fortified Variants: Manufacturers introduce fat-filled milk powder enriched with vitamins A, D, iron, and zinc to address nutritional deficiencies in developing markets. These fortified products support 15 million children through school feeding programs across Africa and Southeast Asia. The nutritional enhancement trend drives 12% higher product value while meeting WHO dietary guidelines.

- E-commerce and Digital Distribution Expansion: Online platforms facilitate 8% of consumer sales, particularly for household and small-business purchases. Digital marketplaces like Alibaba and Amazon Business process 45,000+ monthly orders, offering instant access to product specifications, certifications, and competitive pricing. This distribution shift enables smaller food businesses to source quality ingredients efficiently.

Growth Factors in the Fat-filled Milk Powder Market

- Surging Food Processing Industry Demand: The global food and beverage sector consumes 580,000 metric tons of fat-filled milk powder annually for producing yogurt, cheese, ice cream, and beverages. Rapid urbanization in emerging economies drives demand for processed foods, with urban populations projected to reach 5.2 billion by 2030, expanding the customer base significantly.

- Extended Shelf Life and Storage Convenience: Fat-filled milk powder offers 18-24 months shelf life at ambient temperature, eliminating refrigeration requirements. This benefit proves critical for regions with limited cold chain infrastructure, serving 2.8 billion people in Africa, South Asia, and Latin America. The product withstands tropical climates, reducing distribution costs by 25% compared to fresh milk.

- Government Support for Dairy Alternatives: Countries like India and China implement policies promoting affordable nutrition through dairy substitute programs. India's National Dairy Development Board supports production capacity expansion, targeting 250,000 metric tons additional output by 2026. These initiatives make nutritious dairy products accessible to low-income populations.

- Technological Advancements in Production: Modern spray drying techniques achieve 99.5% efficiency in converting liquid blends to powder form, improving product consistency and reducing energy consumption by 20%. Automated blending systems ensure precise vegetable fat integration, maintaining 26% or 28% fat content specifications with ±0.5% tolerance across production runs.

- Expanding Animal Feed Applications: Livestock and poultry industries utilize 95,000 metric tons of fat-filled milk powder annually for calf, pig, and poultry nutrition. The product provides easily digestible energy and protein, supporting optimal growth rates. Dairy farms across Europe and North America incorporate this ingredient in milk replacer formulations for 12 million calves yearly.

Leading Companies Operating in the Global Fat-filled Milk Powder Industry:

- Alpen Food Group B.V

- Bonilait Proteines

- CP Ingredients Limited (GOBIA GROUP LIMITED)

- Dairygold Co-Operative Society Limited

- Dana Dairy Group

- Fitsa Group

- Fonterra Ltd

- Foodexo

- Hoogwegt International

- Lactalis Ingredients

- Lakeland Diaries

- Polindus

- Prolac

- Vreugdenhil Dairy Foods

Fat-filled Milk Powder Market Report Segmentation:

Breakup By Product Type:

- Fat Filled Milk Powder 26%

- Instant Fat Filled Milk Powder 26%

- Fat Filled Milk Powder 28%

- Instant Fat Filled Milk Powder 28%

Fat filled milk powder 28% accounts for the majority of shares due to its rich texture and superior functionality in premium dairy and confectionery applications.

Breakup By Distribution Channel:

- B2B

- Dairy Products

- Bakery Products

- Confectionaries

- Ice Cream

- Others

- B2C

B2B dominates the market as food manufacturers and processors represent the primary customer base for bulk ingredient purchases.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position owing to high consumption of processed foods, strong retail infrastructure, and established food manufacturing industry demanding cost-effective dairy ingredients.

Recent News and Developments in Fat-filled Milk Powder Market

- June 2025: Lactalis Ingredients received US Department of Justice approval to complete the $2.1 billion acquisition of General Mills' US yogurt business, strengthening its North American market position and expanding production capabilities for dairy-based ingredients.

- July 2024: Fonterra announced a strategic collaboration with Nourish Ingredients to develop dairy products using Creamilux, a fermentation-produced lipid that recreates the creamy mouthfeel and emulsification properties of traditional dairy fat for cheese, cream, and bakery applications.

- July 2024: Nestlé's research team unveiled an innovative process that reduces milk powder fat content by up to 60% while preserving creamy taste and texture through controlled protein aggregation, initially launched in Brazil's Ninho Adulto product line.

- February 2025: FrieslandCampina Ingredients received regulatory approval in Thailand for its Vivinal MFGM premium milk fat globule membrane ingredient, enabling use in infant formulas and food products with cognitive support and immune protection benefits.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness