Credit Balance Services

Credit Balance Service: Optimize Your Healthcare Revenue Cycle

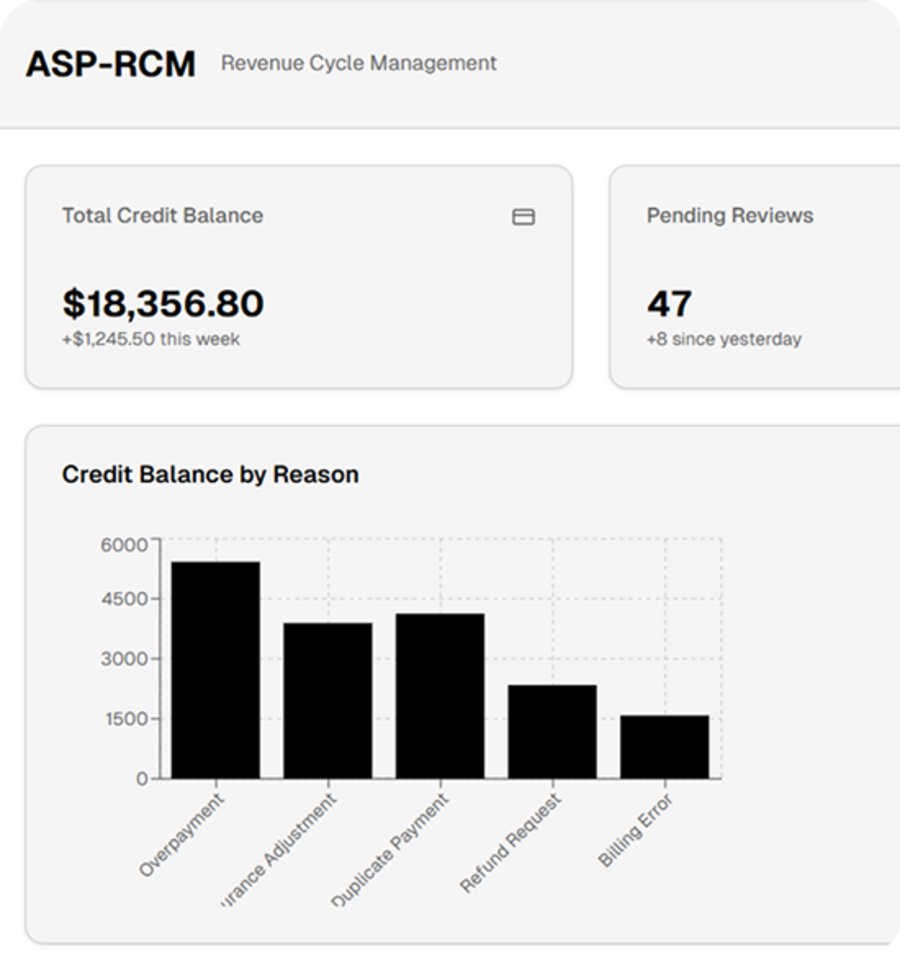

In today’s healthcare industry, managing finances accurately is essential. One of the most common challenges faced by providers is managing credit balances. A credit balance occurs when a patient or insurance payer overpays a healthcare provider. These overpayments can result from duplicate payments, billing errors, insurance adjustments, or even misapplied payments. If not properly managed, credit balances can distort financial statements, create compliance issues, and lead to unnecessary revenue loss. This is why a dedicated Credit Balance Service is a critical component of an effective revenue cycle management (RCM) strategy.

What is a Credit Balance Service?

A Credit Balance Service is a specialized solution that identifies, reconciles, and resolves overpayments in healthcare accounts. The service ensures that any excess funds in patient accounts or insurance claims are properly tracked and addressed. Depending on the situation, funds may be refunded to patients, adjusted against future bills, or coordinated with insurance payers for reimbursement.

Providers who implement a credit balance service benefit from enhanced financial accuracy, reduced administrative workload, and compliance with regulatory guidelines. These services often combine automation tools and expert billing teams to streamline the process, ensuring that overpayments are identified and resolved quickly and accurately.

Key Features of Credit Balance Services

1. Identification of Overpayments

The first step in managing credit balances is identifying accounts with overpayments. This requires careful auditing of patient statements, insurance remittances, and payment histories. By using sophisticated software tools, providers can automatically detect discrepancies and highlight accounts that require attention. Early identification prevents overpayments from accumulating and ensures accurate reporting of financial data.

2. Reconciliation of Accounts

After identifying overpayments, the next step is reconciliation. This involves verifying that each credit balance is valid and determining the correct course of action. Reconciliation ensures that the accounts reflect accurate financial information, reduces the risk of errors, and prevents discrepancies from affecting the provider’s overall financial statements.

3. Resolution and Refund Management

Once credit balances are reconciled, they must be resolved efficiently. Resolution can involve issuing refunds to patients, adjusting future invoices, or coordinating with insurance payers for reimbursements. Timely resolution not only ensures compliance with regulations but also improves cash flow and minimizes administrative backlogs.

4. Reporting and Compliance

Comprehensive reporting is a crucial part of any credit balance service. Providers can track trends in overpayments, monitor high-risk accounts, and generate reports required for regulatory compliance. Accurate reporting helps healthcare organizations prepare for audits, maintain transparency in financial operations, and ensure compliance with guidelines set by CMS and other regulatory authorities.

Benefits of Outsourcing Credit Balance Services

Many healthcare providers choose to outsource credit balance management to specialized RCM companies. Outsourcing offers several advantages:

-

Time and Resource Savings: Managing credit balances internally can be time-consuming. Outsourcing allows staff to focus on patient care and other core operations.

-

Reduced Errors: Expert RCM teams have the experience and tools to ensure accurate reconciliation and resolution.

-

Improved Cash Flow: Timely management of credit balances ensures funds are correctly allocated, reducing outstanding balances and enhancing liquidity.

-

Enhanced Patient Satisfaction: Efficient handling of refunds and accurate billing fosters trust and improves patient experience.

Outsourcing also provides access to advanced reporting and analytics tools, giving healthcare providers insights into recurring issues and trends that can improve revenue cycle performance over time.

Why Credit Balance Services Are Essential

Credit balances are a common but often overlooked problem in healthcare billing. Unresolved overpayments can strain provider-payer relationships, increase audit risk, and create unnecessary administrative burdens. Implementing a professional Credit Balance Service ensures that overpayments are efficiently identified, reconciled, and resolved.

By combining automation, reporting, and expert teams, providers can maintain accurate financial records, reduce compliance risks, and focus on delivering quality care. Furthermore, a structured approach to credit balance management can help prevent recurring billing issues, improve operational efficiency, and create a more financially sustainable practice.

Best Practices for Managing Credit Balances

-

Regular Account Audits: Conducting frequent audits helps detect overpayments early and prevents large credit balances from building up.

-

Automation Tools: Using RCM software for tracking payments, adjustments, and refunds reduces manual errors and saves time.

-

Clear Refund Policies: Having transparent policies for refunding patients ensures smooth resolution and maintains trust.

-

Staff Training: Educating billing and accounting teams on credit balance management improves accuracy and efficiency.

-

Continuous Monitoring: Regular reporting and monitoring allow providers to identify trends, recurring issues, and opportunities for improvement.

Conclusion

Credit balance management is an integral part of an effective healthcare revenue cycle. A reliable Credit Balance Service ensures that overpayments are identified, reconciled, and resolved promptly, safeguarding revenue, maintaining compliance, and enhancing patient satisfaction. Whether managed internally or outsourced, these services offer operational efficiency, accurate financial records, and improved cash flow.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness