Writing Legal Bills Clients Are Happy to Pay: A Guide to Transparent Invoicing

In the legal profession, the quality of your work is paramount, but so is the clarity of your billing. A confusing or unexpectedly high invoice can quickly erode client trust, leading to delayed payments, difficult conversations, and a damaged reputation. The key to avoiding this? Transparent invoicing. By adopting clear, detailed, and fair billing practices, you can transform your invoices from sources of anxiety into statements of value that clients are happy to pay. The most powerful tool to achieve this is modern Legal Billing Software.

Why Transparency is Non-Negotiable

Today’s clients are savvy consumers. They demand to understand what they are paying for. An invoice that simply states "for professional services" with a large total is no longer acceptable. Transparency builds trust, demonstrates the value you’ve delivered, and significantly reduces the likelihood of disputes. It shows respect for the client’s financial investment and reinforces your professionalism.

How to Craft the Perfect Transparent Invoice

-

Detailed Narratives: Move beyond generic task entries like "work on case." Instead, provide specific descriptions: "Draft motion for summary judgment regarding contractual breach; research relevant case law (3.2 hours)." This detail justifies the time spent and shows the client the direct work being done on their matter.

-

Accurate Time Tracking: Every minute counts, but manual timesheets are prone to error and forgetfulness. Legal Billing Software often includes integrated timer features that allow you to track time to the exact minute from your desktop or mobile device. This ensures accuracy and captures all billable activity.

-

Clear Fee Structures: Whether you bill by the hour, use a flat fee, or a contingency model, this must be explicitly stated and agreed upon in the engagement letter. The invoice should then reflect this agreement precisely, with any variations clearly explained.

-

Itemize Everything: Break down all costs. Separate legal fees from expenses like court filing fees, expert witness costs, or travel expenses. Clients appreciate seeing exactly where their money is going.

-

Provide Context: For a particularly complex month or a larger-than-expected bill, a brief cover note or summary can be invaluable. Explain the progress made, why certain tasks were necessary, and the value they brought to the case.

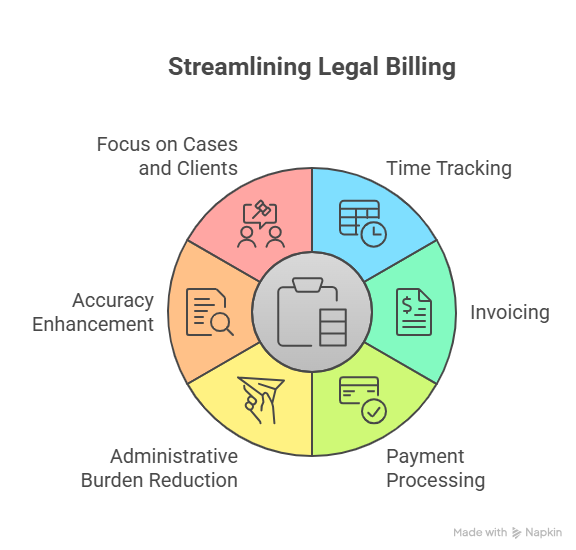

The Role of Legal Billing Software

Attempting to achieve this level of transparency manually is inefficient and unsustainable. This is where investing in robust Legal Billing Software becomes a game-changer. This technology is designed specifically to enforce and simplify transparent billing practices:

-

Precision Tracking: Automated timers capture every billable moment accurately.

-

Effortless Detail: Easy dropdown menus and customizable task codes make adding detailed narratives quick and consistent.

-

Error Reduction: The software automatically calculates totals, applies agreed-upon rates, and ensures mathematical accuracy, preventing simple mistakes that can undermine client confidence.

-

Professional Presentation: Generate clean, easy-to-read invoices that organize fees and expenses logically, enhancing your firm's professional image.

-

Faster Payments: Clear invoices lead to fewer questions and faster approvals. Many systems integrate with online payment portals, allowing clients to pay instantly with a click.

Ultimately, transparent invoicing is an extension of your client service. It communicates honesty, integrity, and respect. By leveraging Legal Billing Software to create detailed, accurate, and clear invoices, you do more than just request payment; you build stronger client relationships founded on trust—and that is something everyone can be happy about.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness