Ceramic Matrix Composites Market Size, Share and Trends 2026-2034

Market Overview:

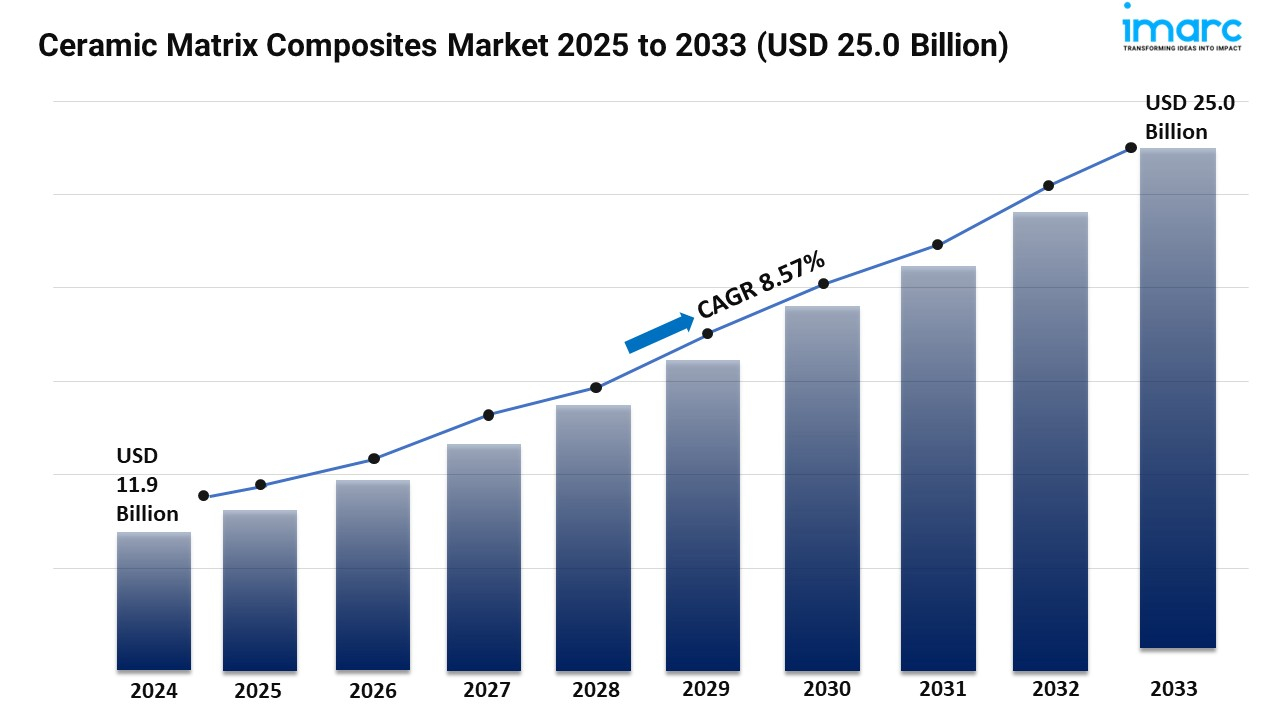

The Ceramic Matrix Composites Market is experiencing significant expansion, driven by Growing Demand from Aerospace and Defense Applications, Increasing Adoption in Automotive Industry for Lightweight Components and Rising Need for High-Temperature Materials in Industrial Applications. According to IMARC Group's latest research publication, "Ceramic Matrix Composites Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The global ceramic matrix composites market size was valued at USD 13.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 26.2 Billion by 2034, exhibiting a CAGR of 8.14% during 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/ceramic-matrix-composites-market/requestsample

Our Report Includes:

- Market Dynamics

- Market Trends and Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Ceramic Matrix Composites Industry:

- Growing Demand from Aerospace and Defense Applications

The aerospace and defense sector continues to be the primary growth engine for the ceramic matrix composites (CMC) market as manufacturers seek materials that can withstand extreme mechanical and thermal stress. CMCs enable components such as turbine shrouds, combustor liners, and missile housings to operate reliably at temperatures that exceed the capacity of nickel-based alloys. As OEMs push for propulsion systems with higher thermal efficiency, CMCs are becoming essential for improving thrust-to-weight ratios and reducing fuel consumption. Defense agencies are also expanding the use of CMCs in hypersonic platforms, where thermal loads are immense. With strategic programs focusing on advanced propulsion and next-generation aircraft performance, demand for ultra-high-temperature structural materials is accelerating rapidly across global defense and aerospace supply chains.

- Increasing Adoption in Automotive Industry for Lightweight Components

The automotive sector is steadily expanding the integration of ceramic matrix composites to meet aggressive decarbonization goals and efficiency standards. CMCs are increasingly used in premium brakes, exhaust components, and thermal shielding systems to provide high strength at lower weight compared to steel and aluminum. Electric vehicles benefit significantly from CMC-enabled thermal management, particularly in high-load braking and high-temperature drivetrain components. Automakers are also exploring CMCs for compact turbo rotors and next-generation propulsion modules to improve performance under extreme thermal cycling. As global regulations tighten around emissions and vehicle efficiency, CMC technology is emerging as a practical solution for creating lighter, more durable, and thermally stable automotive components.

- Rising Need for High-Temperature Materials in Industrial Applications

Industrial sectors are increasingly turning to ceramic matrix composites to withstand harsh operating conditions where metals and traditional ceramics fall short. CMCs provide unmatched thermal shock resistance, chemical durability, and mechanical strength at elevated temperatures, making them valuable in industrial kilns, petrochemical reactors, and high-efficiency power systems. Gas turbine manufacturers are incorporating CMCs into hot gas path components to extend system life and improve thermal efficiency. Chemical processing plants rely on CMC-based equipment to handle corrosive fluids and extreme temperature gradients. As industries prioritize longevity, operational safety, and energy efficiency, CMCs are becoming a preferred choice for next-generation high-temperature engineering solutions.

- Key Trends in the Ceramic Matrix Composites Market

- Shift Toward Large-Scale Commercialization Beyond Aerospace

A major trend shaping the market is the broader commercialization of CMCs as manufacturers overcome previous limitations related to cost, production speed, and scalability. More suppliers are expanding capacity for mass-production methods, enabling CMC integration into mid-volume industries such as automotive, energy, and heavy machinery. Partnerships between OEMs and materials companies are accelerating commercial pilot programs for CMC brake systems, industrial burners, and high-temperature structural parts. This wider commercial uptake is gradually reducing unit costs while driving a more diverse and competitive supply landscape.

- Smart Materials and Embedded Sensor Integration

The market is witnessing the development of CMC components integrated with embedded sensors capable of monitoring stress, temperature, and material degradation in real time. These “smart CMCs” enhance safety and predictive maintenance, especially in mission-critical aerospace and energy systems. Sensor-embedded composites allow operators to track component health without disassembly, reducing downtime and improving reliability. Advances in fiber-optic and nano-sensor technologies are making these intelligent structures more viable for large-scale adoption, opening new opportunities in aerospace maintenance, industrial automation, and next-generation turbine systems.

- Growing Application in Clean Energy and Carbon Reduction Technologies

Ceramic matrix composites are increasingly used in emerging clean-energy platforms due to their ability to operate in extreme thermal environments. Solid oxide fuel cells, advanced nuclear systems, and hydrogen reformers are adopting CMC components to improve efficiency and system durability. CMCs also support carbon-neutral initiatives by enabling higher operating temperatures in gas turbines, improving overall thermal efficiency and reducing fuel consumption. Their integration into renewable storage systems, high-temperature filtration setups, and carbon capture reactors highlights the expanding role of CMCs in global decarbonization strategies.

We explore the factors propelling the ceramic matrix composites market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Ceramic Matrix Composites Industry:

- 3M Company

- Applied Thin Films Inc.

- BJS Ceramics GmbH

- COI Ceramics Inc.

- CoorsTek Inc.

- General Electric Company

- Lancer Systems LP

- Rolls-Royce Holdings plc

- SGL Carbon SE

- Ube Industries Ltd.

- Ultramet Inc.

Ceramic Matrix Composites Market Report Segmentation:

Analysis by Composite Type:

- Silicon Carbide Reinforced Silicon Carbide (SIC/SIC)

- Carbon Reinforced Carbon (C/C)

- Oxide-Oxide (Ox/Ox)

- Others

Silicon carbide reinforced silicon carbide (SIC/SIC) leads the market with around 35.2% of market share in 2024 due to their exceptional qualities such as high-temperature resistance, mechanical strength, and thermal stability.

Breakup by Matrix Material:

- Oxide

- Silicon Carbide

- Carbon

- Others

Silicon carbide matrix materials dominate the market as they provide superior thermal conductivity, strength retention at high temperatures, and compatibility with various fiber reinforcements.

Analysis by Fiber Type:

- Short Fiber

- Continuous Fiber

Continuous fiber leads the market with around 69.4% of market share in 2024 due to its ability to provide improved structural integrity, damage tolerance, and load-carrying capacity.

Analysis by Fiber Material:

- Alumina Fiber

- Refractory Ceramic Fiber (RCF)

- SiC Fiber

- Others

SiC fiber leads the market with around 43.1% of market share in 2024 due to its high mechanical strength, thermal stability, as well as its ability to resist corrosion and oxidation.

Breakup by End Use Industry:

- Aerospace and Defense

- Automotive

- Energy and Power

- Electrical and Electronics

- Others

Aerospace and defense represent the largest end-use segment due to critical requirements for lightweight, high-temperature materials in aircraft engines and defense systems.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads the market driven by strong aerospace industry presence, significant defense spending, and advanced manufacturing capabilities for high-performance CMC components.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness