Multi-fiber Termination Push-on (MTP) Connector Market: Scaling to USD 438 Million by 2034

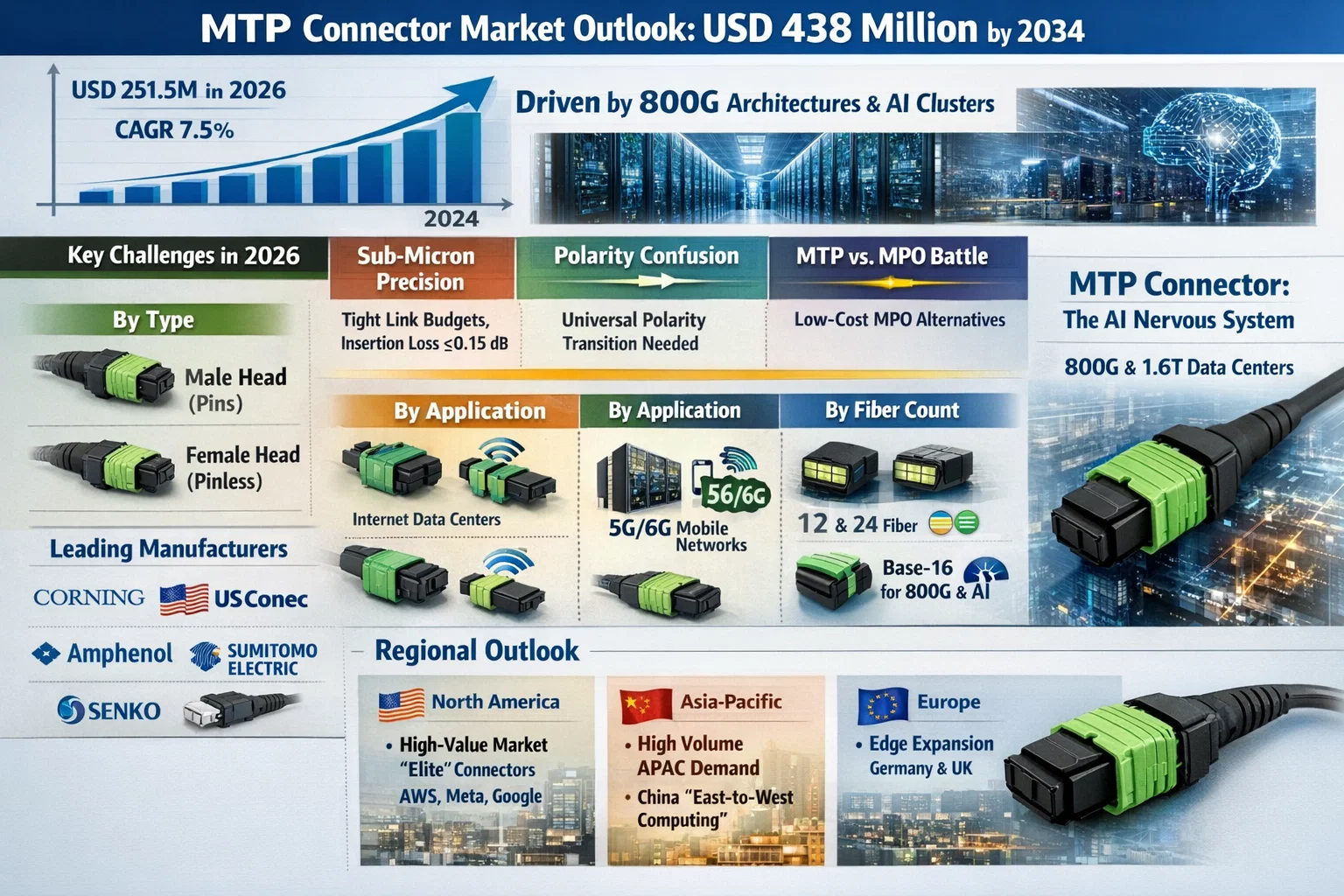

Global Multi-fiber Termination Push-on (MTP) Connector Market, valued at USD 251.5 million in 2026, is projected to reach USD 438.4 million by 2034, growing at a CAGR of 7.5%. As of early 2026, MTP connectors—the high-performance, precision-engineered evolution of the MPO standard—have become the "nervous system" of the AI-driven data center, facilitating the massive parallel optics required for 400G and 800G Ethernet.

The market is currently entering a high-growth phase as hyperscale data centers transition from Base-12 to Base-16 and Base-32 connectivity to support the massive east-west traffic generated by Large Language Model (LLM) training.

Download Full Report: https://semiconductorinsight.com/report/multi-fiber-termination-push-on-connector-market/

Key Market Challenges in 2026

Despite high demand, the sector faces technical and operational headwinds:

- Sub-Micron Precision Barriers: As link budgets tighten for 1.6T applications, the allowable "insertion loss" (IL) has shrunk. Manufacturers are struggling to maintain "MTP Elite" standards (≤0.15 dB) at scale, requiring multi-million dollar investments in automated sub-micron polishing and interference testing equipment.

- Interoperability & Polarity Confusion: With the rise of complex spine-leaf architectures, "Polarity Type A, B, and C" configurations continue to cause significant field-installation errors. In 2026, this is driving a market pivot toward "Universal Polarity" connectors that can be flipped in the field without tools.

- The MPO vs. MTP Brand Battle: While MTP (a registered brand of US Conec) offers superior mechanical floating ferrules and elliptical guide pins, low-cost generic MPO alternatives are aggressively targeting the enterprise and "tier-2" data center market, creating significant price pressure.

Market Segmentation: Male Heads and Data Center Dominance

The market is shifting toward ultra-high-density modules that minimize rack space.

Segment Analysis:

- By Type

- Male Head (Pins): Continues to lead the market due to its role in the "backbone" of structured cabling where pinned connectors are required for alignment in patches and cassettes.

- Female Head (Pinless): Gaining share in the "direct-attach" segment as more transceivers and active equipment move toward pinless interfaces to reduce the risk of equipment damage.

- By Application

- Internet Data Center (IDC): The primary driver, accounting for over 60% of total revenue. 2026 marks the first "wave" of 1.6T switch deployments, which rely exclusively on multi-fiber interfaces.

- Mobile Communication (5G/6G): Demand is rising for ruggedized MTP connectors used in Fiber-to-the-Antenna (FTTA) applications to simplify the cabling of massive MIMO cell sites.

- By Fiber Count

- 12 & 24 Fiber: The traditional workhorses for 100G/400G.

- Base-16 (Fastest Growing): Emerging as the new standard for 800G and AI fabrics (e.g., NVIDIA Blackwell clusters), as it aligns perfectly with 8-lane transceiver architectures.

Key MTP Connector Manufacturers

- Corning Incorporated (U.S.) - Vertically integrated leader in low-loss glass and connector systems.

- US Conec (U.S.) - The primary innovator and brand-holder of the MTP technology.

- Amphenol Corporation (U.S.) - Dominant in high-density interconnects for telecom.

- TE Connectivity (Switzerland) - Leader in ruggedized and industrial-grade MTP solutions.

- Sumitomo Electric Industries (Japan) - Pioneer in high-fiber-count ribbon technology.

- Senko Advanced Components (Japan) - Leading the "Very Small Form Factor" (VSFF) evolution.

- Molex (Koch Industries) (U.S.) - Key supplier to hyperscale and cloud service providers.

Regional Outlook: APAC Volume vs. North American R&D

- North America: Remains the highest-value market. Driven by the CHIPS Act and the concentration of Hyperscalers (AWS, Meta, Google), the U.S. is the primary adopter of high-margin "Elite" low-loss connectors.

- Asia-Pacific: The largest market by volume. China’s "East-to-West Computing" national project is driving massive orders for MTP trunk cables to link distributed data hubs.

- Europe: Rapidly expanding through 2026 as Germany and the UK modernize legacy telecom exchanges into "Edge" compute nodes.

Report Scope and Availability

This report provides a granular analysis of the Global MTP Connector market for the forecast period 2026–2034. It covers the impact of Co-Packaged Optics (CPO), the transition to Base-16 architectures, and the rise of Automated Fiber Inspection in high-density environments.

Download Full Report: https://semiconductorinsight.com/report/multi-fiber-termination-push-on-connector-market/

Download Sample Report: https://semiconductorinsight.com/download-sample-report/?product_id=108038

About Semiconductor Insight

Semiconductor Insight is the world's leading intelligence provider for fiber optics, high-speed interconnects, and data center infrastructure. We provide the technical data and strategic foresight required to navigate the transition from traditional electrical links to the "All-Optical" era.

Website: https://semiconductorinsight.com/

LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

International Support: +91 8087 99 2013

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness