Finished Vehicles Logistics Market Growth, Size, Trends, and Forecast 2025–2033

Market Overview:

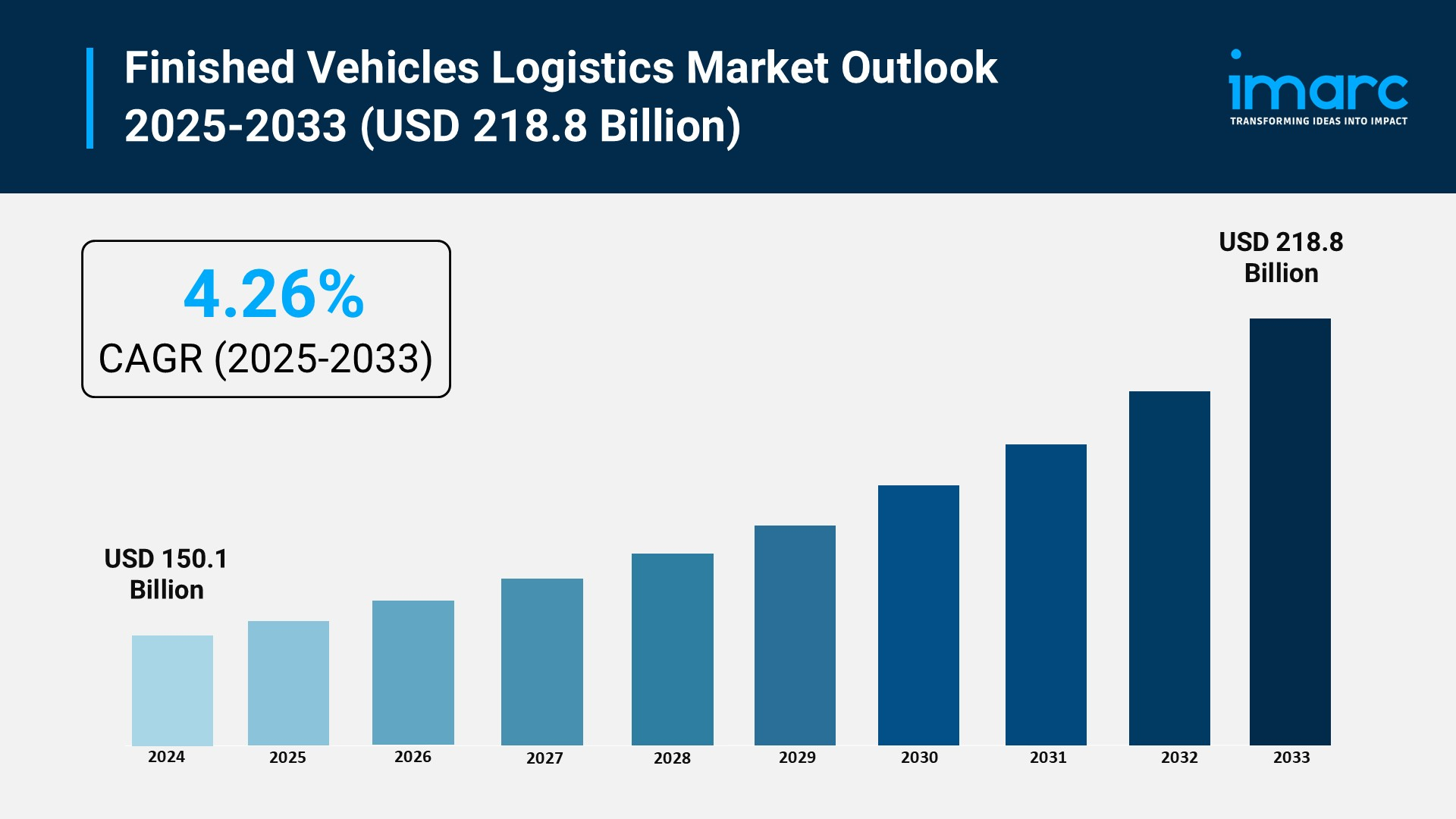

According to IMARC Group's latest research publication, "Finished Vehicles Logistics Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global finished vehicles logistics market size reached USD 150.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 218.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.26% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Finished Vehicles Logistics Market

- AI-powered predictive analytics revolutionizes fleet management, with companies achieving 95% demand forecasting accuracy and cutting operational costs by 20-30% through optimized routing and resource allocation.

- Autonomous vehicle technology transforms long-haul logistics, with pilot programs in the U.S. demonstrating 25% reduction in transit times and 30% decrease in operational costs on autonomous freight corridors between Texas and California.

- Digital transformation investments exceed €2 billion from 2021-2025, with major logistics providers like DHL implementing AI-driven platforms for real-time tracking, improving customer experience and enhancing operational excellence across finished vehicle distribution networks.

- AI-enabled robotics systems in automotive logistics compounds reduce vehicle handling time by 40%, with Stanley Robotics launching North America's first robotic automotive logistics management system featuring outdoor autonomous operations.

- Machine learning algorithms optimize multimodal transportation planning, reducing empty miles by 45% and cutting carbon emissions significantly through intelligent capacity marketplaces that match shippers with available transport resources.

Download a sample PDF of this report: https://www.imarcgroup.com/finished-vehicles-logistics-market/requestsample

Key Trends in the Finished Vehicles Logistics Market

- Rapid Digital Transformation and Platform Integration: Logistics providers are investing heavily in digital platforms, with DHL committing over €2 billion (2021-2025) for customer engagement tools and real-time tracking systems. Companies implement accessible mobile apps and online platforms enabling shipment tracking, delivery schedule modifications, and direct service provider communication. Advanced data analytics optimize route planning and resource allocation, improving operational efficiency while reducing costs significantly.

- Rise of Electric Vehicle Logistics Solutions: The rapid adoption of EVs, with sales reaching 1.6 million units in the U.S. (2024) and exceeding 10% market share, creates demand for specialized handling. Logistics companies develop EV-specific transport solutions including battery protection systems, charging infrastructure integration, and temperature-controlled environments. This segment drives market innovation as providers adapt to unique safety requirements and operational challenges of electric vehicle distribution.

- Expansion of Flexible Ownership Models: Vehicle leasing, rental, and subscription services reshape logistics demand, requiring faster turnover and continuous fleet management. Service providers adapt to handle regular vehicle relocation, inspection, refurbishment, and centralized fleet operations across geographic regions. This trend elevates importance of reverse logistics and vehicle pooling, pushing providers toward technology-driven solutions supporting ongoing customer needs throughout vehicle lifecycles.

- Focus on Sustainability and Green Logistics: Stringent EPA emissions regulations for 2027+ model years drive adoption of sustainable practices. Companies implement route optimization reducing fuel consumption by 15%, deploy alternative fuel vehicles, and increase reliance on rail and maritime transport with lower emissions. Environmental consciousness becomes competitive advantage as automakers prioritize logistics partners aligned with sustainability objectives and carbon reduction targets.

- Adoption of Autonomous and Connected Technologies: Integration of AI, IoT, RFID tracking, and blockchain enhances supply chain visibility and operational efficiency. Real-time monitoring systems provide minute-by-minute updates on vehicle location and condition, reducing uncertainty and improving planning. Several U.S. states and European regions approve autonomous trucking lanes, with autonomous technologies moving from pilot programs to commercial deployment handling long-haul stretches complementing human drivers.

Growth Factors in the Finished Vehicles Logistics Market

- Surging Global Vehicle Production: Rapid automotive industry expansion in emerging markets drives demand for sophisticated logistics. India produced 28.4 million vehicles in FY 2023-24 (up from 25.9 million in FY 2022-23). Increasing vehicle output, diverse models, and customization features necessitate specialized, efficient logistics handling greater volumes and meeting stricter delivery schedules worldwide.

- Growth in Commercial Vehicle Demand: Rising logistics, construction, and transportation sector activities increase commercial vehicle production and distribution needs. Commercial vehicles dominate the market due to their essential role in goods transport, heavy-weight capacity, and resilience. Regular application creates ongoing demand for finished vehicle logistics services across road, rail, air, and sea transportation networks.

- Technological Advancement Integration: Implementation of advanced technologies including GPS tracking, IoT sensors, AI analytics, and blockchain revolutionizes logistics operations. These innovations enhance route optimization, enable live tracking, improve data accuracy, and reduce delivery times and expenses. Technology-driven solutions allow providers to deliver more efficient, transparent, customer-centric services appealing to OEMs.

- Environmental Regulations and Compliance: Government initiatives like India's FAME II scheme (5,228 INR crore subsidies for 1,153,079 electric vehicles by December 2023) promote sustainable automotive sector growth. Strict environmental standards and carbon emission regulations encourage logistics companies to reduce carbon footprints through optimized operations, attracting environmentally-aware manufacturers and gaining competitive advantages.

- Asia-Pacific Manufacturing Hub Expansion: Region's substantial automotive production base in China, Japan, India, and South Korea creates massive logistics demand. High import-export activities, efficient manufacturing capabilities, and infrastructure improvements (seaports, rail networks, highways) encourage adoption of capable logistics systems. Government support and subsidies further strengthen regional market dominance and growth prospects.

Leading Companies Operating in the Global Finished Vehicles Logistics Industry:

- CargoTel Inc.

- CEVA Logistics (CMA CGM)

- DHL (Deutsche Post AG)

- DSV A/S

- Hellmann Worldwide Logistics SE & Co. KG

- Kuehne + Nagel International AG

- Omsan Logistics

- Pound Gates

Finished Vehicles Logistics Market Report Segmentation:

Breakup By Activity:

- Transport (Rail, Road, Air, Sea)

- Warehouse

- Value-added Services

Transport (rail, road, air, sea) accounts for the majority of shares due to flexibility across routes, support for large volumes, cost reduction capabilities, and adaptation to different shipment sizes ensuring reliable worldwide distribution.

Breakup By Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

- Hybrid Electric Vehicle

- Battery Electric Vehicle

Commercial vehicle dominates the market owing to increasing demand in logistics, construction, and transportation sectors, regular goods transport applications, resilience, and heavy-weight capacity rendering it vital for production and logistics services.

Breakup By Distribution Channel:

- OEMs (Original Equipment Manufacturers)

- Aftermarket

OEMs (Original Equipment Manufacturers) represents the largest segment as they have direct control over vehicle manufacturing and distribution, guaranteeing quality, prompt deliveries, and efficient logistics coordination while maintaining strong dealer and customer relationships.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to substantial automotive production base, growing vehicle demand, expanding infrastructure, and rising logistics technology investments. Rapid urbanization and increasing exports contribute to the region's market dominance.

Recent News and Developments in Finished Vehicles Logistics Market

- June 2025: Volkswagen Group Logistics announced launch of new automotive terminal at Port of Venice, Italy, set for autumn 2025 operations. The facility will support exports from plants in southern Germany and central Europe, reducing lead times, increasing rail use, lowering emissions, and offering storage for up to 12,000 vehicles.

- March 2025: Geely Auto partnered with CEVA Logistics to transport electric EX5 SUVs to Australia for official market launch. Vehicles became available for test drives starting March 11, marking Geely's expansion into Australian EV market with efficient nationwide delivery supporting Australian dealerships.

- September 2024: Stanley Robotics announced landmark agreement with Canadian finished vehicle logistics company to launch North America's first robotic automotive logistics compound management system in Toronto, marking first use of outdoor robotics in finished vehicle logistics on the continent.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness