India E2W Market Report, Size, Demands, Trends, Forecast 2032 | UnivDatos

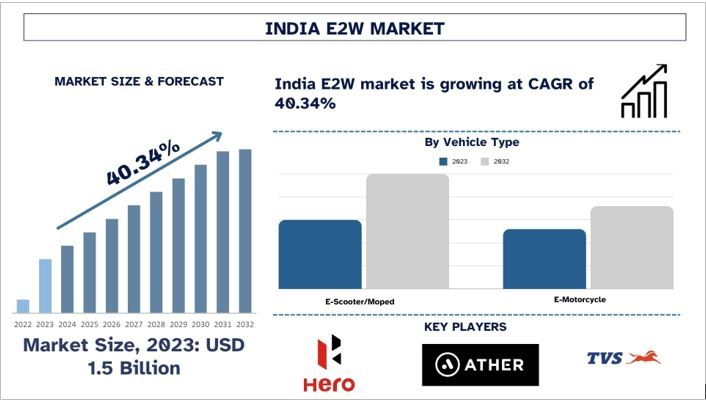

The India E2W Market was valued at approximately USD 1.5 Billion in 2023 and is expected to grow at a robust CAGR of around 40.34% during the forecast period (2024-2032)

India’s electric two-wheeler (E2W) industry is entering a transformative phase, supported by rising fuel prices, technological improvements, and substantial government incentives. According to recent insights from UnivDatos Market Insights, the sector is projected to grow at an exceptional pace, registering a CAGR of more than 71% by 2027. Increasing consumer awareness, falling battery prices, and stronger participation from OEMs are shaping a high-growth environment for E2Ws across the country.

Market Overview

Despite investment slowdowns during FY2021 due to COVID-19–related disruptions, the long-term outlook for E2Ws remains promising. Most investments during that period were funneled into high-speed electric models, which made up nearly 80% of the total OEM funding. The government's FAME-II incentives have significantly narrowed the cost gap between E2Ws and traditional ICE scooters, making electric options financially attractive. Battery costs, a major component of EV pricing, are expected to stabilize around USD 100/kWh by 2023–24, which will further accelerate market penetration.

Segmentation Overview

Vehicle Type

E-Scooters/Mopeds

Currently dominate the Indian E2W landscape due to affordability and suitability for short-distance commuting.

E-Motorcycles

Expected to gain significant traction as performance-oriented products improve and more OEMs enter the premium electric segment.

Speed Category

Low-Speed E2Ws (≤25 km/h)

These models lead the market because they do not require license or registration—making them appealing for beginners and cost-conscious users.

High-Speed E2Ws

With a 47% YoY increase in FY2021 (41,048 units sold), high-speed models are projected to dominate by 2025, driven by better technology and rising preference for performance EVs.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-e2w-market?popup=report-enquiry

Technology

Battery-Based E2Ws

Account for the larger market share. As battery prices continue to decline, electric scooters and bikes are becoming more economical compared to petrol vehicles.

Plug-In Models

While still a smaller segment, plug-in technology is expected to evolve as charging infrastructure expands across cities.

Notable investments include Ola’s INR 2,400 crore mega-factory in Tamil Nadu, which aims to deliver an annual production capacity of 10 million electric scooters.

End User

B2C (Retail Consumers)

Currently the largest segment, boosted by urban commuters seeking cost-effective transportation.

B2B (Commercial Use)

Expected to grow rapidly as logistics companies, hyperlocal delivery firms, and ride-sharing fleets transition to electric vehicles to lower operational expenses. The hyperlocal delivery sector alone attracted more than INR 600 crore in 2018.

Regional Insights

South India is emerging as the hotspot for E2W adoption thanks to strong state-level policies, improved infrastructure, and rising fuel prices. States such as Karnataka, Tamil Nadu, and Kerala have been instrumental in pushing EV adoption through subsidies and charging infrastructure expansion. Market activity in North, West, and East India is growing steadily as consumer acceptance increases.

Click here to view the Report Description & TOC: https://univdatos.com/reports/india-e2w-market

Competitive Landscape

The E2W market in India is highly dynamic, with established players and emerging startups competing through innovation, pricing, and technology advancements. Key participants include:

expanding their product portfolios, forming strategic partnerships, and investing in R&D to enhance motor efficiency, range, and user experience.

Key Questions Addressed

What technological innovations are shaping the future of the India E2W market?

Which regional markets are witnessing the fastest adoption?

What challenges—such as charging infrastructure and upfront cost—still hinder growth?

How will government initiatives and declining battery prices influence long-term demand?

What strategies are OEMs deploying to gain competitive advantage?

Contact Us:

UnivDatos

Email: contact@univdatos.com

Contact no: +1 978 7330253

Website: www.univdatos.com

Linked In: https://www.linkedin.com/company/univ-datos/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness