Bulletproof Helmet Market Trends, Growth, and Demand Forecast 2025-2033

Market Overview:

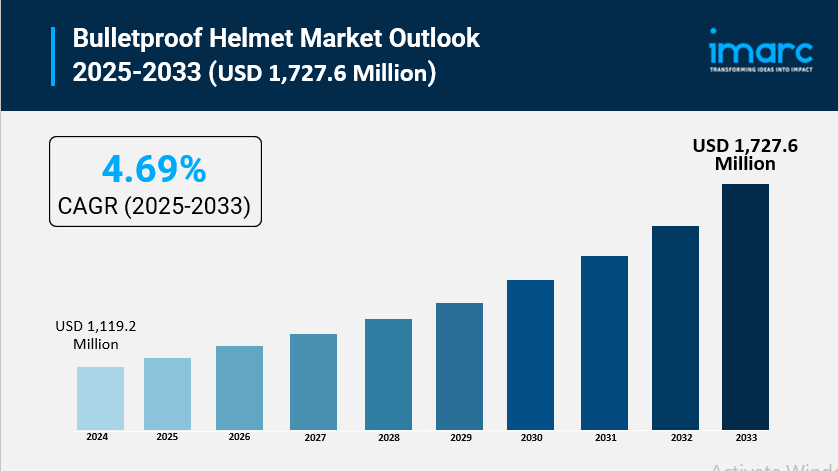

The bulletproof helmet market is experiencing rapid growth, driven by the health and wellness movement, the ready-to-drink (RTD) convenience, and flavor innovation and product diversification. According to IMARC Group's latest research publication, "Bulletproof Helmet Market by Material (Metal Material, Nonmetal Material, Composite Material), Application (Military and Defense, Law Enforcement), and Region 2025-2033", The global bulletproof helmet market size reached USD 1,119.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,727.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.69% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/bulletproof-helmet-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Bulletproof Helmet Market

- Increasing Global Defense Modernization Programs

A primary driver for the bulletproof helmet industry is the massive investment in defense modernization by governments worldwide. Nations are progressively replacing older, heavier Personal Protective Equipment (PPE) with advanced, lightweight ballistic helmets to enhance troop mobility and survivability. For instance, in a key Asian country, the Ministry of Defence launched a program for over 100,000 helmets as part of a significant security force upgrade. Similarly, a major NATO member has transitioned over 80% of its frontline forces to new-generation helmets compatible with small-caliber, high-velocity rounds. This persistent governmental emphasis on equipping soldiers with state-of-the-art protection that meets modern battlefield challenges is creating substantial, sustained procurement cycles for manufacturers. The military and defense application segment currently accounts for the largest share of the global market.

- Heightened Geopolitical Tensions and Security Threats

The growing frequency of asymmetric warfare, cross-border skirmishes, and internal insurgencies is compelling law enforcement and military agencies to boost their procurement of protective gear. The rise in global security threats directly correlates with increased demand for high-grade ballistic helmets. A report indicated that cranial trauma represents a significant percentage of battlefield injuries, underscoring the critical need for reliable head protection. Furthermore, in one of the world's largest defense markets, a five-year contract for Advanced Combat Helmets was awarded with a maximum value of over two hundred million US dollars, demonstrating the financial commitment to troop safety. This sustained high-risk global security environment ensures continuous demand from both national defense and homeland security forces.

- Technological Advancements in Material Science

The continuous innovation in materials science, particularly the development of high-performance composite materials, is fueling market growth by providing a superior value proposition. Manufacturers are increasingly utilizing Ultra-High-Molecular-Weight Polyethylene (UHMWPE) fibers and advanced aramid composites, which offer comparable or better ballistic protection at a significantly reduced weight compared to older materials like Kevlar. For example, the use of these lighter materials in next-generation combat helmets can reduce the tactical weight carried by soldiers by over twenty percent, directly improving combat effectiveness and reducing physical fatigue during extended operations. This focus on maximizing the protection-to-weight ratio is a key reason why the composite material segment holds the dominant market share.

Key Trends in the Bulletproof Helmet Market

- Integration of Smart and Digital Technologies

A major trend is the transformation of ballistic helmets into sophisticated digital platforms, moving beyond passive protection to active situational awareness tools. Modern tactical helmets are increasingly featuring integrated communication systems, heads-up displays (HUDs), and sensor suites. For example, some elite military and specialized police units are now deploying smart helmets that include biometric feedback systems capable of monitoring a soldier's real-time vitals, such as pulse and body temperature, and alerting command centers to critical conditions. These units, which cater to a premium market segment, are often co-developed through partnerships between helmet manufacturers and wearable technology firms, illustrating a push for digitized battlefield gear that enhances both protection and operational intelligence.

- Shift Towards Modular and High-Cut Designs

The market is showing a distinct shift from traditional full-coverage helmets to high-cut, modular designs that prioritize versatility and accessory integration. High-cut helmets, like the popular FAST (Future Assault Shell Technology) models, are designed to expose the ears to maximize peripheral vision and hearing, which are crucial for urban and special operations. A key aspect of this trend is the incorporation of modular rail systems and NVG (Night Vision Goggle) shrouds, with recent procurements showing a significant proportion of newly acquired helmets featuring compatibility with night vision and integrated communication gear. This modularity allows military and SWAT teams to quickly customize their headgear for different mission profiles, accommodating communication headsets, cameras, and lights without sacrificing ballistic integrity.

- Focus on Blunt Trauma Reduction

While ballistic protection remains the core function, a powerful emerging trend is the enhanced focus on mitigating blunt force trauma, which is caused by the non-penetrating impact behind a bullet strike. Manufacturers are investing heavily in advanced internal padding and suspension systems that utilize specialized energy-absorbing foam and liner materials to reduce the energy transferred to the wearer's head upon impact. This focus is driven by a desire to prevent Traumatic Brain Injury (TBI) even when the projectile is stopped. Real-world applications of this trend include new helmet liner systems that use impact-resistant foam technology to provide enhanced resistance to blunt trauma while simultaneously improving ergonomic fit and comfort for personnel wearing the helmet for extended periods.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging bulletproof helmet market trends.

Leading Companies Operating in the Global Bulletproof Helmet Industry:

- Argun s.r.o.

- ArmorSource LLC

- Avon Protection plc

- Hard Shell FZE

- MKU Limited (GKG Group)

- Point Blank Enterprises Inc.

- Protection Group Denmark

- Sinoarmor

- Ulbrichts GmbH

Bulletproof Helmet Market Report Segmentation:

By Material:

- Metal Material

- Nonmetal Material

- Composite Material

The bulletproof helmet market is segmented by material, with composite material representing the largest segment.

By Application:

- Military and Defense

- Law Enforcement

In terms of application, the military and defense sector holds the largest market share in the bulletproof helmet market.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America, including the United States and Canada, is the largest market for bulletproof helmets, driven by various factors influencing demand in the region.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness